NYS Tax Department Changes to Certain Estate Tax Forms

Understanding the NYS Tax Department Changes to Estate Tax Forms

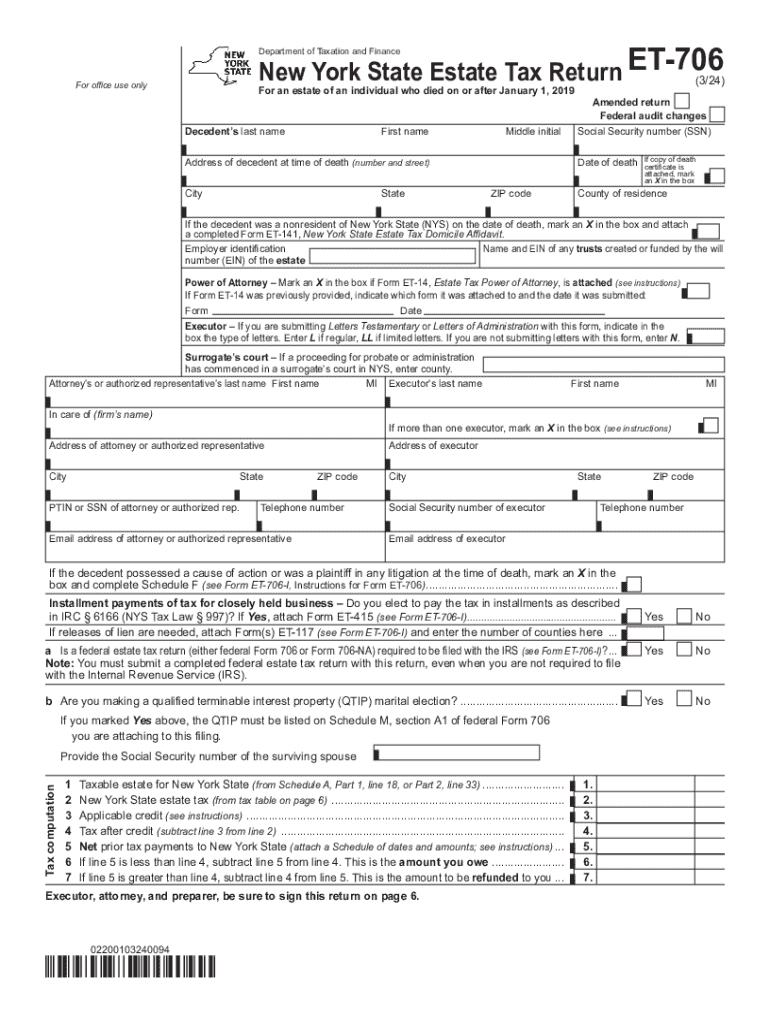

The NYS Tax Department has implemented several changes to estate tax forms, including the ET 706 form. These changes aim to streamline the process for taxpayers and ensure compliance with updated regulations. Understanding these modifications is crucial for estate executors and administrators who are responsible for filing estate tax returns in New York State.

Key changes may include updated filing requirements, revisions to reporting thresholds, and alterations in the information required on the form. Familiarizing oneself with these changes helps in accurately completing the ET 706 form and avoiding potential penalties.

Steps to Complete the ET 706 Form

Completing the ET 706 form involves several important steps. First, gather all necessary documentation related to the decedent's estate, including asset valuations, debts, and prior tax returns. Accurate information is essential to ensure compliance with state regulations.

Next, carefully fill out each section of the form, paying close attention to the instructions provided by the NYS Tax Department. It is important to report all taxable assets and deductions correctly. After completing the form, review it for accuracy before submission to avoid delays or issues with processing.

Required Documents for the ET 706 Form

When filing the ET 706 form, several documents are required to support the information reported. These typically include:

- Death certificate of the decedent

- Asset valuations, including appraisals for real estate and personal property

- Records of debts and liabilities

- Prior tax returns, if applicable

- Documentation of any gifts made by the decedent prior to death

Having these documents ready will facilitate the completion of the form and ensure that all necessary information is included.

Filing Deadlines for the ET 706 Form

Filing deadlines for the ET 706 form are critical to avoid penalties. In New York State, the form must generally be filed within nine months of the decedent's date of death. If additional time is needed, an extension may be requested, but it is essential to file the request before the original deadline.

Staying informed about these deadlines helps executors manage the estate efficiently and ensures compliance with state tax laws.

Legal Use of the ET 706 Form

The ET 706 form serves a legal purpose in reporting the estate's taxable value to the NYS Tax Department. It is a crucial component of the estate settlement process, ensuring that all taxes owed are calculated and reported accurately.

Failure to file the form or inaccuracies in reporting can lead to legal repercussions, including fines and penalties. Executors must understand their responsibilities under the law and ensure that the form is completed correctly and submitted on time.

Examples of Using the ET 706 Form

Practical examples of using the ET 706 form can help clarify its application. For instance, if an individual passes away leaving behind a house, bank accounts, and investments, the executor must report these assets on the ET 706 form. Each asset's value must be determined and documented, along with any debts that may reduce the taxable estate.

Another example involves reporting gifts made by the decedent during their lifetime, which may affect the overall taxable estate. Understanding these scenarios can guide executors in accurately completing the form and fulfilling their obligations.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nys tax department changes to certain estate tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the et 706 form and why is it important?

The et 706 form is a federal estate tax return used to report the value of an estate and calculate any taxes owed. It is important for ensuring compliance with tax regulations and can help in the proper distribution of assets. Understanding how to complete the et 706 form is crucial for executors and beneficiaries.

-

How can airSlate SignNow help with the et 706 form?

airSlate SignNow provides a seamless platform for electronically signing and sending the et 706 form. Our solution simplifies the process, allowing users to complete and submit the form quickly and securely. This ensures that all necessary signatures are obtained without delays.

-

Is there a cost associated with using airSlate SignNow for the et 706 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solution ensures that you can manage the et 706 form and other documents without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the et 706 form?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking for the et 706 form. These features enhance the efficiency of document management and ensure that you can easily access and manage your forms. Additionally, our platform supports multiple file formats.

-

Can I integrate airSlate SignNow with other software for the et 706 form?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage the et 706 form alongside your existing tools. This integration capability enhances workflow efficiency and ensures that all your documents are synchronized across platforms.

-

What are the benefits of using airSlate SignNow for the et 706 form?

Using airSlate SignNow for the et 706 form streamlines the signing process, reduces paperwork, and enhances security. Our platform allows for quick access to documents and ensures that all signatures are legally binding. This ultimately saves time and reduces the risk of errors in the filing process.

-

Is airSlate SignNow secure for handling the et 706 form?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive documents like the et 706 form. We utilize advanced encryption and authentication measures to protect your data. You can trust that your information is secure while using our platform.

Get more for NYS Tax Department Changes To Certain Estate Tax Forms

- Arizona a1 form

- Azdorgovformsindividualinnocent spouse reliefarizona department of revenue azdor

- For the calendar year 2022 or fiscal year beginning m m d d 2 0 2 2 and ending m m d d y y y y form

- Dr 501sc form fill out and sign printable pdf templatesignnow

- Arizona form 290 request for penalty abatement

- Get fl dr 534 2021 2022 us legal forms

- Dr 486 r 0622 petition to the value adjustment board floridarevenuecom form

- Application for reinstatement department of revenue form

Find out other NYS Tax Department Changes To Certain Estate Tax Forms

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter