Connecticut Form Ct 588 Fill Out & Sign Online

Understanding the Connecticut Form CT-588

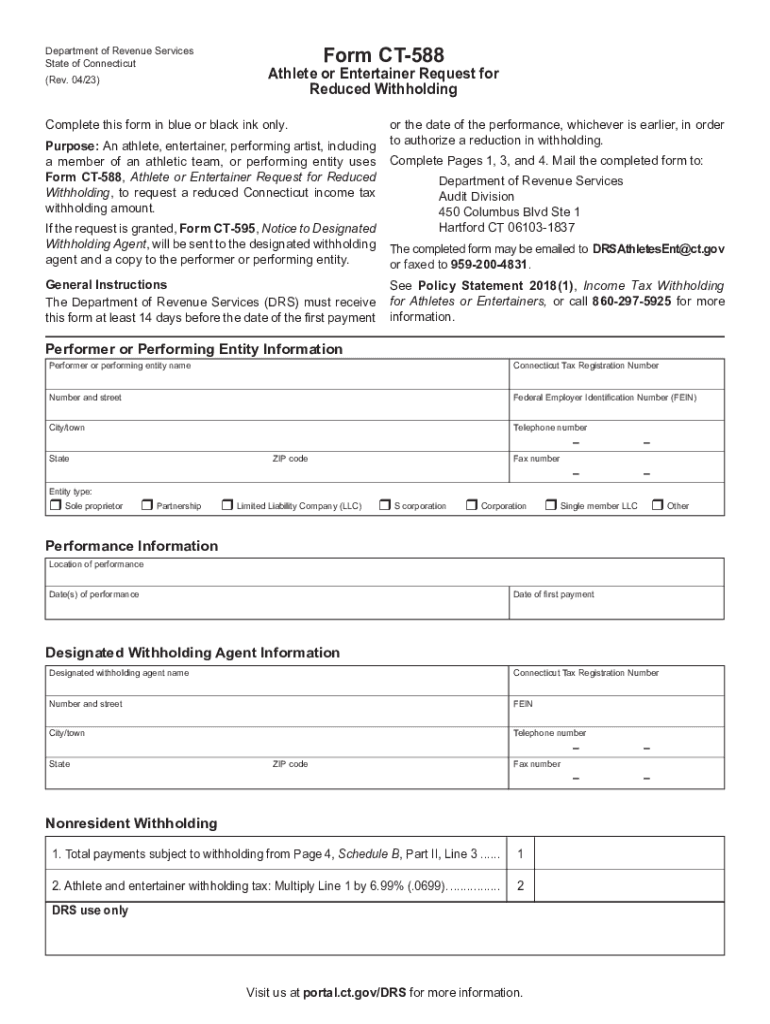

The Connecticut Form CT-588 is essential for individuals and entities engaging in specific transactions within the state. This form primarily addresses withholding tax obligations for entertainers and athletes performing in Connecticut. It is crucial to understand the purpose of this form to ensure compliance with state tax regulations.

Form CT-588 is designed to assist in determining the appropriate amount of tax to withhold from payments made to non-resident entertainers and athletes. This ensures that the state collects the necessary taxes from individuals who may not be subject to Connecticut tax laws otherwise.

Steps to Complete the Connecticut Form CT-588

Completing the Connecticut Form CT-588 involves several key steps. First, gather all necessary information, including the performer’s details, the nature of the performance, and the payment amount. Next, accurately fill out the form, ensuring all fields are completed correctly to avoid delays.

Once the form is filled out, review it for accuracy. Any errors can lead to penalties or delays in processing. After confirming that all information is correct, submit the form to the appropriate state agency, either electronically or via mail, depending on your preference.

Eligibility Criteria for Using the Connecticut Form CT-588

Eligibility to use the Connecticut Form CT-588 is primarily determined by the residency status of the performer or athlete. Non-residents who receive compensation for performances in Connecticut must use this form to report their earnings and ensure proper withholding of state taxes.

Additionally, the form is applicable to various types of entertainers, including musicians, actors, and athletes. Understanding the eligibility criteria is vital for compliance and to avoid potential penalties for non-compliance.

Required Documents for Filing the Connecticut Form CT-588

When preparing to file the Connecticut Form CT-588, certain documents are necessary to support the information provided. These include proof of residency status, details of the performance contract, and any prior tax filings that may be relevant.

Having these documents ready can streamline the filing process and ensure that all required information is accurately reported, reducing the likelihood of issues with the state tax authorities.

Penalties for Non-Compliance with Connecticut Tax Regulations

Failing to comply with Connecticut tax regulations regarding the Form CT-588 can result in significant penalties. Non-compliance may lead to fines, interest on unpaid taxes, and potential legal action from state authorities.

It is essential to understand these consequences and take the necessary steps to ensure timely and accurate filing of the form to avoid any penalties that could impact your financial standing.

Form Submission Methods for Connecticut Form CT-588

The Connecticut Form CT-588 can be submitted through various methods, providing flexibility for users. Options include online submission via the state’s tax portal, mailing a physical copy of the form, or delivering it in person to the appropriate tax office.

Choosing the right submission method can depend on factors such as urgency, personal preference, and the availability of electronic filing options. Each method has its own processing times and requirements, so it is important to consider these when planning your submission.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the connecticut form ct 588 fill out ampamp sign online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a CT request withholding?

A CT request withholding is a formal request to withhold a portion of payments for tax purposes in Connecticut. This process ensures compliance with state tax regulations and helps businesses manage their tax liabilities effectively.

-

How does airSlate SignNow facilitate CT request withholding?

airSlate SignNow streamlines the process of submitting CT request withholding forms by allowing users to eSign and send documents securely. This eliminates the need for physical paperwork and speeds up the submission process, ensuring timely compliance.

-

What are the pricing options for using airSlate SignNow for CT request withholding?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Each plan includes features that support CT request withholding, ensuring you have the tools necessary for efficient document management at a competitive price.

-

Can I integrate airSlate SignNow with other software for CT request withholding?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow for CT request withholding. This integration allows for better data management and ensures that all necessary documents are easily accessible.

-

What features does airSlate SignNow provide for managing CT request withholding?

airSlate SignNow includes features such as customizable templates, automated reminders, and secure eSigning, all of which are essential for managing CT request withholding efficiently. These tools help streamline the process and reduce the risk of errors.

-

How can airSlate SignNow benefit my business when handling CT request withholding?

By using airSlate SignNow, your business can save time and reduce costs associated with paper-based processes for CT request withholding. The platform enhances collaboration and ensures that all stakeholders can access and sign documents quickly and securely.

-

Is airSlate SignNow compliant with Connecticut regulations for CT request withholding?

Yes, airSlate SignNow is designed to comply with Connecticut regulations regarding CT request withholding. The platform regularly updates its features to ensure that users can meet all legal requirements efficiently.

Get more for Connecticut Form Ct 588 Fill Out & Sign Online

Find out other Connecticut Form Ct 588 Fill Out & Sign Online

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract