Business Tax Filers Taxpayer Form

What is the Business Tax Filers Taxpayer

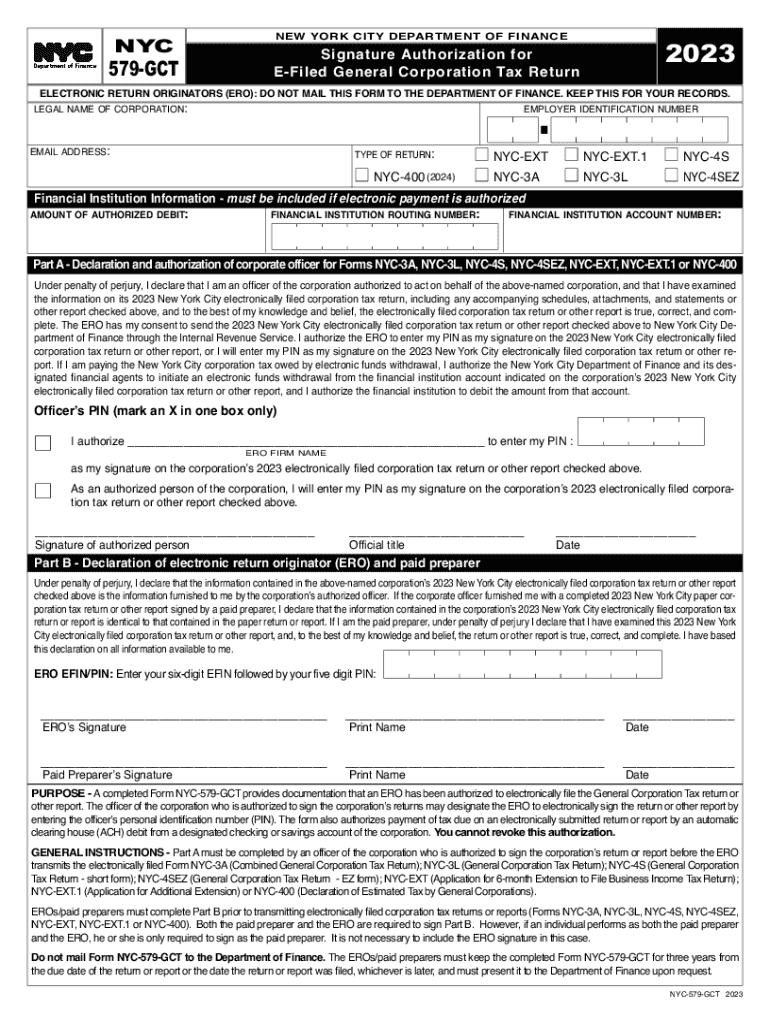

The Business Tax Filers Taxpayer refers to individuals or entities that are required to file tax returns for business activities. This includes various business structures such as sole proprietorships, partnerships, corporations, and limited liability companies (LLCs). Understanding this designation is crucial for compliance with federal tax laws and ensuring that all business income is accurately reported to the Internal Revenue Service (IRS).

How to use the Business Tax Filers Taxpayer

Using the Business Tax Filers Taxpayer involves completing the appropriate tax forms that correspond to the business structure and income level. Taxpayers must gather all necessary financial documents, including income statements, expense reports, and any relevant deductions. Once the required information is compiled, the taxpayer can fill out the necessary forms, ensuring all details are accurate to avoid potential penalties.

Steps to complete the Business Tax Filers Taxpayer

Completing the Business Tax Filers Taxpayer process involves several key steps:

- Identify your business structure and the corresponding tax form.

- Gather all necessary financial documentation, including income and expenses.

- Complete the tax form accurately, ensuring all information is correct.

- Review the completed form for any errors or omissions.

- Submit the form either electronically or by mail, depending on the requirements.

Required Documents

To successfully file as a Business Tax Filers Taxpayer, several documents are typically required:

- Income statements, such as profit and loss statements.

- Expense records, including receipts and invoices.

- Previous tax returns for reference.

- Any applicable schedules or additional forms specific to your business type.

Filing Deadlines / Important Dates

Business Tax Filers Taxpayers must adhere to specific filing deadlines to avoid penalties. Generally, the deadline for most business tax returns falls on March fifteenth for partnerships and S corporations, while C corporations typically have a due date of April fifteenth. It is essential to check the IRS guidelines for any updates or changes to these dates annually.

IRS Guidelines

The IRS provides comprehensive guidelines for Business Tax Filers Taxpayers, detailing the necessary forms, filing procedures, and compliance requirements. Taxpayers should familiarize themselves with these guidelines to ensure they meet all legal obligations. This includes understanding the specific forms needed based on business structure and the types of income reported.

Penalties for Non-Compliance

Failure to comply with the Business Tax Filers Taxpayer requirements can result in significant penalties. These may include fines for late filing, interest on unpaid taxes, and potential audits. It is crucial for taxpayers to understand the implications of non-compliance and take proactive measures to meet all filing requirements on time.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the business tax filers taxpayer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features does airSlate SignNow offer for Business Tax Filers Taxpayer?

airSlate SignNow provides a range of features tailored for Business Tax Filers Taxpayer, including document eSigning, templates for tax forms, and secure cloud storage. These features streamline the tax filing process, making it easier for businesses to manage their documents efficiently. Additionally, the platform ensures compliance with legal standards, which is crucial for tax-related documents.

-

How does airSlate SignNow benefit Business Tax Filers Taxpayer?

For Business Tax Filers Taxpayer, airSlate SignNow offers signNow benefits such as reduced turnaround time for document signing and enhanced collaboration among team members. The platform's user-friendly interface allows businesses to focus on their core activities while ensuring that tax documents are processed quickly and securely. This efficiency can lead to better financial management and timely tax submissions.

-

What is the pricing structure for Business Tax Filers Taxpayer using airSlate SignNow?

airSlate SignNow offers flexible pricing plans suitable for Business Tax Filers Taxpayer, allowing businesses to choose a plan that fits their needs and budget. The pricing is competitive and includes various features that cater specifically to tax-related document management. Businesses can opt for monthly or annual subscriptions, with discounts available for long-term commitments.

-

Can airSlate SignNow integrate with other tools for Business Tax Filers Taxpayer?

Yes, airSlate SignNow seamlessly integrates with various tools and software commonly used by Business Tax Filers Taxpayer, such as accounting software and CRM systems. This integration enhances workflow efficiency by allowing users to manage their documents and data in one place. By connecting with other applications, businesses can streamline their tax filing processes even further.

-

Is airSlate SignNow secure for Business Tax Filers Taxpayer?

Absolutely, airSlate SignNow prioritizes security for Business Tax Filers Taxpayer by employing advanced encryption and compliance with industry standards. This ensures that sensitive tax documents are protected from unauthorized access. Additionally, the platform offers features like audit trails and user authentication to enhance document security further.

-

How can Business Tax Filers Taxpayer get started with airSlate SignNow?

Getting started with airSlate SignNow is simple for Business Tax Filers Taxpayer. Users can sign up for a free trial to explore the platform's features and see how it fits their needs. Once ready, businesses can choose a suitable pricing plan and start uploading their documents for eSigning and management.

-

What support options are available for Business Tax Filers Taxpayer using airSlate SignNow?

airSlate SignNow offers comprehensive support options for Business Tax Filers Taxpayer, including a dedicated help center, live chat, and email support. Users can access tutorials and FAQs to resolve common issues quickly. The support team is also available to assist with any specific queries related to tax document management.

Get more for Business Tax Filers Taxpayer

Find out other Business Tax Filers Taxpayer

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation