Form E 6

What is the Form E-6

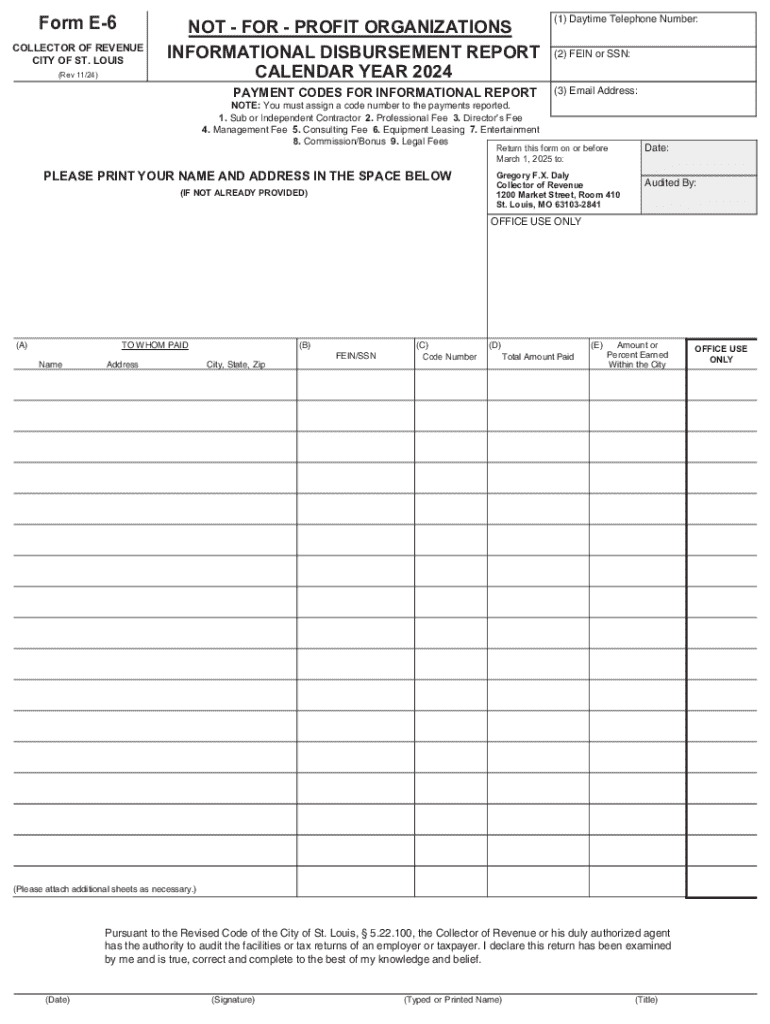

The Form E-6 is a specific document utilized in various administrative processes within the United States. It serves as a crucial tool for individuals and businesses to provide necessary information for compliance with local regulations. This form is often required in specific contexts, such as tax reporting or legal documentation, and is designed to streamline the submission of pertinent data to relevant authorities.

How to use the Form E-6

Using the Form E-6 involves several straightforward steps. First, ensure that you have the correct version of the form, which can typically be obtained from official government websites or offices. Next, read the instructions carefully to understand the information required. Fill out the form accurately, providing all necessary details. Once completed, submit the form according to the specified guidelines, whether online, by mail, or in person, depending on the requirements of the issuing authority.

Steps to complete the Form E-6

Completing the Form E-6 requires attention to detail. Follow these steps for a successful submission:

- Gather all necessary documents and information that will be required to fill out the form.

- Carefully read the instructions provided with the form to understand what is needed.

- Fill in the form, ensuring that all fields are completed accurately and legibly.

- Review the completed form for any errors or omissions before submission.

- Submit the form as directed, ensuring that you meet any deadlines associated with the submission.

Key elements of the Form E-6

The Form E-6 includes several key elements that must be addressed for it to be valid. These typically encompass personal identification information, specific details relevant to the purpose of the form, and any required signatures. Each section of the form is designed to capture essential information that facilitates processing by the relevant authorities.

Legal use of the Form E-6

The legal use of the Form E-6 is governed by specific regulations that outline its purpose and the circumstances under which it must be filed. It is important to ensure that the form is used in compliance with these regulations to avoid any legal issues. Misuse or incorrect submission of the form can lead to penalties or delays in processing.

Filing Deadlines / Important Dates

Filing deadlines for the Form E-6 can vary based on the context in which it is used. It is crucial to be aware of these deadlines to ensure timely submission. Missing a deadline may result in penalties or complications with the processing of your form. Always check the latest guidelines from the relevant authority to stay informed about important dates.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form e 6

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form E 6 and how does it work with airSlate SignNow?

Form E 6 is a specific document used for various business processes. With airSlate SignNow, you can easily create, send, and eSign Form E 6, streamlining your workflow and ensuring compliance. Our platform simplifies the entire process, making it efficient and user-friendly.

-

What are the pricing options for using airSlate SignNow with Form E 6?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Whether you're a small business or a large enterprise, you can find a plan that allows you to manage Form E 6 efficiently. Visit our pricing page for detailed information on the available options.

-

What features does airSlate SignNow provide for managing Form E 6?

airSlate SignNow includes a variety of features designed to enhance your experience with Form E 6. These features include customizable templates, automated workflows, and secure eSigning capabilities. This ensures that your documents are processed quickly and securely.

-

How can airSlate SignNow benefit my business when using Form E 6?

Using airSlate SignNow for Form E 6 can signNowly improve your business efficiency. It reduces the time spent on paperwork and minimizes errors, allowing your team to focus on more important tasks. Additionally, the platform enhances collaboration and ensures that all stakeholders can access and sign documents easily.

-

Can I integrate airSlate SignNow with other tools while using Form E 6?

Yes, airSlate SignNow offers seamless integrations with various third-party applications. This means you can easily connect your existing tools with our platform to manage Form E 6 more effectively. Popular integrations include CRM systems, cloud storage services, and project management tools.

-

Is it secure to eSign Form E 6 using airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security and compliance when it comes to eSigning Form E 6. Our platform uses advanced encryption and authentication methods to protect your documents, ensuring that your sensitive information remains safe throughout the signing process.

-

How can I track the status of my Form E 6 documents in airSlate SignNow?

With airSlate SignNow, you can easily track the status of your Form E 6 documents in real-time. Our dashboard provides updates on who has viewed or signed the document, allowing you to stay informed and follow up as needed. This feature enhances accountability and ensures timely completion.

Get more for Form E 6

- Polytech lae non school leaver application form 2022

- Form te7 application to file a statement out of time parking

- Ustp entrance exam reviewer form

- Elisha goodman books download pdf form

- Defy waiver form

- Dermatology and skin cancer institute history and intake form

- Sections 144g 45 or 144g 81 waiver request assisted living licensure form

- Winters building department form

Find out other Form E 6

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word