S 114 Instructions for Wisconsin Sales and Use Tax Return, Form ST 12, and County Sales and Use Tax Schedule, Schedule CT

Understanding the S 114 Instructions for Wisconsin Sales and Use Tax Return

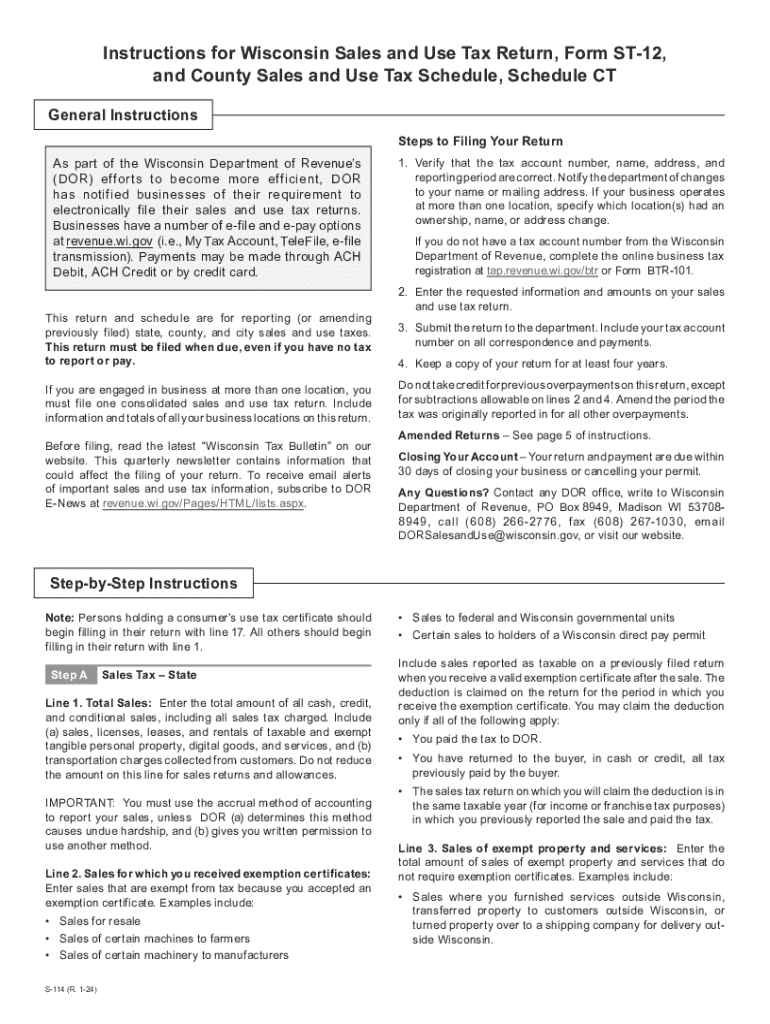

The S 114 Instructions for Wisconsin Sales and Use Tax Return, Form ST 12, and County Sales and Use Tax Schedule, Schedule CT, provide essential guidance for businesses and individuals required to file sales and use tax returns in Wisconsin. This document outlines the necessary steps, legal requirements, and specific information needed to accurately complete the forms. Understanding these instructions is crucial for compliance with state tax laws and for avoiding potential penalties.

How to Complete the S 114 Instructions for Wisconsin Sales and Use Tax Return

To effectively complete the S 114 Instructions, individuals must gather relevant financial information, including sales data, purchase records, and any applicable exemptions. The instructions detail each section of Form ST 12 and Schedule CT, guiding users on how to report taxable sales, calculate tax owed, and claim any exemptions. It is important to follow the instructions closely to ensure all information is accurate and complete.

Obtaining the S 114 Instructions for Wisconsin Sales and Use Tax Return

The S 114 Instructions can be obtained from the Wisconsin Department of Revenue's official website or through local tax offices. These instructions are often available in both digital and printed formats, allowing users to choose their preferred method of access. Ensuring you have the most current version is important, as tax regulations may change annually.

Key Elements of the S 114 Instructions for Wisconsin Sales and Use Tax Return

Key elements of the S 114 Instructions include detailed explanations of taxable and exempt sales, guidance on calculating the correct tax rates, and information on filing deadlines. Additionally, the instructions provide insights into record-keeping requirements and any necessary supporting documentation that must accompany the tax return. Understanding these elements helps taxpayers fulfill their obligations accurately.

Filing Deadlines for the S 114 Instructions for Wisconsin Sales and Use Tax Return

Filing deadlines for the S 114 Instructions are critical for compliance. Generally, sales and use tax returns are due on a quarterly or annual basis, depending on the taxpayer's volume of sales. The instructions specify these deadlines, along with any extensions that may be available. Timely filing is essential to avoid late fees and penalties.

Form Submission Methods for the S 114 Instructions for Wisconsin Sales and Use Tax Return

Taxpayers can submit the S 114 Instructions and associated forms through various methods. Options typically include online submission via the Wisconsin Department of Revenue's e-filing system, mailing paper forms to designated addresses, or in-person submissions at local tax offices. Each method has its own set of guidelines and requirements, which are detailed in the instructions.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the s 114 instructions for wisconsin sales and use tax return form st 12 and county sales and use tax schedule schedule ct

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the S 114 Instructions For Wisconsin Sales And Use Tax Return, Form ST 12, And County Sales And Use Tax Schedule, Schedule CT?

The S 114 Instructions provide detailed guidance on how to complete the Wisconsin Sales and Use Tax Return, Form ST 12, and the County Sales and Use Tax Schedule, Schedule CT. These instructions help businesses understand their tax obligations and ensure accurate reporting. Following these guidelines is crucial for compliance and avoiding penalties.

-

How can airSlate SignNow assist with the S 114 Instructions For Wisconsin Sales And Use Tax Return?

airSlate SignNow simplifies the process of completing and submitting the S 114 Instructions For Wisconsin Sales And Use Tax Return, Form ST 12, and County Sales and Use Tax Schedule, Schedule CT. Our platform allows users to easily eSign documents and manage tax forms efficiently. This streamlines the workflow and reduces the risk of errors.

-

What features does airSlate SignNow offer for handling tax documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents like the S 114 Instructions For Wisconsin Sales And Use Tax Return. These features enhance productivity and ensure that all necessary forms are completed accurately and on time.

-

Is airSlate SignNow cost-effective for small businesses dealing with tax forms?

Yes, airSlate SignNow is a cost-effective solution for small businesses that need to manage tax forms, including the S 114 Instructions For Wisconsin Sales And Use Tax Return. Our pricing plans are designed to fit various budgets, making it accessible for businesses of all sizes. This affordability helps small businesses stay compliant without breaking the bank.

-

Can I integrate airSlate SignNow with other accounting software for tax purposes?

Absolutely! airSlate SignNow offers integrations with various accounting software, allowing seamless management of tax documents like the S 114 Instructions For Wisconsin Sales And Use Tax Return. This integration helps streamline your workflow, ensuring that all financial data is synchronized and easily accessible for tax preparation.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management provides numerous benefits, including enhanced security, ease of use, and improved efficiency. By utilizing our platform for the S 114 Instructions For Wisconsin Sales And Use Tax Return, businesses can reduce paperwork, minimize errors, and ensure timely submissions. This ultimately leads to better compliance and peace of mind.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your tax documents, including those related to the S 114 Instructions For Wisconsin Sales And Use Tax Return. Our platform employs advanced encryption and secure storage solutions to protect sensitive information. This commitment to security helps businesses confidently manage their tax obligations without fear of data bsignNowes.

Get more for S 114 Instructions For Wisconsin Sales And Use Tax Return, Form ST 12, And County Sales And Use Tax Schedule, Schedule CT

Find out other S 114 Instructions For Wisconsin Sales And Use Tax Return, Form ST 12, And County Sales And Use Tax Schedule, Schedule CT

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement