D2441 Child and Dependent Care Credit for PartYear Form

What is the D2441 Child And Dependent Care Credit For PartYear

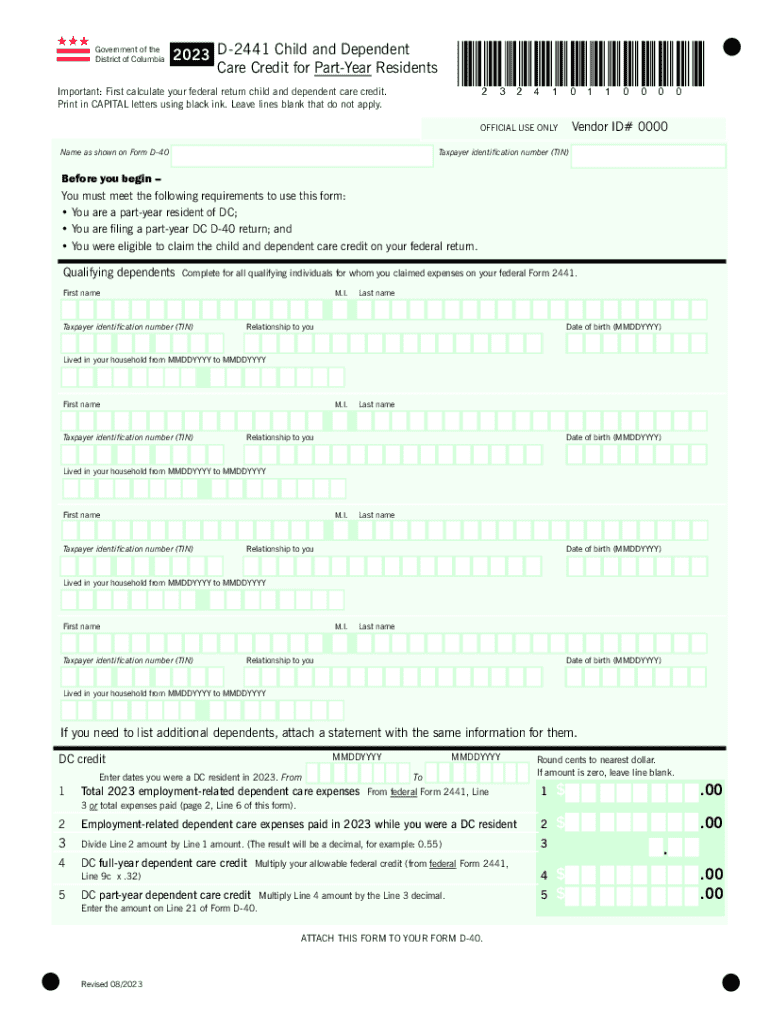

The D2441 Child and Dependent Care Credit for Part-Year is a tax credit designed for taxpayers who incur expenses for the care of qualifying children or dependents while they work or look for work. This credit is particularly relevant for those who have not lived in the United States for the entire tax year but have incurred eligible expenses during their period of residency. It allows taxpayers to claim a percentage of their qualifying care expenses, potentially reducing their overall tax liability.

Eligibility Criteria

To qualify for the D2441 Child and Dependent Care Credit for Part-Year, taxpayers must meet specific criteria. Generally, the individual must have earned income, and the care must be provided for a child under the age of thirteen or a dependent who is physically or mentally incapable of self-care. Additionally, the care must be necessary for the taxpayer to work or actively seek employment. Taxpayers must also have lived in the U.S. for part of the tax year to be eligible for this credit.

Steps to Complete the D2441 Child And Dependent Care Credit For PartYear

Completing the D2441 form involves several steps. First, gather all necessary documentation, including receipts for care expenses and information regarding the care provider. Next, fill out the form by providing personal information, including your filing status and the number of qualifying dependents. Calculate the total amount of qualifying expenses and apply the appropriate percentage to determine the credit amount. Finally, ensure that the form is signed and submitted along with your tax return.

Required Documents

When filing for the D2441 Child and Dependent Care Credit for Part-Year, certain documents are essential. Taxpayers should have:

- Receipts or invoices for child and dependent care expenses.

- The care provider's name, address, and taxpayer identification number (TIN).

- Proof of earned income, such as W-2 forms or pay stubs.

- Any other relevant tax documents that support your claim.

IRS Guidelines

The IRS provides specific guidelines for claiming the D2441 Child and Dependent Care Credit for Part-Year. Taxpayers should refer to IRS Publication 503 for detailed information on eligible expenses, the calculation of the credit, and the filing process. It is crucial to follow these guidelines closely to ensure compliance and avoid potential issues with tax returns.

Filing Deadlines / Important Dates

Filing deadlines for the D2441 Child and Dependent Care Credit for Part-Year align with the general tax filing deadlines in the United States. Typically, individual tax returns are due on April fifteenth of each year. However, if you are unable to meet this deadline, you may file for an extension, which grants an additional six months to submit your return. It is important to note that any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the d2441 child and dependent care credit for partyear

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the D2441 Child And Dependent Care Credit For PartYear?

The D2441 Child And Dependent Care Credit For PartYear is a tax credit designed to help families offset the costs of childcare for dependents while they work or look for work. This credit can signNowly reduce your tax liability, making it easier for families to manage childcare expenses during part of the year.

-

How can airSlate SignNow assist with the D2441 Child And Dependent Care Credit For PartYear?

airSlate SignNow provides an efficient platform for managing and signing documents related to the D2441 Child And Dependent Care Credit For PartYear. By streamlining the documentation process, users can ensure they have all necessary forms completed accurately and submitted on time, maximizing their potential tax benefits.

-

What features does airSlate SignNow offer for managing tax-related documents?

airSlate SignNow offers features such as eSignature, document templates, and secure cloud storage, which are essential for managing tax-related documents like those for the D2441 Child And Dependent Care Credit For PartYear. These features simplify the process of preparing and signing necessary forms, ensuring compliance and efficiency.

-

Is there a cost associated with using airSlate SignNow for the D2441 Child And Dependent Care Credit For PartYear?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and provides access to a range of features that can help you efficiently manage your documents related to the D2441 Child And Dependent Care Credit For PartYear, ultimately saving you time and resources.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various tax preparation software, enhancing your ability to manage documents related to the D2441 Child And Dependent Care Credit For PartYear. This integration allows for a smoother workflow, ensuring all necessary documents are easily accessible and organized.

-

What are the benefits of using airSlate SignNow for tax credits like D2441?

Using airSlate SignNow for tax credits like the D2441 Child And Dependent Care Credit For PartYear offers numerous benefits, including time savings, improved accuracy, and enhanced security. The platform's user-friendly interface makes it easy to prepare and sign documents, ensuring you can focus on maximizing your tax benefits.

-

How does airSlate SignNow ensure the security of my documents?

airSlate SignNow prioritizes the security of your documents by employing advanced encryption and secure cloud storage. This ensures that all documents related to the D2441 Child And Dependent Care Credit For PartYear are protected, giving you peace of mind while managing sensitive information.

Get more for D2441 Child And Dependent Care Credit For PartYear

- Intermediate accounting ifrs edition 3rd edition solution manual pdf form

- Lausd retirement benefits form

- Pli form fill up

- Witness statement template south africa form

- Fnb funding application form

- Lowes donation request letter form

- Skin wellness center of alabama hipaa patient consent form

- Observation of communicative competencecs1doc form

Find out other D2441 Child And Dependent Care Credit For PartYear

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter