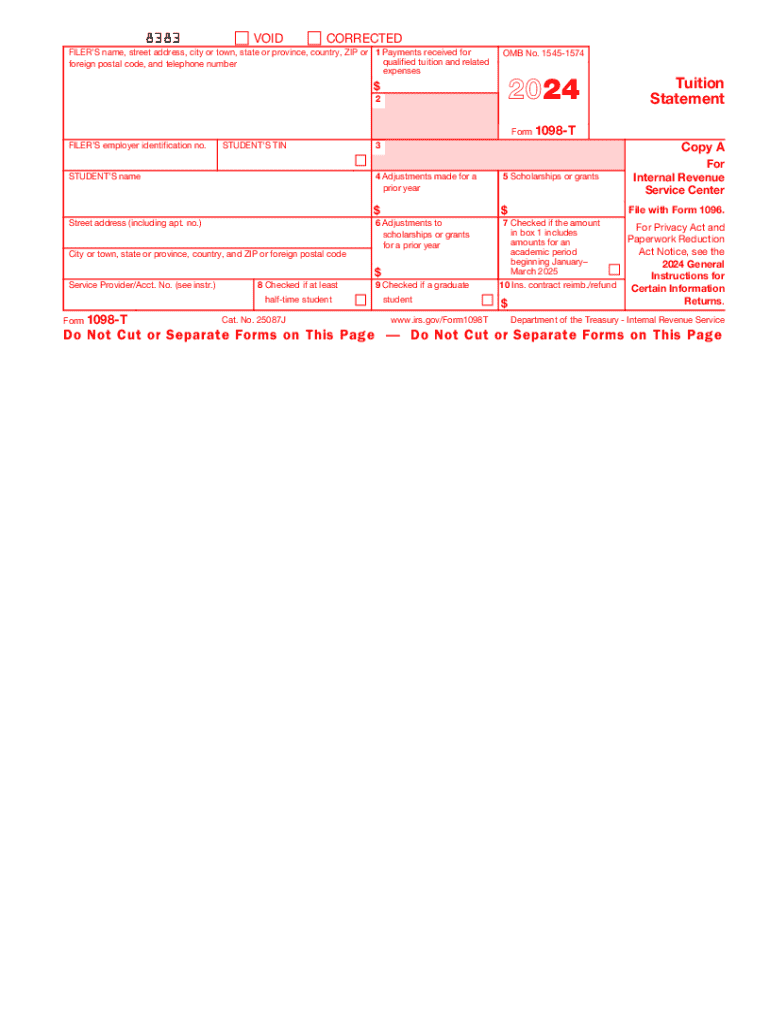

Form 1098 T

What is the Form 1098-T?

The Form 1098-T, also known as the Tuition Statement, is an IRS tax form used by eligible educational institutions to report information about students who are enrolled and pay qualified tuition and related expenses. It is primarily utilized by students and their families to claim education-related tax benefits, such as the American Opportunity Credit and the Lifetime Learning Credit. This form provides essential details, including the amount of tuition paid, scholarships received, and other financial aid, which are crucial for accurately filing federal income tax returns.

How to obtain the Form 1098-T

Students can typically obtain the Form 1098-T from their educational institution. Most schools provide this form electronically through their student portals or send it via mail. If a student does not receive their form, they should contact the school's financial aid office or registrar's office to request a copy. Additionally, many institutions offer downloadable versions of the form on their websites, making it easier for students to access the necessary information for tax filing.

Steps to complete the Form 1098-T

Completing the Form 1098-T involves several steps:

- Gather necessary documents, including tuition payment receipts and any scholarship or grant information.

- Fill out the student’s personal information, such as name, Social Security number, and address.

- Report qualified tuition and related expenses in the appropriate sections of the form.

- Include any scholarships or grants that the student received during the tax year.

- Review the completed form for accuracy before submitting it with the tax return.

Key elements of the Form 1098-T

The Form 1098-T contains several key elements that are important for both the educational institution and the student:

- Box 1: Reports payments received for qualified tuition and related expenses.

- Box 2: (No longer used) Previously reported amounts billed for qualified tuition.

- Box 5: Lists scholarships and grants received by the student.

- Box 4: Indicates any adjustments made to scholarships or grants from a prior year.

- Student Information: Includes the student’s name, address, and taxpayer identification number.

IRS Guidelines

The IRS provides specific guidelines regarding the use of Form 1098-T. Educational institutions must ensure that the information reported is accurate and complete. Students should use the form to determine eligibility for education tax credits and deductions. It is important to note that while the form is helpful, it does not guarantee that a taxpayer will qualify for these benefits. The IRS advises taxpayers to review the eligibility criteria for education credits thoroughly and to keep supporting documents for their records.

Filing Deadlines / Important Dates

For the tax year 2024, educational institutions must provide the Form 1098-T to students by January 31 of the following year. Students should ensure they have received their form before filing their tax returns. The deadline for filing federal income tax returns typically falls on April 15, unless that date falls on a weekend or holiday, in which case the deadline may be extended. It is essential for students to be aware of these dates to avoid any potential penalties or missed opportunities for tax credits.

Handy tips for filling out Form 1098 T online

Quick steps to complete and e-sign Form 1098 T online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Gain access to a GDPR and HIPAA compliant service for optimum efficiency. Use signNow to electronically sign and share Form 1098 T for e-signing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1098 t

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 1098 t form and why is it important?

The 1098 t form is a tax document used to report tuition payments made to eligible educational institutions. It is important for students and parents as it helps in claiming education-related tax credits, potentially reducing tax liability. Understanding how to properly fill out and submit the 1098 t can ensure you maximize your tax benefits.

-

How can airSlate SignNow help with the 1098 t form?

airSlate SignNow provides an efficient platform for electronically signing and sending the 1098 t form. With its user-friendly interface, you can easily manage your documents, ensuring that your 1098 t is completed and submitted on time. This streamlines the process, making it hassle-free for both students and educational institutions.

-

What features does airSlate SignNow offer for managing 1098 t forms?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for managing 1098 t forms. These features enhance the efficiency of handling tax documents, ensuring that all necessary information is accurately captured and securely transmitted. Additionally, the platform allows for easy collaboration between parties involved.

-

Is airSlate SignNow cost-effective for handling 1098 t forms?

Yes, airSlate SignNow is a cost-effective solution for handling 1098 t forms. With various pricing plans available, businesses can choose an option that fits their budget while still accessing powerful features. This affordability makes it an ideal choice for educational institutions and students alike.

-

Can I integrate airSlate SignNow with other software for 1098 t processing?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing the processing of 1098 t forms. Whether you use accounting software or student management systems, these integrations streamline workflows and ensure that your documents are efficiently managed across platforms.

-

What are the benefits of using airSlate SignNow for 1098 t forms?

Using airSlate SignNow for 1098 t forms provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning and easy document sharing, which can save time during tax season. Additionally, the secure environment ensures that sensitive information is protected.

-

How does airSlate SignNow ensure the security of my 1098 t forms?

airSlate SignNow prioritizes security by employing advanced encryption and compliance with industry standards to protect your 1098 t forms. This ensures that your sensitive information remains confidential and secure during transmission and storage. You can trust that your documents are safe with airSlate SignNow.

Get more for Form 1098 T

- Electrical risk assessment example pdf form

- Dermalogica consultation card 389729545 form

- Declaration form for tendering purposes

- Application of ecd job kericho county online form

- De 4 56380 form

- Texasworkforce org ui ev html form

- Record keeping form chemical uses startf finisht

- Revised po bond doc comptroller tn form

Find out other Form 1098 T

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple