Exemption Certificates Pub KS 1520 Rev 7 24 Publications Exemption CertificatesRev 7 24 Form

Understanding the Exemption Certificates Pub KS 1520 Rev 7 24

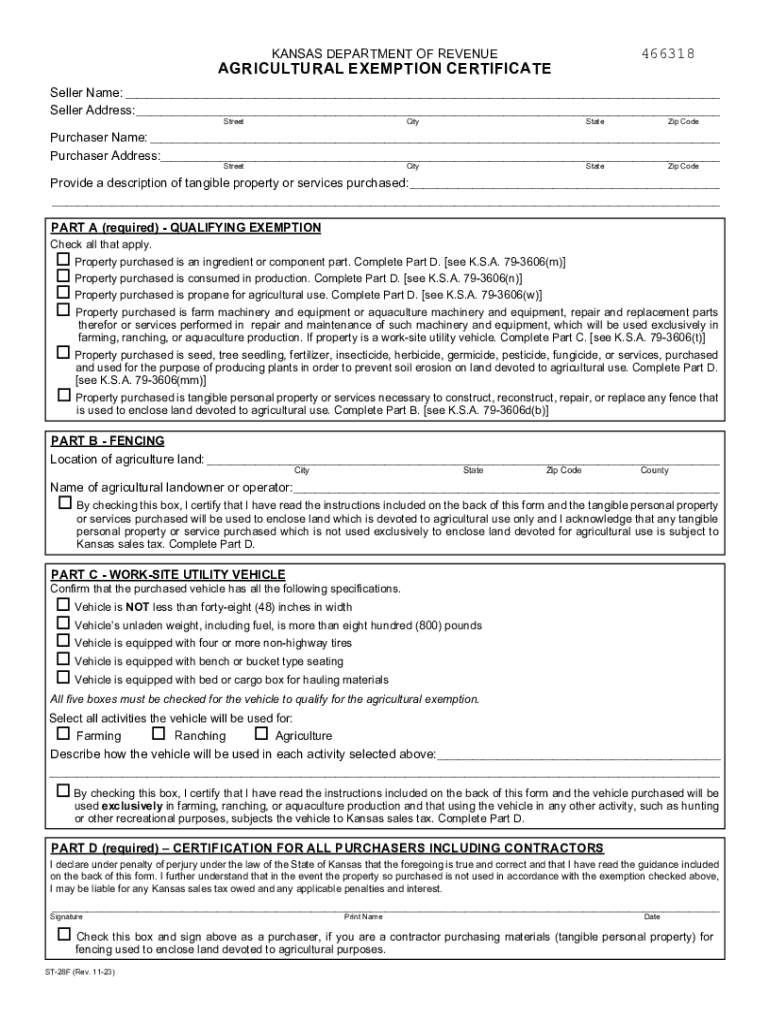

The Exemption Certificates Pub KS 1520 Rev 7 24 is a crucial document used in the state of Kansas for tax exemption purposes. This certificate allows eligible entities to make purchases without paying sales tax. It is primarily utilized by organizations that qualify for tax-exempt status, such as nonprofit organizations, government agencies, and certain educational institutions. Understanding the purpose and function of this certificate is essential for ensuring compliance with state tax regulations.

Steps to Complete the Exemption Certificates Pub KS 1520 Rev 7 24

Completing the Exemption Certificates Pub KS 1520 Rev 7 24 involves several key steps:

- Obtain the certificate form from the appropriate state department or website.

- Fill in the required information, including the name of the purchaser, the type of exemption, and the reason for the exemption.

- Provide the appropriate tax identification number, which may vary based on the entity type.

- Sign and date the form to validate the information provided.

- Submit the completed certificate to the seller at the time of purchase.

Ensuring that all information is accurate is vital to avoid potential issues with tax compliance.

Legal Use of the Exemption Certificates Pub KS 1520 Rev 7 24

The legal use of the Exemption Certificates Pub KS 1520 Rev 7 24 is governed by Kansas state law. This certificate must be used strictly for qualifying purchases related to the exempt organization's purpose. Misuse of the certificate, such as using it for personal purchases or for items not eligible for exemption, can result in penalties. It is important for organizations to maintain proper documentation and records of all transactions made with the exemption certificate to ensure compliance and protect against audits.

Eligibility Criteria for the Exemption Certificates Pub KS 1520 Rev 7 24

To qualify for the Exemption Certificates Pub KS 1520 Rev 7 24, entities must meet specific eligibility criteria set by the state of Kansas. Generally, eligible organizations include:

- Nonprofit organizations recognized under section 501(c)(3) of the Internal Revenue Code.

- Government entities, including federal, state, and local agencies.

- Educational institutions that meet certain criteria.

It is important for applicants to review the specific requirements and ensure they have the necessary documentation to support their tax-exempt status.

Examples of Using the Exemption Certificates Pub KS 1520 Rev 7 24

Understanding how to use the Exemption Certificates Pub KS 1520 Rev 7 24 can help organizations maximize their benefits. Common examples include:

- A nonprofit purchasing office supplies for its operations.

- A government agency acquiring equipment for public services.

- An educational institution buying materials for classroom use.

In each case, the organization must present the exemption certificate to the seller at the time of purchase to avoid sales tax charges.

How to Obtain the Exemption Certificates Pub KS 1520 Rev 7 24

Obtaining the Exemption Certificates Pub KS 1520 Rev 7 24 is a straightforward process. Organizations can typically acquire the form through the Kansas Department of Revenue's website or by contacting their local tax office. It is essential to ensure that the form is the most current version, as updates may occur. Once obtained, organizations should complete the form accurately and retain copies for their records.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the exemption certificates pub ks 1520 rev 7 24 publications exemption certificatesrev 7 24

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ks exemption get process with airSlate SignNow?

The ks exemption get process with airSlate SignNow allows businesses to easily manage and sign documents electronically. By utilizing our platform, you can streamline your workflow and ensure compliance with Kansas exemption requirements. Our user-friendly interface simplifies the entire process, making it accessible for all users.

-

How does airSlate SignNow help with ks exemption get documentation?

airSlate SignNow provides a comprehensive solution for managing ks exemption get documentation. Our platform allows you to create, send, and eSign documents securely, ensuring that all necessary information is captured accurately. This reduces the risk of errors and enhances the efficiency of your documentation process.

-

What are the pricing options for airSlate SignNow related to ks exemption get?

We offer flexible pricing plans for airSlate SignNow that cater to various business needs, including those focused on ks exemption get. Our plans are designed to be cost-effective, providing you with the tools necessary to manage your documents without breaking the bank. You can choose a plan that best fits your budget and requirements.

-

Can airSlate SignNow integrate with other tools for ks exemption get?

Yes, airSlate SignNow seamlessly integrates with various tools and applications to enhance your ks exemption get process. Whether you use CRM systems, cloud storage, or other business applications, our integrations ensure that your workflow remains uninterrupted. This connectivity allows for a more streamlined experience.

-

What features does airSlate SignNow offer for ks exemption get?

airSlate SignNow offers a range of features specifically designed to assist with ks exemption get. These include customizable templates, automated workflows, and secure eSigning capabilities. Our platform is built to enhance productivity and ensure that your documentation is handled efficiently.

-

How can airSlate SignNow benefit my business in the ks exemption get process?

By using airSlate SignNow, your business can signNowly improve the ks exemption get process. Our solution reduces the time spent on paperwork, minimizes errors, and enhances compliance with legal requirements. This allows your team to focus on more strategic tasks while ensuring that all documentation is handled properly.

-

Is airSlate SignNow secure for handling ks exemption get documents?

Absolutely! airSlate SignNow prioritizes security, ensuring that all ks exemption get documents are protected. We utilize advanced encryption and security protocols to safeguard your data, giving you peace of mind while managing sensitive information. Your documents are safe with us.

Get more for Exemption Certificates Pub KS 1520 Rev 7 24 Publications Exemption CertificatesRev 7 24

Find out other Exemption Certificates Pub KS 1520 Rev 7 24 Publications Exemption CertificatesRev 7 24

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free