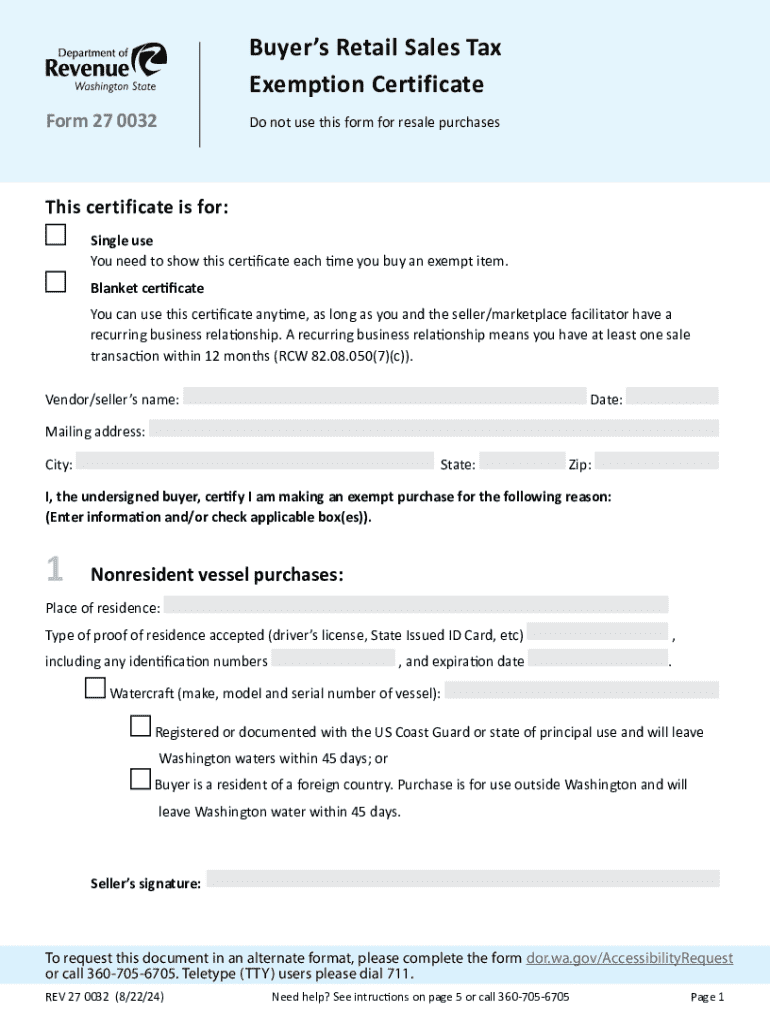

Buyers Retail Sales Tax Exemption Certificate Form 27 0032

Understanding the Buyers Retail Sales Tax Exemption Certificate Form 27 0032

The Buyers Retail Sales Tax Exemption Certificate, known as Form 27 0032, is a crucial document for businesses and individuals seeking to purchase goods without incurring sales tax. This form is primarily used in Washington State and is essential for buyers who qualify for tax exemption status. The certificate allows eligible purchasers to buy items for resale or for specific exempt purposes, thereby streamlining the purchasing process and reducing tax liabilities.

Steps to Complete the Buyers Retail Sales Tax Exemption Certificate Form 27 0032

Filling out the Buyers Retail Sales Tax Exemption Certificate requires careful attention to detail. Here are the steps to complete the form:

- Begin by entering the purchaser's name and address accurately.

- Provide the seller's name and address to establish the transaction context.

- Indicate the reason for the exemption, such as resale or specific exempt use.

- Include the purchaser's Washington State Department of Revenue (DOR) registration number, if applicable.

- Sign and date the form to validate the information provided.

Ensure all fields are filled out completely to avoid delays in processing or potential penalties.

Legal Use of the Buyers Retail Sales Tax Exemption Certificate Form 27 0032

The Buyers Retail Sales Tax Exemption Certificate is legally binding when used correctly. It is designed for specific situations, such as purchases made for resale or items that are exempt under Washington State law. Misuse of the form, such as using it for personal purchases or failing to meet exemption criteria, can result in penalties or fines. It is important for users to understand the legal implications and ensure compliance with state regulations.

Obtaining the Buyers Retail Sales Tax Exemption Certificate Form 27 0032

To obtain the Buyers Retail Sales Tax Exemption Certificate, individuals or businesses can download the form directly from the Washington State Department of Revenue website. It is also available at various business resource centers. Ensure that you have the most current version of the form to avoid any compliance issues. If assistance is needed, contacting the Department of Revenue can provide clarity on eligibility and usage.

Examples of Using the Buyers Retail Sales Tax Exemption Certificate Form 27 0032

Practical examples of using the Buyers Retail Sales Tax Exemption Certificate can help clarify its application. For instance:

- A retail store purchasing inventory for resale can present the certificate to suppliers to avoid paying sales tax.

- A non-profit organization buying supplies for a charitable event may also qualify for tax exemption.

These scenarios illustrate the form's utility in various business contexts, ensuring that eligible buyers can maximize their financial resources.

State-Specific Rules for the Buyers Retail Sales Tax Exemption Certificate Form 27 0032

Each state has its own regulations regarding sales tax exemption certificates. In Washington, the Buyers Retail Sales Tax Exemption Certificate must be used in accordance with state laws. This includes understanding what qualifies as exempt purchases and ensuring that the form is filled out correctly. Familiarity with local tax codes can help avoid inadvertent misuse of the certificate.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the buyers retail sales tax exemption certificate form 27 0032

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a retail certificate?

A retail certificate is a document that allows businesses to purchase goods without paying sales tax. This certificate is essential for retailers who want to buy inventory for resale. By using a retail certificate, businesses can save on costs and streamline their purchasing process.

-

How can airSlate SignNow help with retail certificates?

airSlate SignNow provides a seamless way to create, send, and eSign retail certificates electronically. This solution simplifies the management of retail certificates, ensuring that all documents are securely stored and easily accessible. With airSlate SignNow, businesses can enhance their efficiency and compliance when handling retail certificates.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various businesses. Whether you are a small retailer or a large corporation, you can find a plan that fits your budget while providing the necessary features for managing retail certificates. Visit our pricing page for detailed information on each plan.

-

What features does airSlate SignNow offer for managing retail certificates?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning capabilities specifically designed for retail certificates. These features help businesses streamline their document processes and ensure compliance with tax regulations. Additionally, users can track the status of their retail certificates in real-time.

-

Are there any benefits to using airSlate SignNow for retail certificates?

Using airSlate SignNow for retail certificates offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Businesses can save time by automating the signing process and minimizing errors associated with manual handling. Furthermore, the platform ensures that all retail certificates are securely stored and easily retrievable.

-

Can airSlate SignNow integrate with other software for retail certificate management?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing the management of retail certificates. This integration allows businesses to connect their existing systems, such as CRM and accounting software, to streamline workflows. By using airSlate SignNow, you can ensure that your retail certificate processes are fully integrated and efficient.

-

How secure is airSlate SignNow for handling retail certificates?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your retail certificates. The platform adheres to industry standards, ensuring that all documents are securely transmitted and stored. Businesses can trust airSlate SignNow to safeguard their sensitive information related to retail certificates.

Get more for Buyers Retail Sales Tax Exemption Certificate Form 27 0032

- Wonderful world of blood worksheet answers form

- Trinidad and tobago village council constitution pdf form

- Markhams account application online 24810699 form

- Lotus materia medica pdf download form

- Liebowitz social anxiety scale scoring pdf form

- Ratio and proportion worksheets with answers pdf form

- Diploma provisional certificate download form

- United of omaha life insurance company a mutual of form

Find out other Buyers Retail Sales Tax Exemption Certificate Form 27 0032

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free