32423 Louisiana Department of Revenue Form

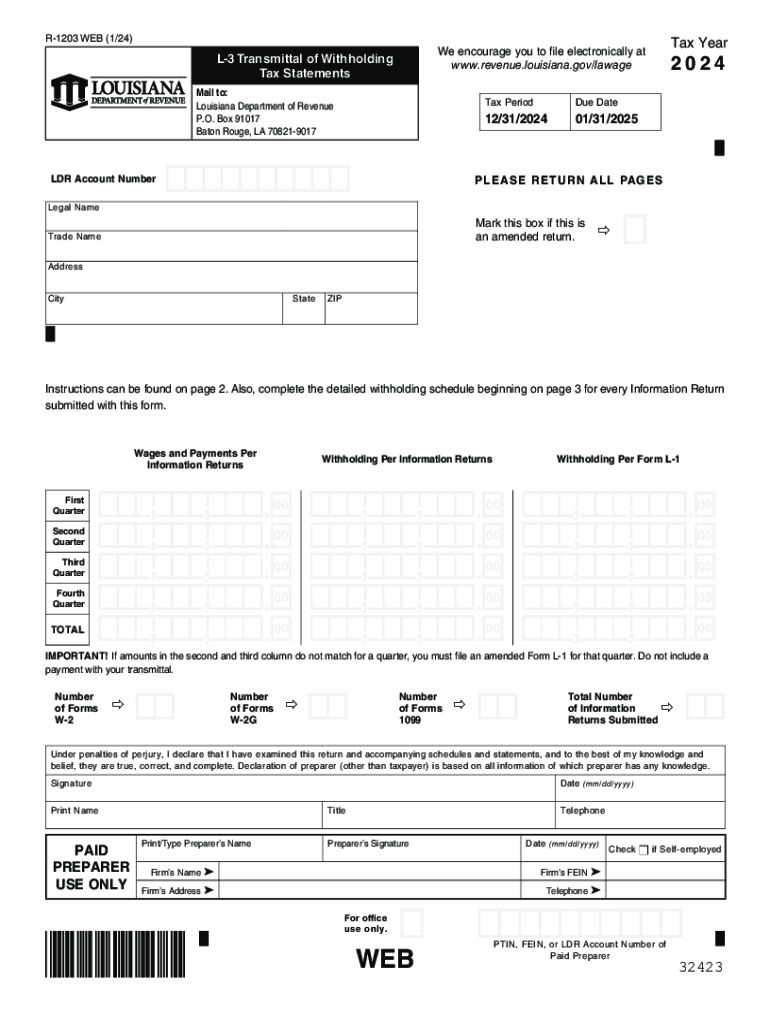

What is the LA L Transmittal?

The LA L Transmittal is a crucial form used by businesses in Louisiana to report withholding tax statements to the Louisiana Department of Revenue. This form is essential for ensuring compliance with state tax regulations and provides a summary of the withholding taxes that have been deducted from employee wages. It is typically used in conjunction with the R-1203 form, which details individual withholding amounts for each employee.

Steps to Complete the LA L Transmittal

Completing the LA L Transmittal involves several key steps:

- Gather all necessary employee withholding information, including names, Social Security numbers, and amounts withheld.

- Obtain the latest version of the LA L Transmittal form from the Louisiana Department of Revenue's official website.

- Fill out the form accurately, ensuring that all data aligns with the corresponding R-1203 forms.

- Review the completed form for accuracy to avoid any potential penalties or delays.

- Submit the form by the specified filing deadline, either electronically or via mail.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the LA L Transmittal to avoid penalties. Typically, the form must be submitted by the last day of the month following the end of each quarter. For example, for the first quarter (January to March), the submission deadline is April 30. Staying informed about these dates helps ensure timely compliance with state tax obligations.

Required Documents

To complete the LA L Transmittal, businesses must have several documents ready:

- Employee payroll records showing the total amount withheld for each employee.

- The R-1203 form for each employee, detailing individual withholding amounts.

- Any previous correspondence or forms submitted to the Louisiana Department of Revenue for reference.

Form Submission Methods

The LA L Transmittal can be submitted through various methods, catering to different business needs:

- Online: Businesses can file electronically through the Louisiana Department of Revenue's online portal, which offers a streamlined process.

- Mail: The completed form can be printed and mailed to the appropriate address provided by the Department of Revenue.

- In-Person: Businesses may also choose to submit the form in person at their local Department of Revenue office.

Penalties for Non-Compliance

Failure to file the LA L Transmittal on time or inaccuracies in the submitted information can lead to significant penalties. These may include monetary fines, interest on unpaid taxes, and potential audits. It is crucial for businesses to ensure that their submissions are accurate and timely to avoid these repercussions.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 32423 louisiana department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is la l transmittal and how does it work with airSlate SignNow?

La l transmittal is a document used to transmit information or materials between parties. With airSlate SignNow, you can easily create, send, and eSign la l transmittal documents, ensuring secure and efficient communication. Our platform streamlines the process, allowing you to manage your documents in one place.

-

How much does airSlate SignNow cost for managing la l transmittal documents?

AirSlate SignNow offers competitive pricing plans that cater to various business needs. You can choose from monthly or annual subscriptions, which provide access to features specifically designed for handling la l transmittal documents. Our cost-effective solution ensures you get the best value for your investment.

-

What features does airSlate SignNow offer for la l transmittal?

AirSlate SignNow provides a range of features for la l transmittal, including customizable templates, real-time tracking, and secure eSigning. These features enhance the efficiency of document management and ensure that your la l transmittal documents are processed quickly and securely.

-

Can I integrate airSlate SignNow with other tools for la l transmittal?

Yes, airSlate SignNow offers seamless integrations with various applications, making it easy to manage your la l transmittal documents alongside your existing workflows. Whether you use CRM systems, cloud storage, or project management tools, our platform can connect with them to enhance your productivity.

-

What are the benefits of using airSlate SignNow for la l transmittal?

Using airSlate SignNow for la l transmittal provides numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. Our platform simplifies the document signing process, allowing you to focus on your core business activities while ensuring that your la l transmittal documents are handled professionally.

-

Is airSlate SignNow user-friendly for creating la l transmittal documents?

Absolutely! AirSlate SignNow is designed with user experience in mind, making it easy for anyone to create la l transmittal documents without any technical expertise. Our intuitive interface guides you through the process, ensuring that you can quickly generate and send your documents.

-

How secure is airSlate SignNow for handling la l transmittal documents?

AirSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your la l transmittal documents. We ensure that your sensitive information remains confidential and secure throughout the entire signing process, giving you peace of mind.

Get more for 32423 Louisiana Department Of Revenue

Find out other 32423 Louisiana Department Of Revenue

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online