Pub KS 1216 Business Tax Application and Instructions Rev 7 24 an Important Step in Starting a Business is to Select the Type of Form

Understanding the Pub KS 1216 Business Tax Application

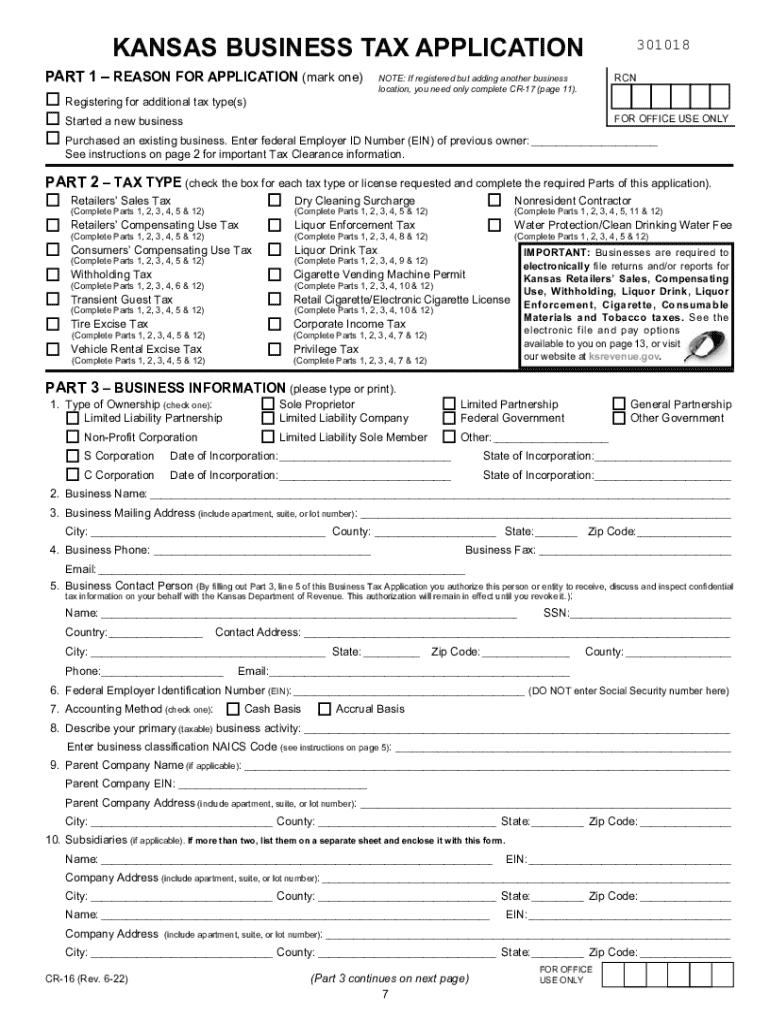

The Pub KS 1216 Business Tax Application and Instructions Rev 7 24 is a crucial document for individuals looking to establish a business in the United States. This form serves as a formal application for obtaining a business tax identification number, which is essential for tax reporting and compliance. It outlines the necessary steps for selecting the appropriate business structure, such as a sole proprietorship, partnership, corporation, or limited liability company (LLC). Each structure has distinct implications for ownership, liability, and tax obligations, making it vital for entrepreneurs to understand their options before proceeding.

Steps to Complete the Pub KS 1216 Business Tax Application

Completing the Pub KS 1216 Business Tax Application involves several key steps:

- Gather necessary information, including your business name, address, and ownership details.

- Select the type of business structure that best fits your needs.

- Provide accurate financial information, including estimated income and expenses.

- Review the application for completeness and accuracy before submission.

- Submit the application either online, by mail, or in person, depending on your preference.

Key Elements of the Pub KS 1216 Business Tax Application

The Pub KS 1216 includes several critical elements that applicants must pay attention to:

- Business Structure Selection: Clearly indicate the chosen business structure.

- Ownership Information: Provide details about all owners and their respective shares.

- Financial Projections: Include estimated revenue and expenses for the first year.

- Contact Information: Ensure that accurate contact details are provided for follow-up.

Legal Use of the Pub KS 1216 Business Tax Application

The legal use of the Pub KS 1216 Business Tax Application is essential for compliance with federal and state tax laws. By accurately completing and submitting this form, businesses can ensure they are properly registered with the IRS and can legally operate within their respective jurisdictions. This form also aids in establishing the business's legitimacy, which is important for securing financing and building trust with customers and suppliers.

Filing Deadlines and Important Dates

When dealing with the Pub KS 1216, it is vital to be aware of key filing deadlines. Typically, applications should be submitted as early as possible, ideally before the start of the business operations. Specific deadlines may vary based on the state and the type of business structure chosen. Staying informed about these dates helps avoid penalties and ensures compliance with tax regulations.

Eligibility Criteria for the Pub KS 1216 Business Tax Application

To be eligible to complete the Pub KS 1216 Business Tax Application, applicants must meet certain criteria:

- The applicant must be a resident of the United States.

- The business must be legally recognized within the state it operates.

- All required documentation, such as identification and financial records, must be provided.

Understanding these eligibility requirements is crucial for a smooth application process.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pub ks 1216 business tax application and instructions rev 7 24 an important step in starting a business is to select the type

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Pub KS 1216 Business Tax Application And Instructions Rev 7 24?

The Pub KS 1216 Business Tax Application And Instructions Rev 7 24 is a crucial document for businesses in Kansas. It provides essential guidelines on how to select the appropriate business structure or organization, which defines ownership and responsibilities. Understanding this application is an important step in starting your business.

-

How does airSlate SignNow assist with the Pub KS 1216 Business Tax Application?

airSlate SignNow streamlines the process of completing and submitting the Pub KS 1216 Business Tax Application And Instructions Rev 7 24. Our platform allows you to easily eSign and send documents, ensuring that your application is processed efficiently. This can save you time and reduce the stress associated with paperwork.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions ensure that you can access the tools necessary for managing documents, including the Pub KS 1216 Business Tax Application And Instructions Rev 7 24. You can choose a plan that fits your budget while still benefiting from our comprehensive features.

-

What features does airSlate SignNow provide for document management?

Our platform includes features such as eSigning, document templates, and real-time collaboration. These tools are designed to simplify the process of managing important documents like the Pub KS 1216 Business Tax Application And Instructions Rev 7 24. With airSlate SignNow, you can ensure that your business documentation is organized and accessible.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow offers integrations with various software applications to enhance your workflow. This means you can easily connect our platform with tools you already use, making it simpler to manage documents like the Pub KS 1216 Business Tax Application And Instructions Rev 7 24. Integration helps streamline your business processes.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security for your documents. By utilizing our platform for tasks such as the Pub KS 1216 Business Tax Application And Instructions Rev 7 24, you can focus more on growing your business rather than getting bogged down by administrative tasks.

-

Is airSlate SignNow user-friendly for new business owners?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible for new business owners. Whether you're completing the Pub KS 1216 Business Tax Application And Instructions Rev 7 24 or managing other documents, our intuitive interface ensures that you can navigate the platform with ease.

Get more for Pub KS 1216 Business Tax Application And Instructions Rev 7 24 An Important Step In Starting A Business Is To Select The Type Of

Find out other Pub KS 1216 Business Tax Application And Instructions Rev 7 24 An Important Step In Starting A Business Is To Select The Type Of

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast