New York City Credits Tax NY Gov Form

Understanding the New York City Credits Tax

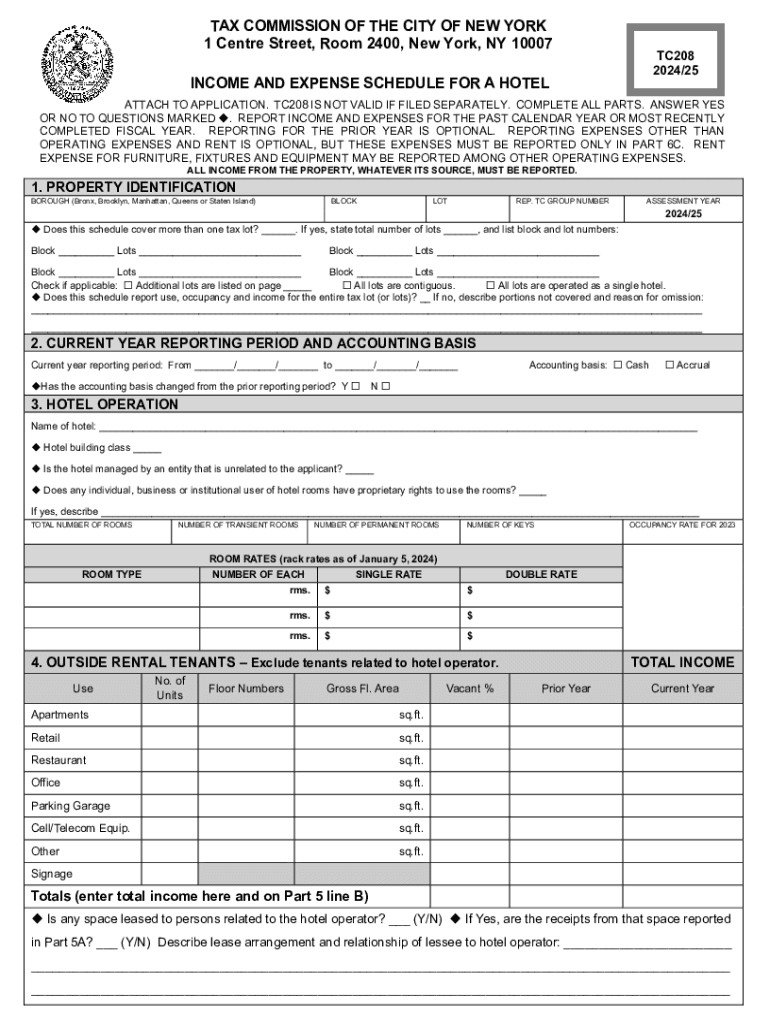

The New York City Credits Tax is a tax incentive designed to support businesses operating within the city. This tax can help reduce the overall tax burden for eligible businesses, particularly in the hospitality sector. Understanding the nuances of this tax can significantly impact financial planning and compliance.

Steps to Complete the New York City Credits Tax Form

Filling out the New York City Credits Tax form requires careful attention to detail. Here are the essential steps:

- Gather all necessary documentation, including financial statements and proof of expenses.

- Complete the form accurately, ensuring all sections are filled out according to the guidelines.

- Review the form for any errors or omissions before submission.

- Submit the form by the specified deadline to avoid penalties.

Eligibility Criteria for the New York City Credits Tax

To qualify for the New York City Credits Tax, businesses must meet certain criteria. Typically, eligibility includes:

- Operating within New York City.

- Meeting specific revenue thresholds.

- Documenting eligible expenses related to hotel operations.

It is crucial for businesses to check the latest eligibility requirements as they may change annually.

Required Documents for the New York City Credits Tax

When applying for the New York City Credits Tax, businesses must provide several key documents, including:

- Financial statements that detail income and expenses.

- Receipts and invoices for eligible hotel expenses.

- Previous tax returns, if applicable, to support claims.

Having these documents ready can streamline the application process and ensure compliance.

Penalties for Non-Compliance with the New York City Credits Tax

Failing to comply with the New York City Credits Tax regulations can lead to significant penalties. These may include:

- Fines based on the amount of tax owed.

- Interest on unpaid taxes, which can accumulate over time.

- Potential audits by the tax authority, leading to further scrutiny of business finances.

Understanding these penalties emphasizes the importance of accurate and timely filing.

Form Submission Methods for the New York City Credits Tax

Businesses can submit the New York City Credits Tax form through various methods:

- Online submission via the official tax portal, which is often the quickest method.

- Mailing a physical copy of the form to the designated tax office.

- In-person submission at local tax offices, providing an opportunity for immediate assistance.

Choosing the right submission method can help ensure that the form is processed efficiently.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new york city credits tax ny gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is tc expense hotel and how does it work?

TC expense hotel refers to the process of managing travel and accommodation expenses for business trips. With airSlate SignNow, you can easily create, send, and eSign documents related to hotel bookings and expense reports, streamlining the entire process for your team.

-

How can airSlate SignNow help with tc expense hotel management?

AirSlate SignNow simplifies tc expense hotel management by allowing users to create customizable templates for expense reports. This ensures that all necessary information is captured accurately, making it easier to track and approve hotel expenses efficiently.

-

What are the pricing options for using airSlate SignNow for tc expense hotel?

AirSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Whether you need basic features for small teams or advanced functionalities for larger organizations, you can find a plan that fits your budget while effectively managing tc expense hotel.

-

Are there any integrations available for tc expense hotel with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various accounting and travel management software, enhancing your tc expense hotel workflow. This allows for automatic syncing of data, reducing manual entry and ensuring accuracy in expense reporting.

-

What features does airSlate SignNow offer for tc expense hotel documentation?

AirSlate SignNow provides features such as customizable templates, automated workflows, and secure eSigning for tc expense hotel documentation. These tools help streamline the approval process and ensure that all documents are legally binding and easily accessible.

-

How does airSlate SignNow ensure the security of tc expense hotel documents?

Security is a top priority for airSlate SignNow. The platform uses advanced encryption and secure cloud storage to protect your tc expense hotel documents, ensuring that sensitive information remains confidential and compliant with industry standards.

-

Can I track the status of my tc expense hotel documents with airSlate SignNow?

Absolutely! AirSlate SignNow allows you to track the status of your tc expense hotel documents in real-time. You can see when documents are sent, viewed, and signed, providing transparency and accountability throughout the expense management process.

Get more for New York City Credits Tax NY gov

- Schedule r form 941 allocation schedule for aggregate form 941 filers

- Earned income tax credit eitcinternal revenue service irs tax forms

- Internal revenue service instructions for forms 1098 e and

- Nm rpd 41373 2020 2022 fill out tax template online us legal forms

- 2022 form 8404 interest charge on disc related deferred tax liability

- Reasonable cause regulations ampamp requirements for missing and incorrect form

- Schedule r forms 941 and form 940 internal revenue service

- Nm trd pit adj 2020 2022 fill out tax template online us legal forms

Find out other New York City Credits Tax NY gov

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself