FORM CT 941X INSTRUCTIONS

Understanding the CT 941 Form

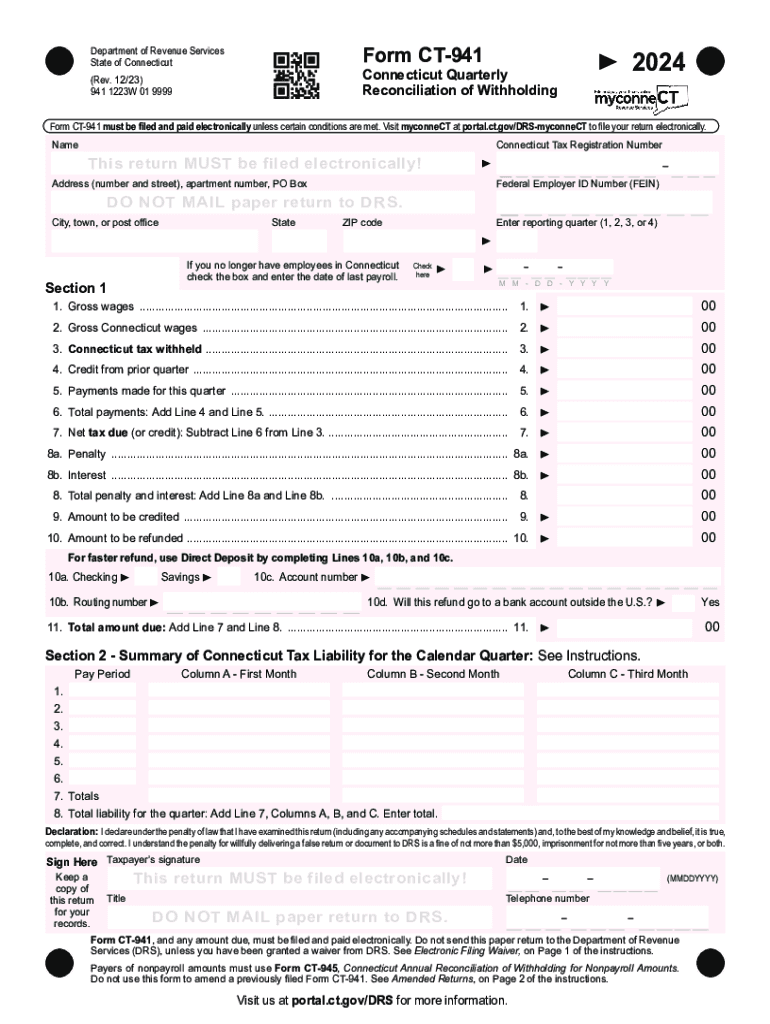

The CT 941 form, officially known as the Connecticut Quarterly Reconciliation of Withholding, is essential for employers in Connecticut. This form is used to report the state income tax withheld from employee wages during each quarter. Accurate completion ensures compliance with state tax regulations and helps maintain good standing with the Connecticut Department of Revenue Services.

Steps to Complete the CT 941 Form

Completing the CT 941 form involves several key steps:

- Gather necessary information, including total wages paid and the amount of state tax withheld.

- Fill out the form with accurate figures for each quarter, ensuring that all calculations align with payroll records.

- Review the form for accuracy, checking for any discrepancies in reported amounts.

- Submit the completed form by the specified deadline to avoid penalties.

Filing Deadlines for the CT 941 Form

Employers must adhere to strict filing deadlines for the CT 941 form. The due date for submission is the last day of the month following the end of each quarter. For example:

- First quarter (January to March) - Due by April 30

- Second quarter (April to June) - Due by July 31

- Third quarter (July to September) - Due by October 31

- Fourth quarter (October to December) - Due by January 31 of the following year

Form Submission Methods for CT 941

The CT 941 form can be submitted through various methods:

- Online: Employers can file electronically through the Connecticut Department of Revenue Services website.

- Mail: The completed form can be mailed to the appropriate address specified by the state.

- In-Person: Employers may also deliver the form directly to a local Department of Revenue Services office.

Penalties for Non-Compliance with CT 941

Failure to file the CT 941 form on time or inaccuracies in reporting can result in significant penalties. These may include:

- Late filing penalties, which can accumulate over time.

- Interest on any unpaid taxes, increasing the total amount owed.

- Potential audits or additional scrutiny from state tax authorities.

Who Issues the CT 941 Form

The CT 941 form is issued by the Connecticut Department of Revenue Services. This state agency oversees tax collection and compliance, providing resources and guidance for employers to ensure they meet their tax obligations accurately and timely.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 941x instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct 941 and how does it relate to airSlate SignNow?

CT 941 is a form used for reporting payroll taxes in Connecticut. airSlate SignNow simplifies the process of signing and sending this form electronically, ensuring compliance and efficiency for businesses. With our platform, you can easily manage your CT 941 submissions without the hassle of paper documents.

-

How much does airSlate SignNow cost for handling CT 941 forms?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Our plans include features specifically designed for managing documents like the CT 941, ensuring you get the best value for your investment. You can choose a plan that fits your needs and budget.

-

What features does airSlate SignNow offer for CT 941 document management?

Our platform provides a range of features for managing CT 941 documents, including eSigning, document templates, and secure storage. These features streamline the process, making it easier to prepare and submit your CT 941 forms efficiently. Additionally, you can track the status of your documents in real-time.

-

Can I integrate airSlate SignNow with other software for CT 941 processing?

Yes, airSlate SignNow offers seamless integrations with various software applications, enhancing your workflow for CT 941 processing. Whether you use accounting software or HR management tools, our platform can connect with them to simplify document handling. This integration helps maintain accuracy and saves time.

-

What are the benefits of using airSlate SignNow for CT 941 submissions?

Using airSlate SignNow for CT 941 submissions provides numerous benefits, including faster processing times and reduced paperwork. Our electronic signature solution ensures that your documents are signed securely and stored safely. This not only enhances compliance but also improves overall productivity.

-

Is airSlate SignNow secure for handling sensitive CT 941 information?

Absolutely! airSlate SignNow prioritizes security and compliance, especially when handling sensitive information like CT 941 forms. We utilize advanced encryption and security protocols to protect your data, ensuring that your documents remain confidential and secure throughout the signing process.

-

How can I get started with airSlate SignNow for my CT 941 needs?

Getting started with airSlate SignNow for your CT 941 needs is simple. You can sign up for a free trial on our website to explore our features and see how they can benefit your business. Once you're ready, choose a pricing plan that suits your requirements and start managing your CT 941 documents effortlessly.

Get more for FORM CT 941X INSTRUCTIONS

- Principles of instrumental analysis solutions manual pdf form

- Application for vacant seat admission form

- Coolsculpting consent form

- Subsidized housing toronto form

- Section 16 1 thermal energy and matter form

- Patient update information form

- Moneebusiness license application form

- Aanvraag voor het verblijfsdoel medische behandeling ind form

Find out other FORM CT 941X INSTRUCTIONS

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online