Use Your Mouse or Tab Key to Move through the Fiel Form

Understanding the Illinois Property Transfer Process

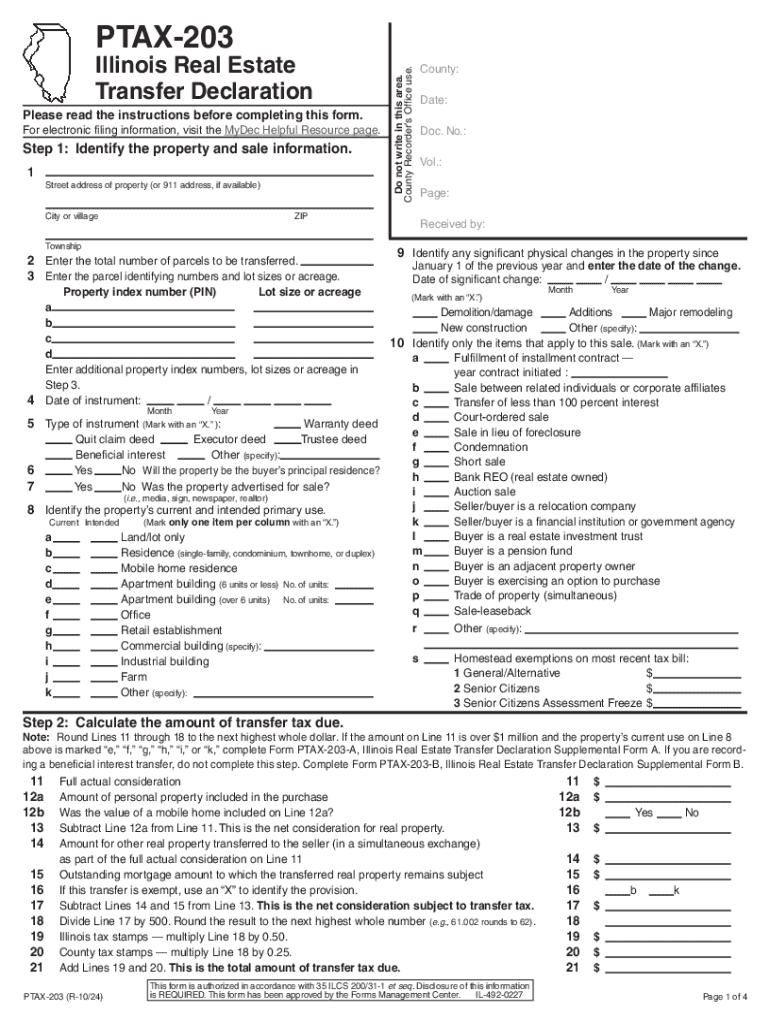

The Illinois property transfer process involves several steps to ensure that ownership is legally transferred from one party to another. This process is crucial for both buyers and sellers, as it protects their rights and ensures compliance with state laws. The primary document used in this process is the Illinois PTAX 203 form, which is essential for reporting the transfer of property for tax purposes.

Key Elements of the Illinois PTAX 203 Form

The Illinois PTAX 203 form is designed to collect information about the property being transferred. Key elements of the form include:

- Property Description: Details about the property, including its address and parcel number.

- Transferor and Transferee Information: Names and addresses of the parties involved in the transfer.

- Sales Price: The amount for which the property is being sold.

- Exemptions: Any applicable exemptions that may affect the transfer tax.

Completing these elements accurately is vital for a smooth property transfer process.

Steps to Complete the Illinois PTAX 203 Form

Completing the Illinois PTAX 203 form involves several straightforward steps:

- Gather necessary information about the property, including its legal description and parcel number.

- Fill out the form with accurate details regarding the transferor and transferee.

- Indicate the sales price and any exemptions that apply.

- Review the form for accuracy before submission.

- Submit the completed form to the appropriate local tax authority.

Following these steps helps ensure compliance with Illinois property transfer regulations.

Required Documents for Property Transfer in Illinois

When completing the property transfer process in Illinois, several documents are typically required:

- Illinois PTAX 203 Form: The primary form for reporting property transfers.

- Deed: A legal document that conveys ownership of the property.

- Identification: Valid identification for both the transferor and transferee.

- Proof of Payment: Documentation showing that any applicable taxes or fees have been paid.

Having these documents ready can facilitate a smoother transaction.

Filing Deadlines for the Illinois PTAX 203 Form

Filing deadlines for the PTAX 203 form are crucial to avoid penalties. Generally, the form must be filed within thirty days of the property transfer. It is important to check with local authorities for any specific deadlines that may apply to your situation, as these can vary by county.

Penalties for Non-Compliance with Property Transfer Regulations

Failure to comply with Illinois property transfer regulations, including the timely filing of the PTAX 203 form, can result in penalties. These may include:

- Fines imposed by local tax authorities.

- Increased tax assessments on the property.

- Potential legal disputes regarding ownership rights.

Understanding these penalties emphasizes the importance of adhering to property transfer requirements.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the use your mouse or tab key to move through the fiel 625205003

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it facilitate il property transfer?

airSlate SignNow is a digital solution that allows businesses to send and eSign documents efficiently. For il property transfer, it streamlines the process by enabling users to securely sign and manage property documents online, reducing the time and effort involved in traditional methods.

-

How much does airSlate SignNow cost for il property transfer services?

airSlate SignNow offers various pricing plans tailored to different business needs. For il property transfer, you can choose a plan that fits your budget while ensuring you have access to essential features for document management and eSigning.

-

What features does airSlate SignNow offer for il property transfer?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage, all of which are beneficial for il property transfer. These tools help ensure that your documents are organized and easily accessible throughout the transfer process.

-

Is airSlate SignNow compliant with legal requirements for il property transfer?

Yes, airSlate SignNow complies with legal standards for electronic signatures, making it a reliable choice for il property transfer. This compliance ensures that your signed documents are legally binding and recognized in court, providing peace of mind during transactions.

-

Can I integrate airSlate SignNow with other tools for il property transfer?

Absolutely! airSlate SignNow offers integrations with various applications, enhancing your workflow for il property transfer. You can connect it with CRM systems, cloud storage services, and more to streamline your document management process.

-

What are the benefits of using airSlate SignNow for il property transfer?

Using airSlate SignNow for il property transfer provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. By digitizing the signing process, you can save time and minimize errors, making your property transfer smoother.

-

How secure is airSlate SignNow for handling il property transfer documents?

airSlate SignNow prioritizes security with features like encryption and secure access controls, ensuring that your il property transfer documents are protected. This level of security helps safeguard sensitive information and builds trust with your clients.

Get more for Use Your Mouse Or Tab Key To Move Through The Fiel

- Washington confidential information form 497430346

- Protection order court form

- Washington under 18 form

- Legal last will and testament form for single person with no children washington

- Legal last will and testament form for a single person with minor children washington

- Legal last will and testament form for single person with adult and minor children washington

- Legal last will and testament form for single person with adult children washington

- Legal last will and testament for married person with minor children from prior marriage washington form

Find out other Use Your Mouse Or Tab Key To Move Through The Fiel

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title