Form REG 1E Application for ST 5 Exempt Organization Certificate for Nonprofit Exemption from Sales Tax

Understanding the REG 1E Application for ST 5 Exempt Organization Certificate

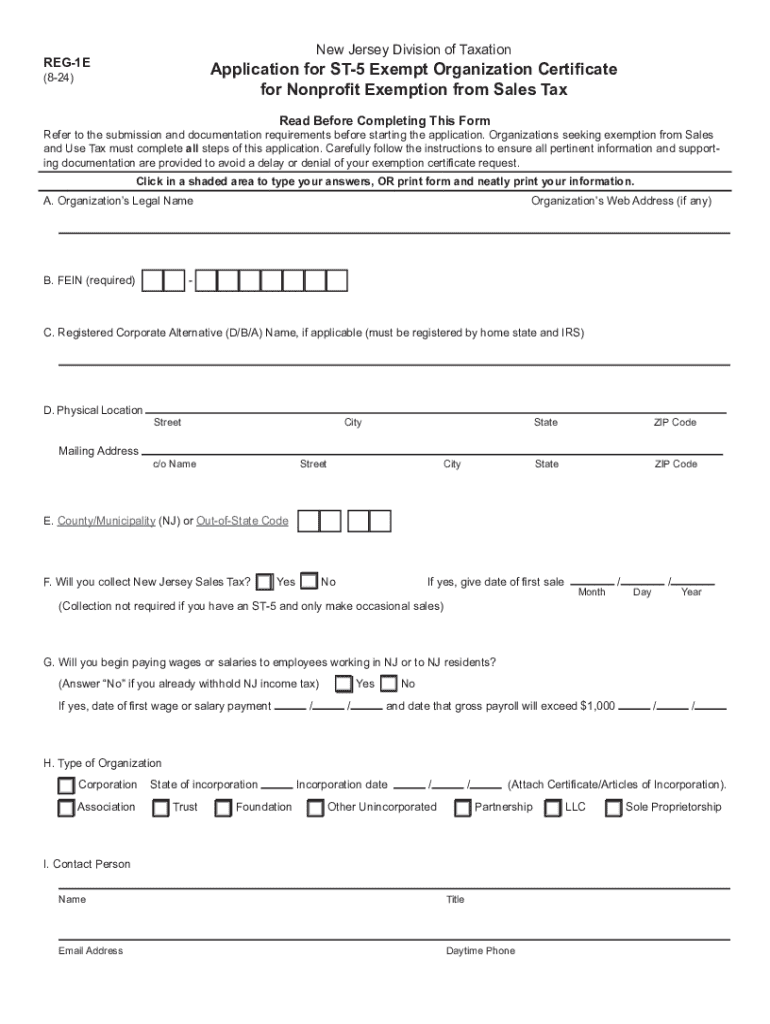

The REG 1E Application is a crucial document for nonprofit organizations seeking exemption from sales tax in New Jersey. This form allows eligible entities to apply for an ST 5 Exempt Organization Certificate, which confirms their status as tax-exempt. Nonprofits must demonstrate that their activities align with the criteria set by the state to qualify for this exemption. This application is essential for organizations looking to reduce their tax burden and allocate more resources towards their missions.

Steps to Complete the REG 1E Application

Completing the REG 1E Application involves several key steps:

- Gather Required Information: Collect necessary details about your organization, including its legal name, address, and federal tax identification number.

- Provide Organizational Details: Clearly outline the purpose of your organization and how it meets the criteria for tax exemption.

- Complete the Application Form: Fill out the REG 1E form accurately, ensuring all sections are completed to avoid delays.

- Submit Supporting Documents: Attach any required documentation that supports your application, such as bylaws, financial statements, or proof of nonprofit status.

- Review and Submit: Double-check all information for accuracy before submitting the application to the appropriate state agency.

Eligibility Criteria for the REG 1E Application

To qualify for the ST 5 Exempt Organization Certificate through the REG 1E Application, organizations must meet specific eligibility criteria. Generally, eligible entities include:

- Nonprofit organizations recognized under Section 501(c)(3) of the Internal Revenue Code.

- Organizations that operate exclusively for charitable, educational, or religious purposes.

- Entities that do not engage in activities for profit or personal gain.

It is important for applicants to ensure they meet these criteria before applying, as failure to do so may result in denial of the exemption.

Required Documents for the REG 1E Application

When submitting the REG 1E Application, organizations must include specific documents to support their request for tax exemption. Required documents typically include:

- Proof of Nonprofit Status: A copy of the IRS determination letter confirming tax-exempt status.

- Organizational Bylaws: Documentation that outlines the governance structure and purpose of the organization.

- Financial Statements: Recent financial records that demonstrate the organization’s operations and funding sources.

Including all necessary documents can help expedite the review process and increase the chances of approval.

Form Submission Methods for the REG 1E Application

The REG 1E Application can be submitted through various methods, ensuring flexibility for organizations. Common submission methods include:

- Online Submission: Many organizations prefer to submit the application electronically through the New Jersey Division of Taxation's online portal.

- Mail: Applicants can also print the completed form and send it via postal mail to the designated state office.

- In-Person Submission: For those who prefer face-to-face interactions, submitting the application in person at a local tax office is an option.

Common Mistakes to Avoid When Submitting the REG 1E Application

To ensure a smooth application process, organizations should be aware of common pitfalls that can lead to delays or denials:

- Incomplete Information: Failing to fill out all required fields can result in processing delays.

- Missing Documents: Not including necessary supporting documents may lead to rejection of the application.

- Incorrect Submission Method: Using an inappropriate submission method can cause confusion and delays in processing.

By being mindful of these issues, organizations can improve their chances of a successful application for the ST 5 Exempt Organization Certificate.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form reg 1e application for st 5 exempt organization certificate for nonprofit exemption from sales tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ST 5 form for sales tax exempt NJ?

The ST 5 form for sales tax exempt NJ is a certificate that allows eligible organizations to make tax-exempt purchases in New Jersey. This form is essential for non-profit organizations, government entities, and certain other groups to avoid paying sales tax on qualifying purchases.

-

How can airSlate SignNow help with the ST 5 form sales tax exempt NJ?

airSlate SignNow simplifies the process of completing and submitting the ST 5 form sales tax exempt NJ. With our easy-to-use platform, you can quickly fill out, eSign, and send the form, ensuring compliance and efficiency in your tax-exempt transactions.

-

Is there a cost associated with using airSlate SignNow for the ST 5 form sales tax exempt NJ?

airSlate SignNow offers a cost-effective solution for managing documents, including the ST 5 form sales tax exempt NJ. Our pricing plans are designed to fit various business needs, ensuring you get the best value for your document management and eSigning requirements.

-

What features does airSlate SignNow offer for managing the ST 5 form sales tax exempt NJ?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for the ST 5 form sales tax exempt NJ. These tools enhance your workflow, making it easier to manage tax-exempt documentation efficiently.

-

Can I integrate airSlate SignNow with other software for the ST 5 form sales tax exempt NJ?

Yes, airSlate SignNow offers integrations with various software applications, allowing you to streamline your processes related to the ST 5 form sales tax exempt NJ. This ensures that your document management system works seamlessly with your existing tools.

-

What are the benefits of using airSlate SignNow for the ST 5 form sales tax exempt NJ?

Using airSlate SignNow for the ST 5 form sales tax exempt NJ provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform helps you manage your tax-exempt forms with ease, saving you time and resources.

-

How secure is airSlate SignNow when handling the ST 5 form sales tax exempt NJ?

airSlate SignNow prioritizes security, ensuring that your ST 5 form sales tax exempt NJ and other documents are protected. We utilize advanced encryption and compliance measures to safeguard your sensitive information throughout the signing process.

Get more for Form REG 1E Application For ST 5 Exempt Organization Certificate For Nonprofit Exemption From Sales Tax

Find out other Form REG 1E Application For ST 5 Exempt Organization Certificate For Nonprofit Exemption From Sales Tax

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure