E File Signature Authorization for RCT 101, PA Corporate Net Income Tax Report PA 8879 C PA Department of Revenue Form

What is the E file Signature Authorization For RCT 101, PA Corporate Net Income Tax Report PA 8879 C PA Department Of Revenue

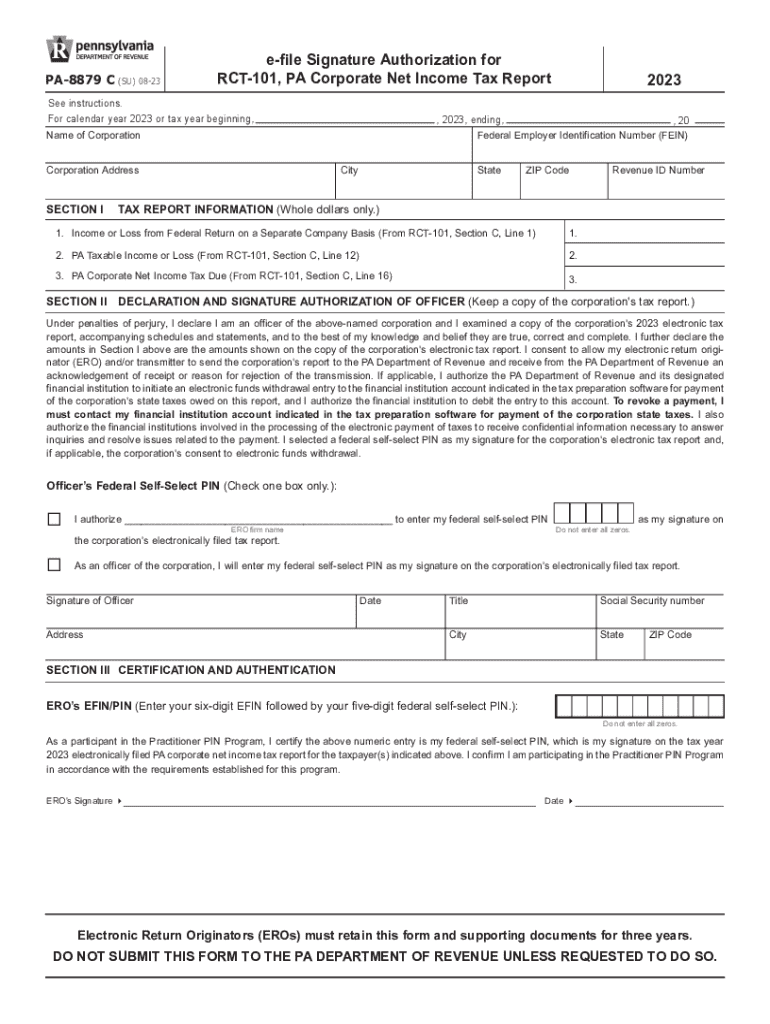

The E file Signature Authorization for RCT 101 is a crucial document for businesses in Pennsylvania that are filing the Corporate Net Income Tax Report. This form, also known as PA 8879 C, allows taxpayers to electronically sign and submit their tax returns to the Pennsylvania Department of Revenue. By using this authorization, businesses can streamline their filing process, ensuring compliance with state regulations while minimizing paperwork.

How to use the E file Signature Authorization For RCT 101, PA Corporate Net Income Tax Report PA 8879 C PA Department Of Revenue

Using the E file Signature Authorization involves a few straightforward steps. First, businesses must complete the RCT 101 form, which details their corporate income tax information. Once the RCT 101 is prepared, the taxpayer must fill out the PA 8879 C form, which serves as the electronic signature authorization. This form must then be signed by an authorized individual within the company, confirming that the information provided is accurate and complete. After signing, the PA 8879 C can be submitted electronically along with the RCT 101 form.

Steps to complete the E file Signature Authorization For RCT 101, PA Corporate Net Income Tax Report PA 8879 C PA Department Of Revenue

Completing the E file Signature Authorization involves several key steps:

- Prepare the RCT 101 form with accurate corporate income tax information.

- Obtain the PA 8879 C form, which is the signature authorization document.

- Fill out the PA 8879 C, ensuring all required fields are completed.

- Have an authorized representative of the business sign the PA 8879 C.

- Submit both the RCT 101 and PA 8879 C forms electronically to the Pennsylvania Department of Revenue.

Legal use of the E file Signature Authorization For RCT 101, PA Corporate Net Income Tax Report PA 8879 C PA Department Of Revenue

The E file Signature Authorization is legally binding and must be used in accordance with Pennsylvania tax laws. By signing the PA 8879 C, the authorized individual affirms that the information submitted is true and correct to the best of their knowledge. This form serves as a digital signature, which is accepted by the Pennsylvania Department of Revenue for electronic submissions. It is essential for businesses to ensure that they comply with all legal requirements when using this authorization to avoid potential penalties.

Required Documents

To successfully complete the E file Signature Authorization, businesses need to gather the following documents:

- The completed RCT 101 form, detailing corporate income tax information.

- The PA 8879 C form for electronic signature authorization.

- Any supporting documentation that may be required for the RCT 101 filing.

Filing Deadlines / Important Dates

It is important for businesses to be aware of the filing deadlines associated with the RCT 101 and PA 8879 C forms. Typically, the deadline for filing the Corporate Net Income Tax Report is the fifteenth day of the fourth month following the end of the tax year. For example, if a business operates on a calendar year, the filing deadline would be April 15. Businesses should ensure that both forms are submitted by this date to avoid late filing penalties.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the e file signature authorization for rct 101 pa corporate net income tax report pa 8879 c pa department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the E file Signature Authorization For RCT 101, PA Corporate Net Income Tax Report PA 8879 C?

The E file Signature Authorization For RCT 101, PA Corporate Net Income Tax Report PA 8879 C is a crucial document that allows businesses to electronically file their corporate net income tax reports with the Pennsylvania Department of Revenue. This authorization simplifies the filing process and ensures compliance with state regulations.

-

How does airSlate SignNow facilitate the E file Signature Authorization process?

airSlate SignNow streamlines the E file Signature Authorization For RCT 101, PA Corporate Net Income Tax Report PA 8879 C by providing an intuitive platform for eSigning documents. Users can easily upload, sign, and send their authorization forms, ensuring a quick and efficient filing experience.

-

What are the pricing options for using airSlate SignNow for E file Signature Authorization?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Each plan includes features that support the E file Signature Authorization For RCT 101, PA Corporate Net Income Tax Report PA 8879 C, making it a cost-effective solution for managing your tax documentation.

-

What features does airSlate SignNow provide for E file Signature Authorization?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking for the E file Signature Authorization For RCT 101, PA Corporate Net Income Tax Report PA 8879 C. These tools enhance the efficiency and security of your document management process.

-

Can I integrate airSlate SignNow with other software for tax filing?

Yes, airSlate SignNow offers seamless integrations with various accounting and tax software, making it easier to manage the E file Signature Authorization For RCT 101, PA Corporate Net Income Tax Report PA 8879 C. This connectivity ensures that your documents are synchronized and accessible across platforms.

-

What are the benefits of using airSlate SignNow for E file Signature Authorization?

Using airSlate SignNow for the E file Signature Authorization For RCT 101, PA Corporate Net Income Tax Report PA 8879 C provides numerous benefits, including time savings, enhanced security, and improved compliance. The platform's user-friendly interface allows for quick document processing, reducing the stress of tax season.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely! airSlate SignNow prioritizes security and employs advanced encryption protocols to protect your documents, including the E file Signature Authorization For RCT 101, PA Corporate Net Income Tax Report PA 8879 C. You can trust that your sensitive information is safe while using our platform.

Get more for E file Signature Authorization For RCT 101, PA Corporate Net Income Tax Report PA 8879 C PA Department Of Revenue

Find out other E file Signature Authorization For RCT 101, PA Corporate Net Income Tax Report PA 8879 C PA Department Of Revenue

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document