, Form 588 Nonresident Withholding Waiver Request , Form 588, Nonresident Withholding Waiver Request

Understanding Form 588 Nonresident Withholding Waiver Request

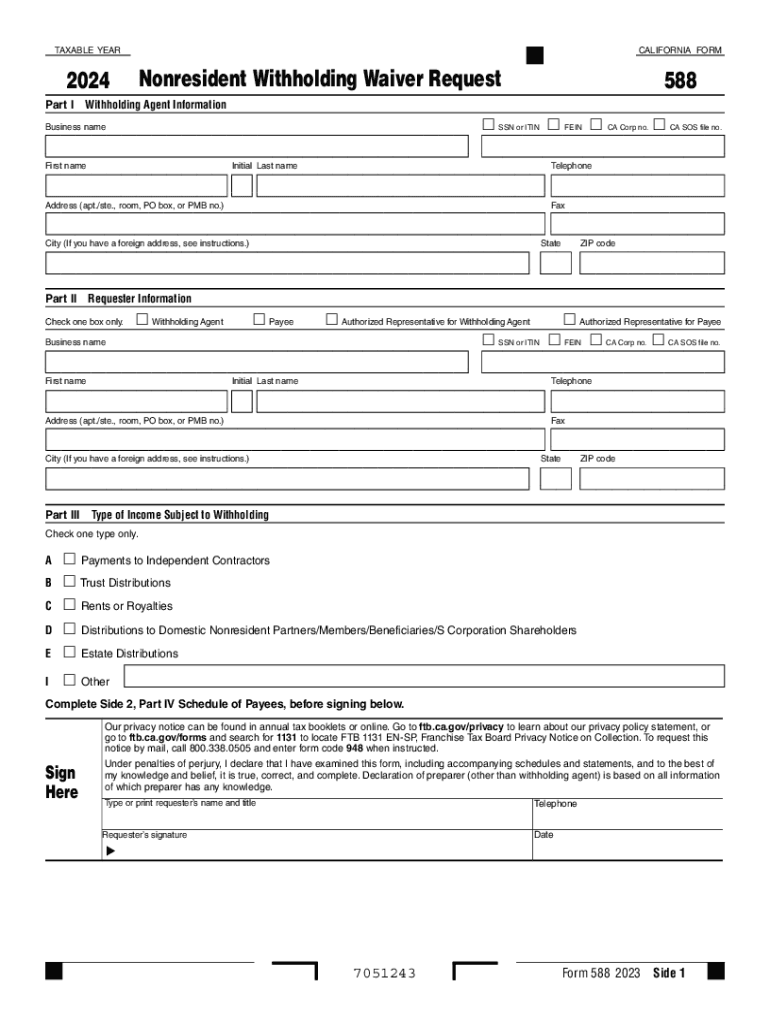

The Form 588, officially known as the Nonresident Withholding Waiver Request, is a crucial document for nonresident individuals and entities who seek to reduce or eliminate withholding on California-source income. This form is particularly relevant for those who may not be subject to California income tax or who qualify for a reduced withholding rate based on applicable treaties or exemptions. Understanding the purpose and implications of this form can help ensure compliance with California tax regulations.

Steps to Complete Form 588

Completing Form 588 involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information, including your personal details and the specifics of the income being received. Follow these steps:

- Provide your name, address, and taxpayer identification number.

- Indicate the type of income you are receiving and the amount.

- Specify the reason for the waiver request, citing relevant tax treaties if applicable.

- Sign and date the form to certify that the information provided is accurate.

Double-check all entries for accuracy before submission to avoid delays or rejections.

Eligibility Criteria for Form 588

To qualify for a waiver using Form 588, certain eligibility criteria must be met. Generally, nonresidents who receive income from California sources may apply if:

- The income is not subject to California tax.

- There is a tax treaty in place that reduces withholding obligations.

- The individual or entity does not have a permanent establishment in California.

Understanding these criteria is essential for determining your eligibility and ensuring that you submit a valid request.

Obtaining Form 588

Form 588 can be obtained from the California Franchise Tax Board (FTB) website or directly through tax preparation software that includes California tax forms. It is advisable to ensure you have the most current version of the form to avoid any compliance issues. Additionally, physical copies may be available at certain tax offices or through professional tax preparers.

Legal Use of Form 588

The legal use of Form 588 is primarily to request a waiver for withholding on California-source income. It is important for nonresidents to understand that submitting this form does not guarantee approval; it is subject to review by the FTB. Proper documentation and adherence to California tax laws are essential for a successful waiver request.

Form Submission Methods

Form 588 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the California Franchise Tax Board’s e-file system.

- Mailing the completed form to the designated FTB address.

- In-person submission at local FTB offices, if necessary.

Choosing the appropriate submission method can help expedite the processing of your waiver request.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 588 nonresident withholding waiver request form 588 nonresident withholding waiver request

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is California withholding and how does it affect my business?

California withholding refers to the state tax that employers must deduct from employees' wages. Understanding California withholding is crucial for compliance and ensuring that your business meets state tax obligations. Using airSlate SignNow can help streamline the process of managing these deductions efficiently.

-

How can airSlate SignNow assist with California withholding documentation?

airSlate SignNow provides a user-friendly platform for creating, sending, and signing documents related to California withholding. This includes tax forms and employee agreements, ensuring that all necessary paperwork is completed accurately and promptly. Our solution simplifies the documentation process, making it easier for businesses to stay compliant.

-

What are the pricing options for airSlate SignNow regarding California withholding services?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, including those needing assistance with California withholding. Our plans are designed to be cost-effective, providing access to essential features without breaking the bank. You can choose a plan that best fits your business needs and budget.

-

Are there any features specifically designed for managing California withholding?

Yes, airSlate SignNow includes features tailored for managing California withholding, such as automated document generation and eSignature capabilities. These features help ensure that all withholding-related documents are processed quickly and securely. Additionally, our platform allows for easy tracking and management of these documents.

-

Can I integrate airSlate SignNow with other tools for California withholding?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and payroll software that can help manage California withholding. This integration ensures that your financial data is synchronized, making it easier to handle tax deductions and compliance. You can connect with tools you already use for a more streamlined workflow.

-

What benefits does airSlate SignNow provide for handling California withholding?

Using airSlate SignNow for California withholding offers numerous benefits, including increased efficiency and reduced paperwork. Our platform allows for quick document turnaround times, ensuring that your withholding processes are timely and compliant. Additionally, the eSignature feature enhances security and convenience for both employers and employees.

-

Is airSlate SignNow compliant with California withholding regulations?

Yes, airSlate SignNow is designed to comply with California withholding regulations, ensuring that your business meets all legal requirements. Our platform is regularly updated to reflect any changes in tax laws, providing peace of mind for users. You can trust that your withholding documentation will be handled in accordance with state guidelines.

Get more for , Form 588 Nonresident Withholding Waiver Request , Form 588, Nonresident Withholding Waiver Request

- 14 day eviction notice template alberta form

- Ignou subject change form pdf

- Klingelschild vorlage form

- Weld log template form

- Application for an entry visa to the republic of moldova sua mfa form

- Akc therapy dog title application american kennel club images akc form

- Coa order form mkt 006 078 10 11 04doc

- Temporary toilet facilities exemption certification form

Find out other , Form 588 Nonresident Withholding Waiver Request , Form 588, Nonresident Withholding Waiver Request

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement