I 010 Form 1 Wisconsin Income Tax Wisconsin Income Tax Form 1

Understanding the Wisconsin Income Tax Form 1

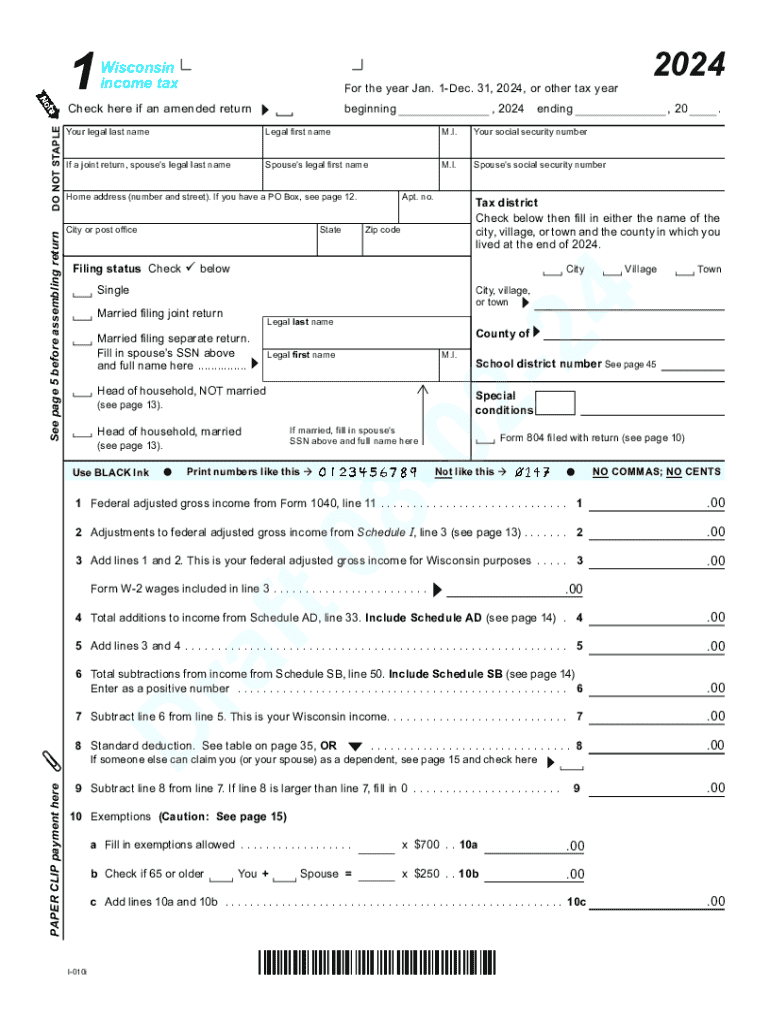

The Wisconsin Income Tax Form 1, often referred to as the WI Form 1, is a crucial document for residents who need to report their income and calculate their state tax obligations. This form is specifically designed for individuals filing their state income tax returns. It encompasses various sections where taxpayers can detail their income sources, deductions, and credits applicable under Wisconsin tax law.

Form 1 is intended for single filers, married couples filing jointly, and heads of household, making it versatile for different taxpayer scenarios. It is essential to ensure that the correct version of the form is used, especially for the tax year being filed, as updates and changes may occur annually.

Steps to Complete the Wisconsin Income Tax Form 1

Completing the Wisconsin Income Tax Form 1 involves several key steps to ensure accuracy and compliance. Here’s a simplified process:

- Gather necessary documents: Collect all income statements, such as W-2s and 1099s, along with any documentation for deductions and credits.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report income: Complete the income section by listing all sources of income, including wages, interest, and dividends.

- Claim deductions: Utilize the deductions section to report any eligible expenses that can reduce your taxable income.

- Calculate tax: Follow the instructions to compute your total tax liability based on the information provided.

- Review and sign: Double-check all entries for accuracy before signing and dating the form.

Obtaining the Wisconsin Income Tax Form 1

The Wisconsin Income Tax Form 1 can be obtained through several methods. The most accessible way is to visit the Wisconsin Department of Revenue website, where you can download the form directly. Additionally, physical copies may be available at local government offices, libraries, or tax preparation services. For the 2024 tax year, ensure you are using the most current version of the form to avoid any filing issues.

Key Elements of the Wisconsin Income Tax Form 1

The Wisconsin Income Tax Form 1 includes several key elements that are vital for accurate tax reporting:

- Personal Information: This section captures taxpayer details, including name, address, and filing status.

- Income Reporting: Taxpayers must list all sources of income, including wages, self-employment income, and interest.

- Deductions and Credits: This section allows taxpayers to claim various deductions and credits that can lower their tax liability.

- Tax Calculation: Instructions are provided for calculating the total tax owed based on the reported income and applicable deductions.

- Signature Line: A signature is required to validate the form, confirming that the information provided is accurate to the best of the taxpayer's knowledge.

Filing Deadlines and Important Dates

It is essential to be aware of the filing deadlines associated with the Wisconsin Income Tax Form 1. Typically, the deadline for filing state income tax returns is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also consider any extensions available for filing, which may require additional forms to be submitted.

Form Submission Methods

Taxpayers have several options for submitting the Wisconsin Income Tax Form 1. The form can be filed electronically through various tax software programs that support Wisconsin tax filings. Alternatively, taxpayers may choose to print the completed form and mail it to the Wisconsin Department of Revenue. In-person submissions are also accepted at designated tax offices, although this option may vary by location.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the i 010 form 1 wisconsin income tax wisconsin income tax form 1 745581716

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Wisconsin tax forms and why are they important?

Wisconsin tax forms are official documents required for filing state taxes in Wisconsin. They are essential for ensuring compliance with state tax laws and for accurately reporting income, deductions, and credits. Using the correct Wisconsin tax forms helps avoid penalties and ensures that you receive any potential refunds.

-

How can airSlate SignNow help with Wisconsin tax forms?

airSlate SignNow simplifies the process of preparing and signing Wisconsin tax forms by providing an easy-to-use platform for document management. Users can quickly upload, fill out, and eSign their tax forms, ensuring a smooth and efficient filing process. This saves time and reduces the stress associated with tax season.

-

Are there any costs associated with using airSlate SignNow for Wisconsin tax forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. The cost is competitive and provides access to features that streamline the preparation and signing of Wisconsin tax forms. You can choose a plan that fits your budget while benefiting from a cost-effective solution.

-

What features does airSlate SignNow offer for managing Wisconsin tax forms?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage specifically designed for Wisconsin tax forms. These features enhance efficiency by allowing users to create, edit, and sign documents from anywhere. Additionally, the platform ensures that all documents are securely stored and easily accessible.

-

Can I integrate airSlate SignNow with other software for Wisconsin tax forms?

Yes, airSlate SignNow offers integrations with various accounting and tax software, making it easier to manage Wisconsin tax forms. This allows users to streamline their workflow by connecting their existing tools with airSlate SignNow. Integrations help ensure that all necessary data is synchronized and accessible.

-

Is airSlate SignNow secure for handling Wisconsin tax forms?

Absolutely, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling Wisconsin tax forms. The platform uses advanced encryption and security protocols to protect sensitive information. Users can confidently manage their tax documents knowing that their data is secure.

-

How does airSlate SignNow improve the efficiency of filing Wisconsin tax forms?

airSlate SignNow enhances efficiency by allowing users to complete and eSign Wisconsin tax forms quickly and easily. The platform reduces the time spent on paperwork and minimizes errors through its user-friendly interface. This streamlined process helps users meet deadlines and reduces the hassle of tax filing.

Get more for I 010 Form 1 Wisconsin Income Tax Wisconsin Income Tax Form 1

Find out other I 010 Form 1 Wisconsin Income Tax Wisconsin Income Tax Form 1

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template