DR 1002 Colorado SalesUse Tax Rates If You Are Using a Screen Reader or Other Assistive Technology, Please Note that Colorado De Form

Understanding the DR 1002 Colorado Sales and Use Tax Rates

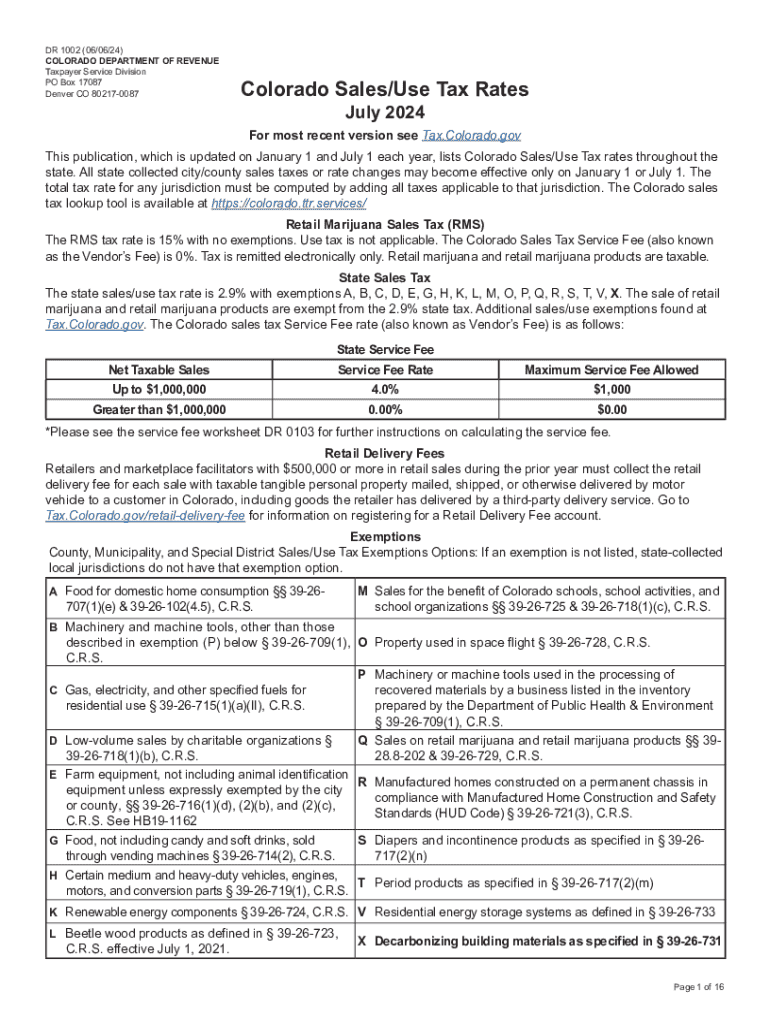

The DR 1002 form is essential for reporting sales and use tax in Colorado. It provides a detailed breakdown of the applicable rates for various goods and services. Understanding these rates is crucial for businesses and individuals who engage in taxable transactions. The form outlines the current Colorado sales tax rates, which can vary by location, and includes information on how to apply these rates to different types of purchases.

Steps to Complete the DR 1002 Form

Completing the DR 1002 form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information regarding your sales and purchases.

- Identify the correct sales tax rate based on your location and the type of goods or services provided.

- Fill out the form accurately, ensuring all figures are correct and reflect your taxable transactions.

- Review the completed form for any errors before submission.

Key Elements of the DR 1002 Form

The DR 1002 form includes several key elements that are vital for accurate reporting:

- Taxable Sales: This section details the total amount of sales subject to tax.

- Exempt Sales: Any sales that are not subject to tax must be documented here.

- Net Tax Due: This calculates the total tax owed after exemptions are applied.

Legal Use of the DR 1002 Form

Using the DR 1002 form correctly is essential for compliance with Colorado tax laws. It is designed to ensure that businesses accurately report their sales and use tax obligations. Failure to use the form appropriately can lead to penalties and interest on unpaid taxes. It is important to keep records of all transactions and maintain copies of submitted forms for your records.

Filing Deadlines for the DR 1002 Form

Timely filing of the DR 1002 form is crucial to avoid penalties. The deadlines for submitting the form typically align with the end of each reporting period, which can be monthly, quarterly, or annually, depending on the volume of sales. Businesses should check the Colorado Department of Revenue's official guidelines for specific deadlines to ensure compliance.

Examples of Using the DR 1002 Form

Understanding practical applications of the DR 1002 form can help clarify its use. For instance, a retail store must report sales tax collected on merchandise sold. A contractor providing taxable services must also report the applicable sales tax on their services. Each scenario requires accurate reporting based on the specific tax rates and exemptions applicable to the transactions.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr 1002 colorado salesuse tax rates if you are using a screen reader or other assistive technology please note that colorado

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the current colorado rates for airSlate SignNow?

The colorado rates for airSlate SignNow vary based on the plan you choose. We offer flexible pricing options that cater to different business needs, ensuring you get the best value for your investment. For detailed pricing information, please visit our pricing page.

-

How does airSlate SignNow compare to other eSignature solutions in terms of colorado rates?

airSlate SignNow offers competitive colorado rates compared to other eSignature solutions. Our pricing structure is designed to provide cost-effective options without compromising on features. This makes us an ideal choice for businesses looking for quality and affordability.

-

What features are included in the colorado rates for airSlate SignNow?

The colorado rates for airSlate SignNow include a comprehensive set of features such as document templates, real-time tracking, and secure cloud storage. Additionally, users benefit from unlimited eSignatures and integrations with popular applications, enhancing productivity and efficiency.

-

Are there any hidden fees associated with the colorado rates?

No, airSlate SignNow is transparent about its pricing. The colorado rates you see are the rates you pay, with no hidden fees or unexpected charges. We believe in providing clear and straightforward pricing to help you make informed decisions.

-

Can I customize my plan based on my needs within the colorado rates?

Yes, airSlate SignNow allows you to customize your plan to fit your specific needs while staying within the colorado rates. You can choose from various features and add-ons to create a solution that works best for your business. Our team is here to help you find the right fit.

-

What are the benefits of using airSlate SignNow at the current colorado rates?

Using airSlate SignNow at the current colorado rates provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security for your documents. Our user-friendly platform simplifies the signing process, allowing you to focus on what matters most—growing your business.

-

Is there a free trial available to evaluate the colorado rates?

Yes, airSlate SignNow offers a free trial that allows you to evaluate our services and see how they align with your needs before committing to the colorado rates. This trial period gives you access to all features, enabling you to experience the benefits firsthand.

Get more for DR 1002 Colorado SalesUse Tax Rates If You Are Using A Screen Reader Or Other Assistive Technology, Please Note That Colorado De

- Mcba real estate forms

- Substitution of attorney letter sample form

- Js3100 form

- Sample filled up bir form 2307 excel

- Indiana hunting permission form

- Contract for residential lots in a community titles scheme form

- Canara bank nri account opening online form

- Account and transaction authorization form usaa

Find out other DR 1002 Colorado SalesUse Tax Rates If You Are Using A Screen Reader Or Other Assistive Technology, Please Note That Colorado De

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure