Instructions for Form FTB 3522 LLC Tax Voucher Instructions for Form FTB 3522, LLC Tax Voucher

Understanding the FTB 3522 LLC Tax Voucher

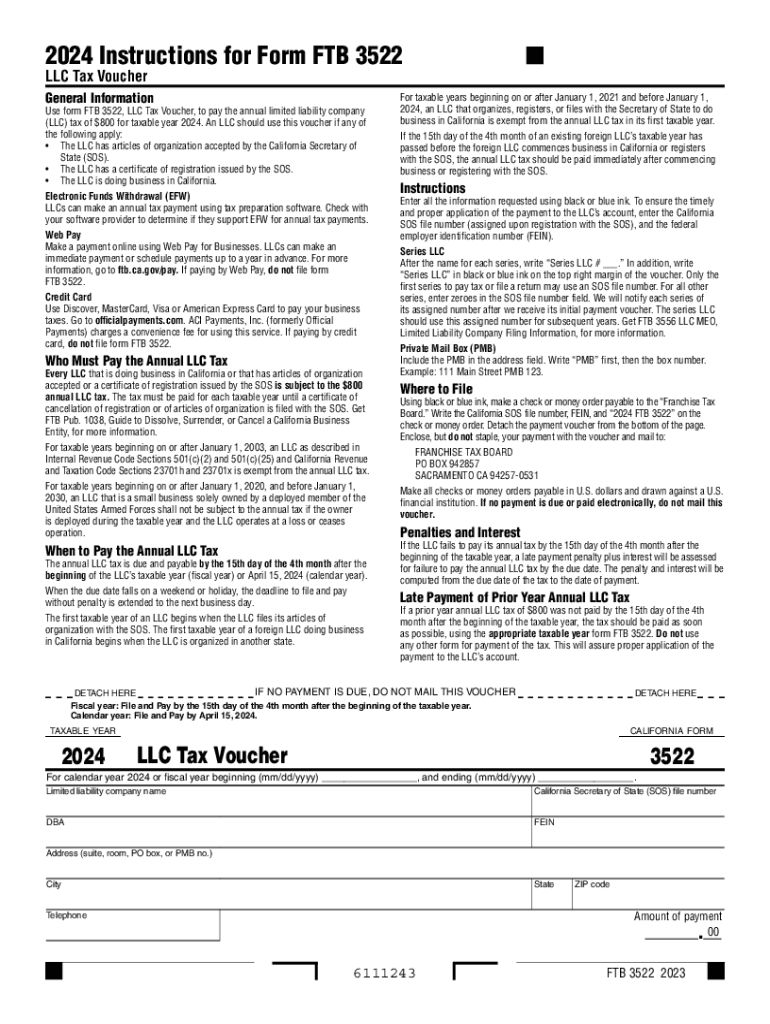

The FTB 3522 form, also known as the LLC Tax Voucher, is essential for Limited Liability Companies (LLCs) in California to report and pay their annual tax. In 2024, California requires LLCs to submit this form along with the annual $800 fee. This payment is crucial for maintaining good standing with the California Franchise Tax Board (FTB). The form serves as a payment voucher and must be completed accurately to ensure compliance with state tax regulations.

Steps to Complete the FTB 3522 Form

Completing the FTB 3522 form involves several key steps:

- Gather necessary information, including your LLC's name, address, and California Secretary of State file number.

- Indicate the payment amount, which is typically $800 for the annual tax.

- Provide your contact information to facilitate any communication regarding your submission.

- Review the form for accuracy before submission to avoid penalties or delays.

Once completed, the form can be submitted online or via mail, depending on your preference.

Filing Deadlines for the FTB 3522

For 2024, the filing deadline for the FTB 3522 is typically the 15th day of the fourth month after the close of your LLC's taxable year. For most LLCs operating on a calendar year, this means the form should be filed by April 15, 2024. It is crucial to adhere to this deadline to avoid late fees and penalties.

Legal Use of the FTB 3522 Form

The FTB 3522 form is legally required for all LLCs operating in California. Failure to file this form can result in significant penalties, including additional fees and interest on unpaid taxes. It is important for LLCs to understand their obligations under California tax law to ensure compliance and avoid any legal repercussions.

Obtaining the FTB 3522 Form

The FTB 3522 form can be easily obtained from the California Franchise Tax Board's official website. It is available as a downloadable PDF, allowing you to print and fill it out manually. Alternatively, many tax preparation software programs include the form, making it convenient for users to complete and file electronically.

Penalties for Non-Compliance

Non-compliance with the FTB 3522 requirements can lead to penalties. If the form is not filed by the deadline, the California FTB may impose a late filing penalty, which can increase the total amount owed. Additionally, LLCs may face interest charges on unpaid taxes. Staying informed about filing requirements and deadlines is vital for avoiding these financial consequences.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form ftb 3522 llc tax voucher instructions for form ftb 3522 llc tax voucher

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 568 California 2024?

Form 568 California 2024 is a tax form used by limited liability companies (LLCs) to report their income and pay the California LLC tax. It is essential for compliance with California tax regulations. Understanding this form is crucial for LLC owners to avoid penalties and ensure proper filing.

-

How can airSlate SignNow help with Form 568 California 2024?

airSlate SignNow provides an efficient platform for eSigning and sending Form 568 California 2024. With our user-friendly interface, you can easily prepare, sign, and share your tax documents securely. This streamlines the filing process, ensuring you meet deadlines without hassle.

-

What are the pricing options for using airSlate SignNow for Form 568 California 2024?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting with a free trial. Our plans are designed to be cost-effective, allowing you to choose the features that best suit your requirements for managing Form 568 California 2024. Visit our pricing page for detailed information.

-

What features does airSlate SignNow offer for managing Form 568 California 2024?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are essential for managing Form 568 California 2024. These tools help ensure that your documents are completed accurately and efficiently. Additionally, our platform allows for easy collaboration with team members.

-

Is airSlate SignNow compliant with California regulations for Form 568 California 2024?

Yes, airSlate SignNow is fully compliant with California regulations regarding electronic signatures and document management. This compliance ensures that your Form 568 California 2024 is legally valid and recognized by the state. You can trust our platform to handle your sensitive tax documents securely.

-

Can I integrate airSlate SignNow with other software for Form 568 California 2024?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow for managing Form 568 California 2024. Whether you use accounting software or project management tools, our platform can seamlessly connect to streamline your document processes.

-

What are the benefits of using airSlate SignNow for Form 568 California 2024?

Using airSlate SignNow for Form 568 California 2024 provides numerous benefits, including time savings, increased efficiency, and enhanced security. Our platform simplifies the eSigning process, allowing you to focus on your business rather than paperwork. Additionally, you can access your documents anytime, anywhere.

Get more for Instructions For Form FTB 3522 LLC Tax Voucher Instructions For Form FTB 3522, LLC Tax Voucher

Find out other Instructions For Form FTB 3522 LLC Tax Voucher Instructions For Form FTB 3522, LLC Tax Voucher

- Sign Missouri Demand Note Online

- How To Sign New York Notice to Stop Credit Charge

- How Do I Sign North Dakota Notice to Stop Credit Charge

- How To Sign Oklahoma Notice of Rescission

- How To Sign Maine Share Donation Agreement

- Sign Maine Share Donation Agreement Simple

- Sign New Jersey Share Donation Agreement Simple

- How To Sign Arkansas Collateral Debenture

- Sign Arizona Bill of Lading Simple

- Sign Oklahoma Bill of Lading Easy

- Can I Sign Massachusetts Credit Memo

- How Can I Sign Nevada Agreement to Extend Debt Payment

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple