SECTION I Employer Form

What is the SECTION I Employer

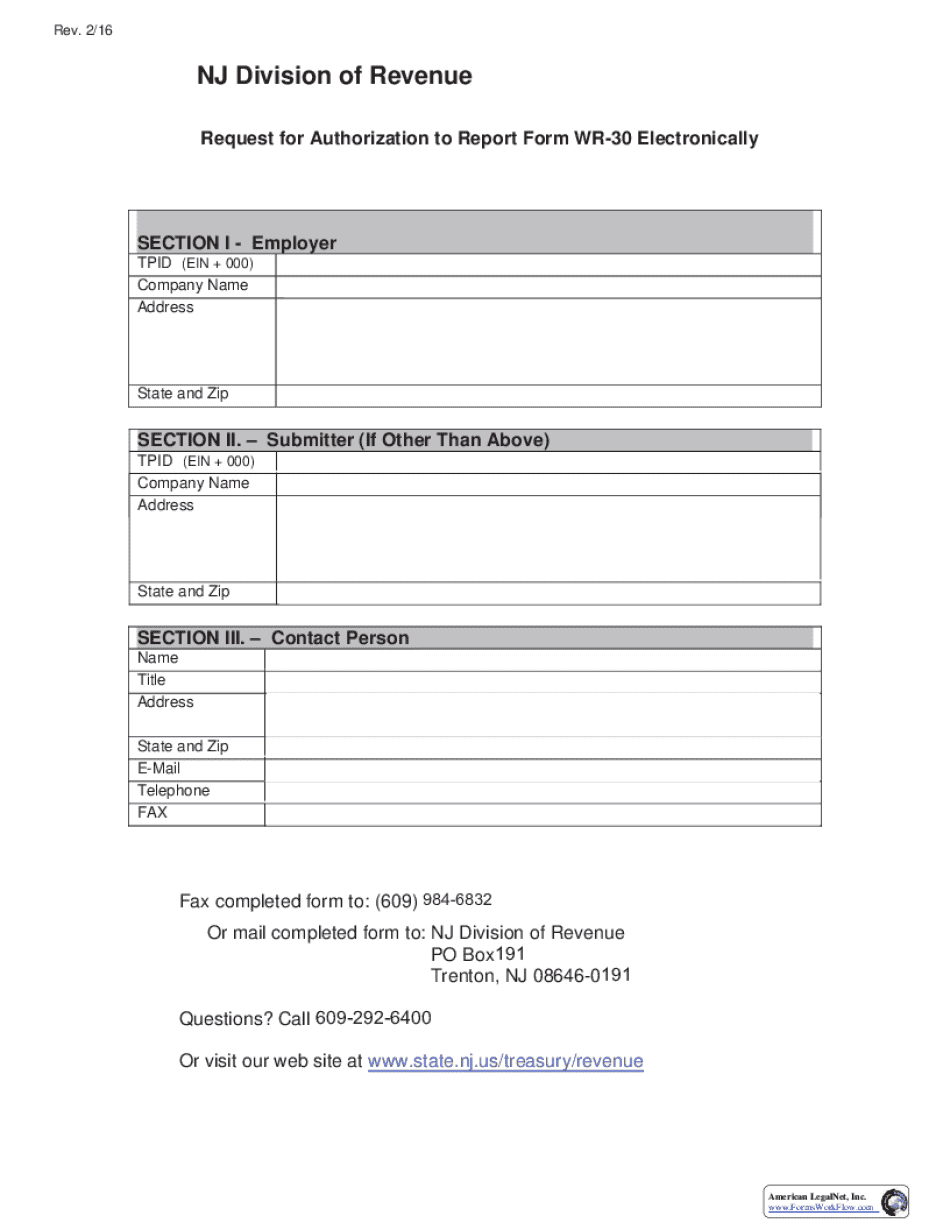

The SECTION I Employer of the employers WR 30 form is a crucial component that identifies the employer and provides essential information for tax reporting. This section requires the employer's name, address, and federal employer identification number (EIN). Accurate completion of this section is vital for ensuring that the tax obligations are correctly attributed to the right entity, thereby avoiding potential issues with the Internal Revenue Service (IRS).

How to use the SECTION I Employer

To effectively use the SECTION I Employer, begin by gathering all necessary information about your business. This includes your legal business name, physical address, and EIN. Fill in each field accurately, ensuring that the information matches what is on file with the IRS. This section must be completed before submitting the entire WR 30 form to ensure compliance with tax regulations.

Steps to complete the SECTION I Employer

Completing the SECTION I Employer involves several straightforward steps:

- Gather your business information, including the legal name and EIN.

- Locate the SECTION I section on the WR 30 form.

- Enter your business name exactly as it appears on IRS documents.

- Input your business address, ensuring it is current and accurate.

- Provide your EIN, which is essential for tax identification purposes.

- Review the completed section for accuracy before moving to the next part of the form.

Legal use of the SECTION I Employer

The SECTION I Employer must be filled out in accordance with U.S. tax laws. Accurate reporting is essential to avoid penalties and ensure that tax obligations are met. Employers are legally required to provide correct information, as inaccuracies can lead to audits or fines from the IRS. It is advisable to consult a tax professional if there are uncertainties regarding the information to be reported.

Required Documents

When completing the SECTION I Employer, certain documents may be necessary to ensure accuracy. These include:

- Your federal employer identification number (EIN) documentation.

- Previous tax filings that include your business name and address.

- Any correspondence from the IRS regarding your business.

Having these documents on hand will facilitate the accurate completion of the WR 30 form.

Form Submission Methods (Online / Mail / In-Person)

The completed WR 30 form, including SECTION I Employer, can be submitted through various methods. Employers may choose to file electronically, which is often faster and more efficient. Alternatively, the form can be mailed to the appropriate tax authority or submitted in person at designated locations. Each submission method has its own guidelines, so it is important to follow the specific instructions provided by the IRS or state tax authority.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the section i employer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the employers wr 30 form and why is it important?

The employers wr 30 form is a crucial document used by employers to report employee wages and taxes. It ensures compliance with state regulations and helps in accurate tax reporting. Understanding this form is essential for businesses to avoid penalties and maintain good standing with tax authorities.

-

How can airSlate SignNow help with the employers wr 30 form?

airSlate SignNow streamlines the process of completing and submitting the employers wr 30 form by providing an easy-to-use eSignature solution. With our platform, you can quickly fill out the form, obtain necessary signatures, and securely send it to the relevant authorities. This saves time and reduces the risk of errors.

-

What features does airSlate SignNow offer for managing the employers wr 30 form?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure cloud storage specifically for managing the employers wr 30 form. These tools enhance efficiency and ensure that all documents are organized and easily accessible. Additionally, our platform supports real-time collaboration among team members.

-

Is airSlate SignNow cost-effective for handling the employers wr 30 form?

Yes, airSlate SignNow provides a cost-effective solution for handling the employers wr 30 form. Our pricing plans are designed to fit various business sizes and budgets, ensuring that you get the best value for your investment. By reducing paperwork and streamlining processes, you can save both time and money.

-

Can I integrate airSlate SignNow with other software for the employers wr 30 form?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, making it easy to manage the employers wr 30 form alongside your existing tools. Whether you use accounting software or HR management systems, our platform can enhance your workflow and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for the employers wr 30 form?

Using airSlate SignNow for the employers wr 30 form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and stored securely, minimizing the risk of data bsignNowes. Additionally, you can track the status of your forms in real-time.

-

How secure is airSlate SignNow when handling the employers wr 30 form?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your data when handling the employers wr 30 form. Our platform is designed to meet industry standards, ensuring that your sensitive information remains confidential and secure throughout the signing process.

Get more for SECTION I Employer

- Muslim wedding card format pdf

- Walmart employee handbook 2022 pdf form

- Air india flight ticket pdf download form

- Breakdown sheet template form

- Fake medical documentation template fake medical documentation template form

- Fake medical certificates for getting out of work school foolproof form

- Medical certificate template pdf format free australia fake doctors note

- Pupil immunization record english minnesota dept of health form for parents to record a childs shot records that will be kept

Find out other SECTION I Employer

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP