WHEN to FILE This Return Must Be Completed and Filed by All Persons Subject to the Tax on or Before April 15 unless the 15th Form

Filing Deadlines and Important Dates

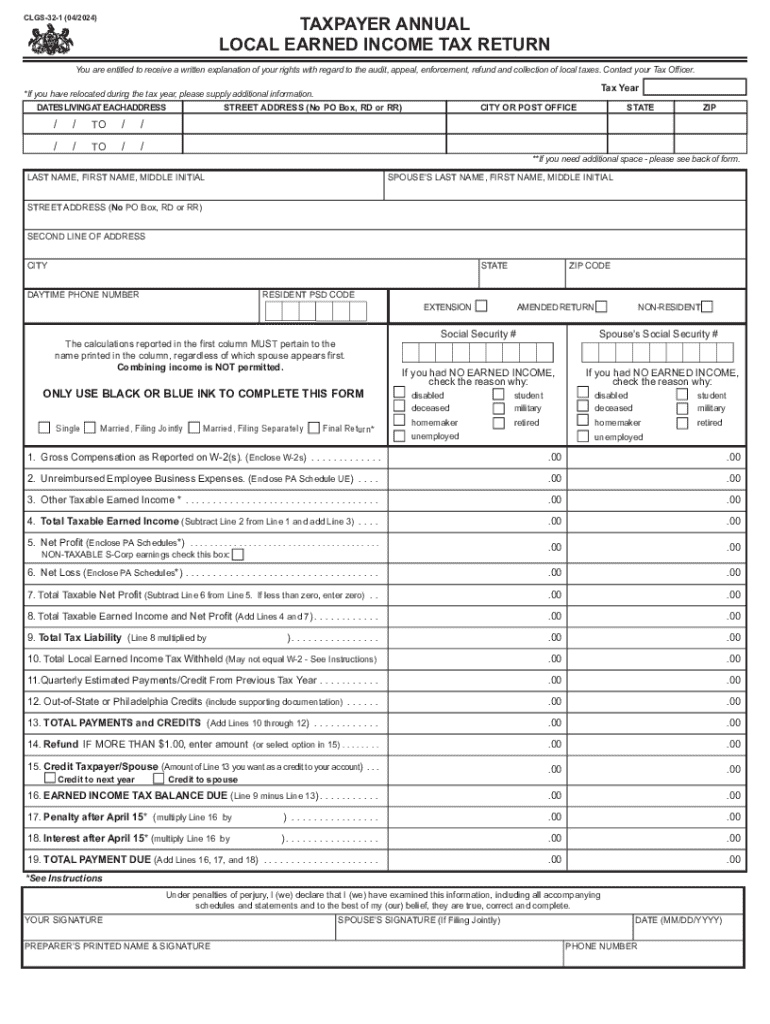

The form CLGS-32-1 must be completed and submitted by all individuals subject to local earned income tax. The deadline for filing this return is April 15 of each year. If April 15 falls on a weekend or holiday, the due date may be extended to the next business day. It is crucial to adhere to this timeline to avoid penalties and ensure compliance with local tax regulations.

Required Documents for Submission

To complete the form CLGS-32-1, certain documents are necessary. These typically include:

- Your previous year's local earned income tax return, if applicable.

- W-2 forms from all employers for the tax year.

- Any 1099 forms that report additional income.

- Documentation of any deductions or credits you intend to claim.

Gathering these documents in advance can streamline the filing process and help ensure accuracy in your return.

Steps to Complete the Form

Completing the form CLGS-32-1 involves several key steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Report your total earned income as indicated on your W-2 and 1099 forms.

- Calculate any deductions or credits you are eligible for, and apply them to your total income.

- Determine your local tax liability based on the tax rates applicable in your jurisdiction.

- Review the completed form for accuracy before submission.

Following these steps carefully will help ensure that your return is accurate and complete.

Form Submission Methods

The form CLGS-32-1 can be submitted through various methods to accommodate different preferences:

- Online Submission: Many local tax authorities allow for electronic filing through their websites.

- Mail: You can print the completed form and send it to the appropriate local tax office via postal mail.

- In-Person: Some jurisdictions may permit you to file the form in person at designated tax offices.

Choosing the right submission method can help ensure that your return is processed efficiently.

Penalties for Non-Compliance

Failure to file the form CLGS-32-1 by the deadline may result in penalties. These can include:

- Late filing fees, which can accumulate over time.

- Interest on any unpaid tax amounts, which may increase your total liability.

- Potential legal action for persistent non-compliance.

Understanding these consequences emphasizes the importance of timely and accurate filing.

Eligibility Criteria

To be eligible for filing the form CLGS-32-1, individuals must meet certain criteria:

- Residents of the jurisdiction where the local earned income tax applies.

- Individuals who have earned income during the tax year.

- Those who are not exempt from local tax obligations due to specific circumstances.

Reviewing these criteria ensures that you are required to file and helps avoid unnecessary complications.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the when to file this return must be completed and filed by all persons subject to the tax on or before april 15 unless the 15th

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the form clgs 32 1 instructions?

The form clgs 32 1 instructions provide detailed guidance on how to complete the CLGS 32-1 form, which is essential for various business processes. Understanding these instructions ensures that you fill out the form correctly, avoiding delays and potential rejections.

-

How can airSlate SignNow help with form clgs 32 1 instructions?

airSlate SignNow simplifies the process of completing the form clgs 32 1 instructions by allowing users to fill out and eSign documents electronically. This not only saves time but also enhances accuracy, ensuring that all required fields are completed correctly.

-

Is there a cost associated with using airSlate SignNow for form clgs 32 1 instructions?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that facilitate the completion of form clgs 32 1 instructions, making it a cost-effective solution for document management.

-

What features does airSlate SignNow offer for completing form clgs 32 1 instructions?

airSlate SignNow includes features such as customizable templates, real-time collaboration, and secure eSigning, all of which enhance the process of completing form clgs 32 1 instructions. These tools streamline workflows and improve efficiency.

-

Can I integrate airSlate SignNow with other applications for form clgs 32 1 instructions?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to seamlessly manage your documents while following the form clgs 32 1 instructions. This connectivity enhances productivity by keeping all your tools in sync.

-

What are the benefits of using airSlate SignNow for form clgs 32 1 instructions?

Using airSlate SignNow for form clgs 32 1 instructions provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. These advantages help businesses streamline their document processes while ensuring compliance.

-

Is airSlate SignNow user-friendly for completing form clgs 32 1 instructions?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate and complete form clgs 32 1 instructions. The intuitive interface allows users to quickly learn how to use the platform without extensive training.

Get more for WHEN TO FILE This Return Must Be Completed And Filed By All Persons Subject To The Tax On Or Before April 15 unless The 15th

- Pre delivery inspection checklist pdi form

- Markup and markdown worksheet answer key pdf form

- Curriculum futbolista form

- Licensing complaint poster form

- According to the paperwork reduction act of form

- Notes for prison pre release claim preliminary ins form

- Please review and complete this packet in its enti form

- Request for light duty letter form

Find out other WHEN TO FILE This Return Must Be Completed And Filed By All Persons Subject To The Tax On Or Before April 15 unless The 15th

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit