DEPRECIATION ADJUSTMENTS for CERTAIN POST 91001 Form

What is the depreciation adjustments for certain post 91001

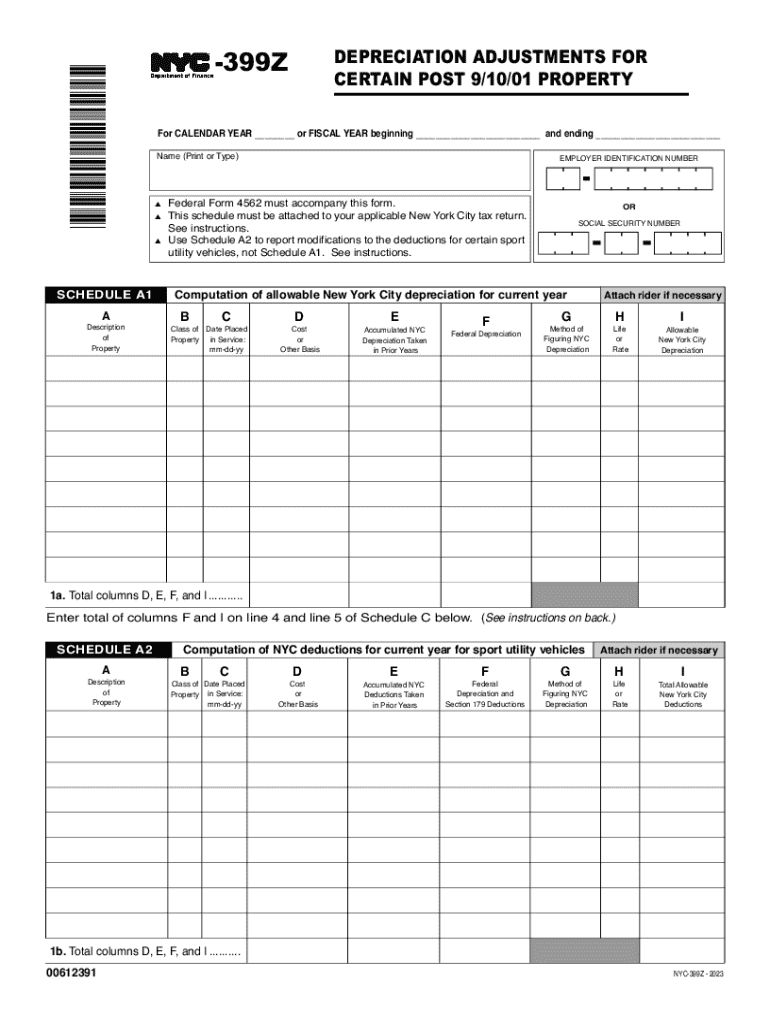

The depreciation adjustments for certain post 91001 refer to specific tax provisions that allow property owners in New York to adjust their depreciation calculations for certain properties. This is particularly relevant for properties that have undergone significant changes or improvements. Understanding these adjustments is crucial for accurate tax reporting and compliance.

How to use the depreciation adjustments for certain post 91001

To effectively use the depreciation adjustments for certain post 91001, property owners should first identify eligible properties that have experienced qualifying changes. Once identified, they can apply the appropriate adjustments on the NYC 399Z form. This involves accurately calculating the adjusted basis of the property and ensuring all supporting documentation is in order for submission.

Steps to complete the depreciation adjustments for certain post 91001

Completing the depreciation adjustments for certain post 91001 involves several key steps:

- Gather all necessary documentation related to the property.

- Determine if the property qualifies for depreciation adjustments based on recent improvements or changes.

- Calculate the adjusted basis of the property using the relevant formulas.

- Fill out the NYC 399Z form accurately, reflecting the adjustments.

- Review the form for completeness and accuracy before submission.

Key elements of the depreciation adjustments for certain post 91001

Key elements of the depreciation adjustments include understanding the types of properties that qualify, the specific adjustments allowed, and the documentation required. It is essential to be aware of the IRS guidelines that govern these adjustments, as they dictate how and when they can be applied. Additionally, knowing the implications of these adjustments on overall tax liability is vital.

Filing deadlines / important dates

Filing deadlines for the depreciation adjustments for certain post 91001 typically align with standard tax deadlines. It is important to keep track of these dates to ensure timely submission of the NYC 399Z form. Missing a deadline can result in penalties or disqualification from certain tax benefits, making it essential to stay informed about any changes in the filing schedule.

Eligibility criteria

Eligibility for the depreciation adjustments for certain post 91001 is determined by specific criteria set forth by tax regulations. Generally, properties must have undergone qualifying improvements or changes within a defined period. Property owners should review these criteria carefully to ensure compliance and maximize their potential tax benefits.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the depreciation adjustments for certain post 91001

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the airSlate SignNow solution for new york nyc 399z?

The airSlate SignNow solution for new york nyc 399z is designed to empower businesses to send and eSign documents efficiently. It offers an easy-to-use interface that simplifies the signing process, making it ideal for companies in New York City looking for a cost-effective solution.

-

How much does airSlate SignNow cost for new york nyc 399z users?

Pricing for airSlate SignNow for new york nyc 399z users varies based on the plan selected. We offer flexible pricing options that cater to different business needs, ensuring that you get the best value for your investment in document management.

-

What features does airSlate SignNow offer for new york nyc 399z?

airSlate SignNow provides a range of features for new york nyc 399z, including customizable templates, real-time tracking, and secure cloud storage. These features enhance the document signing experience, making it faster and more reliable for businesses in NYC.

-

How can airSlate SignNow benefit my business in new york nyc 399z?

By using airSlate SignNow, businesses in new york nyc 399z can streamline their document workflows, reduce turnaround times, and improve overall efficiency. This leads to better customer satisfaction and can signNowly enhance your business operations.

-

Does airSlate SignNow integrate with other tools for new york nyc 399z?

Yes, airSlate SignNow offers seamless integrations with various tools and platforms commonly used by businesses in new york nyc 399z. This allows you to connect your existing systems and enhance your document management processes without any hassle.

-

Is airSlate SignNow secure for new york nyc 399z users?

Absolutely! airSlate SignNow prioritizes security for new york nyc 399z users by implementing advanced encryption and compliance with industry standards. You can trust that your documents and data are protected throughout the signing process.

-

Can I try airSlate SignNow before committing in new york nyc 399z?

Yes, airSlate SignNow offers a free trial for new york nyc 399z users, allowing you to explore its features and benefits without any commitment. This is a great way to see how the solution fits your business needs before making a decision.

Get more for DEPRECIATION ADJUSTMENTS FOR CERTAIN POST 91001

Find out other DEPRECIATION ADJUSTMENTS FOR CERTAIN POST 91001

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy