Power of Attorney TR 41 Kansas Department of Revenue Form

Understanding the Kansas TR-41 Power of Attorney

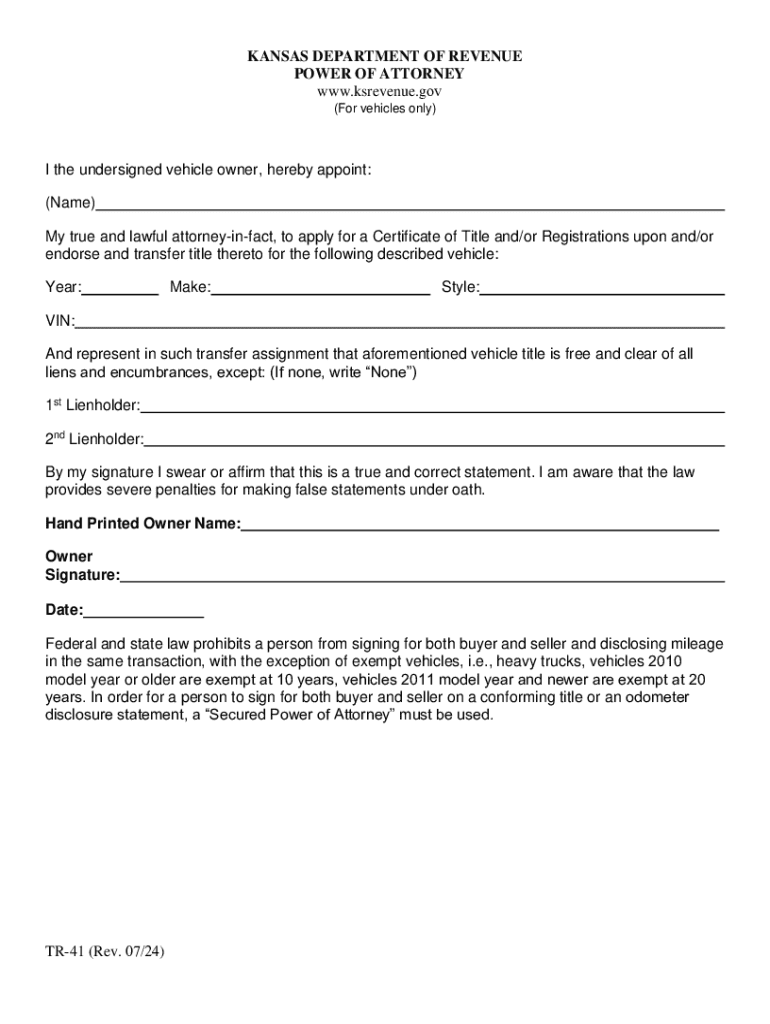

The Kansas TR-41 form, also known as the Power of Attorney, is a legal document that allows an individual to designate another person to act on their behalf in matters related to the Kansas Department of Revenue. This form is particularly useful for individuals who may be unable to manage their tax affairs due to various reasons, such as being out of state or having health issues. By completing the TR-41, a taxpayer can ensure that their appointed representative has the authority to handle specific tax matters, including filing returns and communicating with the Department of Revenue.

Steps to Complete the Kansas TR-41 Form

Filling out the Kansas TR-41 form involves several straightforward steps:

- Begin by downloading the form from the Kansas Department of Revenue's official website.

- Provide your personal information, including your full name, address, and Social Security number.

- Enter the details of the person you are appointing as your representative, including their name, address, and relationship to you.

- Specify the powers you wish to grant your representative, which can include filing tax returns, making payments, and receiving information.

- Sign and date the form to validate your request.

After completing these steps, ensure that the form is submitted according to the guidelines provided by the Kansas Department of Revenue.

Legal Use of the Kansas TR-41 Power of Attorney

The Kansas TR-41 form serves a critical legal function by allowing taxpayers to delegate authority for tax matters. This delegation is recognized by the Kansas Department of Revenue, meaning that any actions taken by your appointed representative are legally binding. It is important to understand that the powers granted can be limited to specific tax issues or can be broad, depending on your needs. This flexibility allows taxpayers to maintain control over their tax affairs while ensuring that necessary actions can be taken in their absence.

Obtaining the Kansas TR-41 Form

To obtain the Kansas TR-41 form, you can visit the Kansas Department of Revenue's official website where the form is available for download. It is essential to ensure that you are using the most current version of the form to avoid any issues with your submission. Additionally, if you require assistance, you may contact the Department of Revenue directly for guidance on how to complete the form correctly.

Required Documents for the Kansas TR-41

When completing the Kansas TR-41 form, certain documents may be necessary to support your application. These typically include:

- A valid form of identification, such as a driver's license or state ID.

- Any previous correspondence with the Kansas Department of Revenue that pertains to your tax situation.

- Documentation that verifies the identity of your appointed representative, if applicable.

Having these documents ready can streamline the process and ensure that your form is processed without unnecessary delays.

Form Submission Methods for the Kansas TR-41

The Kansas TR-41 form can be submitted through various methods, providing flexibility for taxpayers. You can choose to:

- Submit the form online through the Kansas Department of Revenue's electronic submission portal, if available.

- Mail the completed form to the appropriate address provided on the form itself.

- Deliver the form in person at a local Kansas Department of Revenue office.

Each method has its own processing times, so consider your urgency when selecting how to submit the form.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the power of attorney tr 41 kansas department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Kansas TR41 form?

The Kansas TR41 form is a document used for various tax-related purposes in the state of Kansas. It is essential for businesses and individuals to understand its requirements and how to fill it out correctly. Using airSlate SignNow can simplify the process of completing and eSigning the Kansas TR41 form.

-

How can airSlate SignNow help with the Kansas TR41 form?

airSlate SignNow provides an easy-to-use platform for sending and eSigning the Kansas TR41 form. With its intuitive interface, users can quickly upload, fill out, and send the form securely. This streamlines the process and ensures compliance with state regulations.

-

Is there a cost associated with using airSlate SignNow for the Kansas TR41 form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. The cost is competitive and provides access to features that simplify the completion of the Kansas TR41 form. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for the Kansas TR41 form?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage. These features enhance the efficiency of managing the Kansas TR41 form, allowing users to complete and send documents quickly and securely.

-

Can I integrate airSlate SignNow with other applications for the Kansas TR41 form?

Absolutely! airSlate SignNow offers integrations with various applications, making it easy to manage the Kansas TR41 form alongside your existing tools. This flexibility allows for a seamless workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for the Kansas TR41 form?

Using airSlate SignNow for the Kansas TR41 form provides numerous benefits, including time savings, improved accuracy, and enhanced security. The platform ensures that your documents are handled efficiently, allowing you to focus on your core business activities.

-

Is airSlate SignNow secure for handling the Kansas TR41 form?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Kansas TR41 form and other documents are protected. The platform uses advanced encryption and security measures to safeguard your sensitive information.

Get more for Power Of Attorney TR 41 Kansas Department Of Revenue

Find out other Power Of Attorney TR 41 Kansas Department Of Revenue

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free