Virginia Form 502

What is the Virginia Form 502

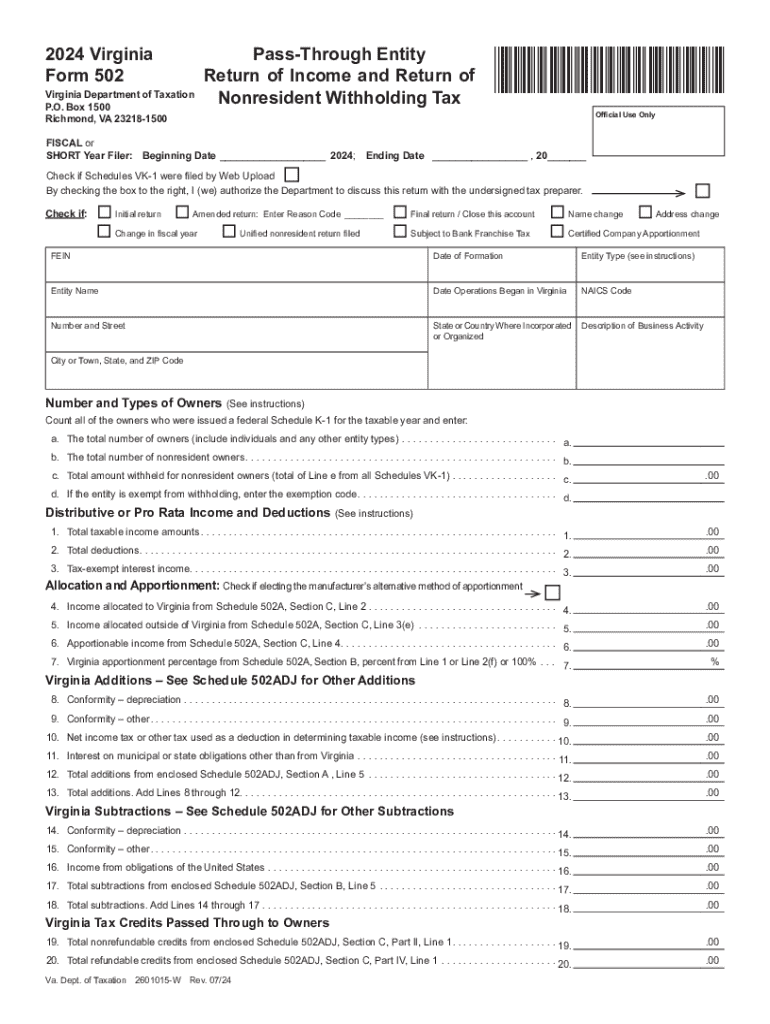

The Virginia Form 502 is a state tax return form used by nonresidents to report income earned in Virginia. This form is essential for individuals who do not reside in Virginia but have income sourced from the state. It ensures that nonresidents pay the appropriate state taxes on their earnings. The form is part of Virginia's efforts to maintain tax compliance and ensure that all individuals contributing to the state economy fulfill their tax obligations.

How to use the Virginia Form 502

To use the Virginia Form 502, individuals must first gather all necessary financial documents, including W-2s, 1099s, and any other income statements. The form requires detailed information about income earned in Virginia, as well as any applicable deductions. Once completed, the form can be submitted through various methods, ensuring that nonresidents accurately report their earnings and comply with state tax regulations.

Steps to complete the Virginia Form 502

Completing the Virginia Form 502 involves several key steps:

- Gather all relevant income documentation, including W-2s and 1099s.

- Fill out personal information, including your name, address, and Social Security number.

- Report all income earned in Virginia, ensuring accuracy in amounts.

- Apply any eligible deductions or credits to reduce your taxable income.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated deadline, either online or by mail.

Required Documents

When completing the Virginia Form 502, certain documents are essential to ensure accurate reporting. These include:

- W-2 forms from employers for income earned in Virginia.

- 1099 forms for any freelance or contract work.

- Documentation of any other income sources, such as rental income.

- Records of any deductions or credits you plan to claim.

Form Submission Methods

The Virginia Form 502 can be submitted through multiple methods to accommodate different preferences. Options include:

- Online submission through the Virginia Department of Taxation's website.

- Mailing a printed copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if preferred.

Penalties for Non-Compliance

Failure to file the Virginia Form 502 or inaccuracies in reporting can result in penalties. These may include:

- Fines for late filing or underreporting income.

- Interest on unpaid taxes, which accrues over time.

- Potential legal actions for continued non-compliance.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the virginia form 502 766807049

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the VA Form 502 and how is it used?

The VA Form 502 is a document used by veterans to apply for various benefits and services. It is essential for ensuring that veterans receive the support they need from the Department of Veterans Affairs. Using airSlate SignNow, you can easily fill out and eSign the VA Form 502, streamlining the application process.

-

How can airSlate SignNow help with completing the VA Form 502?

airSlate SignNow provides a user-friendly platform that allows you to complete the VA Form 502 digitally. With features like templates and eSignature capabilities, you can fill out the form quickly and securely. This not only saves time but also reduces the chances of errors in your application.

-

Is there a cost associated with using airSlate SignNow for the VA Form 502?

Yes, airSlate SignNow offers various pricing plans to suit different needs. While there is a cost associated with using the platform, it is designed to be cost-effective, especially when considering the time saved in processing the VA Form 502. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for the VA Form 502?

airSlate SignNow offers a range of features for the VA Form 502, including customizable templates, secure eSigning, and document tracking. These features enhance the efficiency of completing and submitting the form. Additionally, you can collaborate with others in real-time to ensure all necessary information is included.

-

Can I integrate airSlate SignNow with other applications for the VA Form 502?

Yes, airSlate SignNow supports integrations with various applications, making it easier to manage your documents related to the VA Form 502. You can connect it with tools like Google Drive, Dropbox, and CRM systems to streamline your workflow. This integration capability enhances productivity and organization.

-

What are the benefits of using airSlate SignNow for the VA Form 502?

Using airSlate SignNow for the VA Form 502 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows you to complete and submit the form from anywhere, making it convenient for busy veterans. Additionally, the eSignature feature ensures that your documents are legally binding.

-

Is airSlate SignNow secure for handling the VA Form 502?

Absolutely, airSlate SignNow prioritizes security and compliance, ensuring that your VA Form 502 and other documents are protected. The platform uses advanced encryption and secure storage to safeguard your information. You can trust that your sensitive data is handled with the utmost care.

Get more for Virginia Form 502

Find out other Virginia Form 502

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online