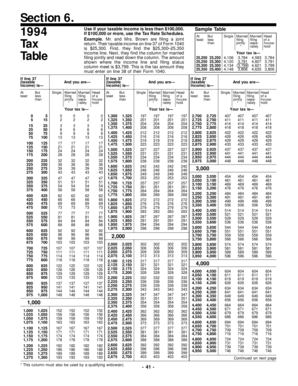

Tax Table If Line 37 Taxable Income is at Least but Less Than Use If Your Taxable Income is Less Than $100,000 Form

Understanding the Tax Table If Line 37 Taxable Income Is At Least But Less Than Use If Your Taxable Income Is Less Than $100,000

The Tax Table if line 37 taxable income is at least but less than use if your taxable income is less than $100,000 provides a structured way to determine the amount of tax owed based on specific income brackets. This table is essential for individuals whose taxable income falls within these parameters. It categorizes income ranges and corresponding tax rates, allowing taxpayers to calculate their tax liability accurately. The table is designed to simplify the tax calculation process and ensure compliance with federal tax laws.

Steps to Complete the Tax Table If Line 37 Taxable Income Is At Least But Less Than Use If Your Taxable Income Is Less Than $100,000

Completing the Tax Table involves several straightforward steps:

- Identify your taxable income as reported on line 37 of your tax return.

- Locate the appropriate income range in the tax table that corresponds to your taxable income.

- Find the tax rate associated with that income range.

- Calculate your tax liability by applying the tax rate to your taxable income.

It is crucial to ensure accuracy at each step to avoid errors that could lead to underpayment or overpayment of taxes.

Legal Use of the Tax Table If Line 37 Taxable Income Is At Least But Less Than Use If Your Taxable Income Is Less Than $100,000

The Tax Table is legally recognized as a valid method for calculating federal income tax. It is essential to use the table in conjunction with the IRS guidelines to ensure compliance with tax laws. The use of this table helps taxpayers fulfill their legal obligations by providing a clear framework for determining tax liabilities. Additionally, utilizing the tax table correctly can prevent potential penalties associated with incorrect tax filings.

Examples of Using the Tax Table If Line 37 Taxable Income Is At Least But Less Than Use If Your Taxable Income Is Less Than $100,000

Here are some examples to illustrate how to use the Tax Table:

- If your taxable income is $50,000, locate the range that includes this amount in the tax table, then apply the corresponding tax rate to determine your tax owed.

- For a taxable income of $75,000, find the relevant income bracket and calculate the tax based on the specified rate.

These examples demonstrate the practical application of the tax table in real-life scenarios, highlighting its importance in tax preparation.

IRS Guidelines for Using the Tax Table If Line 37 Taxable Income Is At Least But Less Than Use If Your Taxable Income Is Less Than $100,000

The IRS provides specific guidelines regarding the use of the Tax Table. Taxpayers must refer to the latest IRS publications to ensure they are using the correct table for the tax year in question. The guidelines also outline how to handle special situations, such as filing jointly or separately, which may affect the applicable tax rates. Adhering to these guidelines is vital for accurate tax reporting and compliance.

Required Documents for Using the Tax Table If Line 37 Taxable Income Is At Least But Less Than Use If Your Taxable Income Is Less Than $100,000

To effectively use the Tax Table, certain documents are necessary:

- Your completed tax return form, specifically the form where line 37 is reported.

- Any additional documentation that supports your taxable income, such as W-2s or 1099s.

- Previous tax returns may also be helpful for reference and comparison.

Having these documents on hand ensures a smooth and accurate tax calculation process.

Quick guide on how to complete 1994 tax table if line 37 taxable income is at least but less than use if your taxable income is less than 100000

Complete [SKS] seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without hold-ups. Manage [SKS] on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest method to adjust and eSign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a standard wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you want to deliver your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Tax Table If Line 37 taxable Income Is At Least But Less Than Use If Your Taxable Income Is Less Than $100,000

Create this form in 5 minutes!

How to create an eSignature for the 1994 tax table if line 37 taxable income is at least but less than use if your taxable income is less than 100000

How to create an eSignature for your 1994 Tax Table If Line 37 Taxable Income Is At Least But Less Than Use If Your Taxable Income Is Less Than 100000 online

How to create an eSignature for the 1994 Tax Table If Line 37 Taxable Income Is At Least But Less Than Use If Your Taxable Income Is Less Than 100000 in Chrome

How to make an eSignature for signing the 1994 Tax Table If Line 37 Taxable Income Is At Least But Less Than Use If Your Taxable Income Is Less Than 100000 in Gmail

How to create an electronic signature for the 1994 Tax Table If Line 37 Taxable Income Is At Least But Less Than Use If Your Taxable Income Is Less Than 100000 from your smart phone

How to create an eSignature for the 1994 Tax Table If Line 37 Taxable Income Is At Least But Less Than Use If Your Taxable Income Is Less Than 100000 on iOS devices

How to create an electronic signature for the 1994 Tax Table If Line 37 Taxable Income Is At Least But Less Than Use If Your Taxable Income Is Less Than 100000 on Android OS

People also ask

-

What is the significance of the Tax Table If Line 37 taxable Income Is At Least But Less Than Use If Your Taxable Income Is Less Than $100,000?

The Tax Table If Line 37 taxable Income Is At Least But Less Than Use If Your Taxable Income Is Less Than $100,000 is crucial for determining tax liabilities for individuals earning under this threshold. It helps clarify the applicable tax rates and calculations, ensuring you pay the correct amount. Using this table can optimize your tax planning and compliance.

-

How can airSlate SignNow help me manage tax documents?

airSlate SignNow provides a simple solution for managing tax-related documents efficiently. Its eSigning features allow you to sign and send tax forms while keeping records organized. This directly supports adherence to guidelines like the Tax Table If Line 37 taxable Income Is At Least But Less Than Use If Your Taxable Income Is Less Than $100,000.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting from a free trial to advanced editions for larger enterprises. Each plan includes essential features that streamline document management tasks, including eSigning capabilities related to taxes. With plans tailored to your requirements, you can ensure compliance with tax regulations like the Tax Table If Line 37 taxable Income Is At Least But Less Than Use If Your Taxable Income Is Less Than $100,000.

-

Does airSlate SignNow integrate with other tax software?

Yes, airSlate SignNow seamlessly integrates with popular tax software to enhance your document handling capabilities. This integration ensures your forms are completed and sent efficiently, all while focusing on compliance with the Tax Table If Line 37 taxable Income Is At Least But Less Than Use If Your Taxable Income Is Less Than $100,000. Eliminate redundant processes and keep all tax-related documents in sync.

-

What features does airSlate SignNow offer for tax season?

During tax season, airSlate SignNow offers features such as bulk sending, automated reminders, and template storage for tax documents. These features simplify the process of gathering signatures and documents, which is particularly helpful for maintaining accuracy with the Tax Table If Line 37 taxable Income Is At Least But Less Than Use If Your Taxable Income Is Less Than $100,000. Save time and reduce errors in your tax documentation.

-

How secure is my tax information with airSlate SignNow?

airSlate SignNow prioritizes the security of your tax information through advanced encryption protocols and secure cloud storage solutions. Ensuring data protection is essential, especially when dealing with sensitive tax documents related to the Tax Table If Line 37 taxable Income Is At Least But Less Than Use If Your Taxable Income Is Less Than $100,000. Feel confident managing your taxes in a protected environment.

-

Can I track the status of my tax documents with airSlate SignNow?

Yes, airSlate SignNow includes real-time tracking for all your sent tax documents. This feature allows you to monitor the signing status, which helps in ensuring compliance with the Tax Table If Line 37 taxable Income Is At Least But Less Than Use If Your Taxable Income Is Less Than $100,000. Stay informed and manage your documentation effectively.

Get more for Tax Table If Line 37 taxable Income Is At Least But Less Than Use If Your Taxable Income Is Less Than $100,000

- Fund balance with treasury bureau of the fiscal service form

- Health care professional39s manual for assigning cghr form

- Registration services packages uc davis conference and event form

- Order form for documents purchase money secondsrefinance

- 71 42954 non harp refi to mod request new insuredservicer 0613 form

- Choose to buy choose to refinance choose to refer riversideca form

- Run while you still can subprime demand and predatory lending in ruralhome form

- Beazer homes applauds imagine homes for winning prestigious form

Find out other Tax Table If Line 37 taxable Income Is At Least But Less Than Use If Your Taxable Income Is Less Than $100,000

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement