18 Printable Form 1040x Instructions Templates

Understanding the IRS 5405 Form

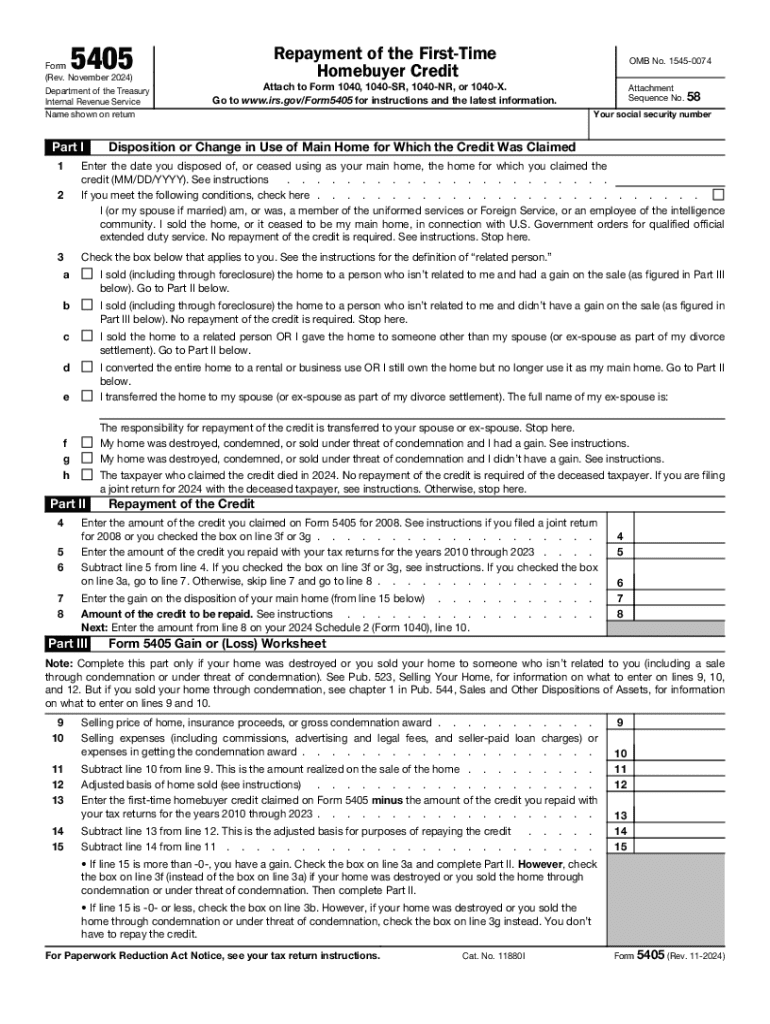

The IRS 5405 form is specifically designed for first-time homebuyers who are claiming the homebuyer credit. This form allows eligible individuals to report the repayment of the credit received in prior years. The credit was available to those who purchased a home between April 2008 and September 2010, and the repayment is required if the home is sold or ceases to be the taxpayer's main home within a specified period.

Steps to Complete the IRS 5405 Form

Filling out the IRS 5405 form requires careful attention to detail. Here are the essential steps:

- Gather necessary information, including your Social Security number, the address of the home, and the date of purchase.

- Indicate the amount of the credit you received when you purchased your home.

- Provide details about any changes in ownership or residency status since the purchase.

- Calculate the repayment amount based on the IRS guidelines for your specific situation.

- Review the completed form for accuracy before submission.

Eligibility Criteria for the IRS 5405 Form

To qualify for the IRS 5405 form, you must meet specific eligibility criteria. Primarily, you must have claimed the first-time homebuyer credit on your tax return. Additionally, the home must have been purchased within the stipulated timeframe, and you must have lived in the home as your primary residence. If you sell the home or it no longer serves as your primary residence, you are required to repay the credit.

Filing Deadlines for the IRS 5405 Form

Filing deadlines for the IRS 5405 form align with the standard tax return deadlines. Typically, individual tax returns are due on April 15 of each year. If you are required to repay the homebuyer credit, ensure that you file the form along with your tax return by this deadline to avoid penalties.

Form Submission Methods for the IRS 5405

The IRS 5405 form can be submitted through various methods. Taxpayers have the option to file electronically using tax software that supports IRS forms. Alternatively, you can print the completed form and mail it to the appropriate IRS address. Ensure that you keep a copy of the submitted form for your records.

IRS Guidelines for the 5405 Form

The IRS provides specific guidelines for completing and submitting the 5405 form. It is essential to follow these guidelines closely to ensure compliance and avoid potential issues. Review the instructions provided by the IRS, which detail how to calculate the repayment amount and what documentation may be required to support your claims.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 18 printable form 1040x instructions templates

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS 5405 fill and how can airSlate SignNow help?

The IRS 5405 fill is a form used for claiming the First-Time Homebuyer Credit. airSlate SignNow simplifies the process by allowing users to easily fill, sign, and send the IRS 5405 form electronically, ensuring compliance and efficiency.

-

Is there a cost associated with using airSlate SignNow for IRS 5405 fill?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that streamline the IRS 5405 fill process, making it a cost-effective solution for managing your documents.

-

What features does airSlate SignNow offer for IRS 5405 fill?

airSlate SignNow provides features such as customizable templates, electronic signatures, and document tracking specifically for IRS 5405 fill. These tools enhance the user experience and ensure that your forms are completed accurately and efficiently.

-

Can I integrate airSlate SignNow with other software for IRS 5405 fill?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage your IRS 5405 fill alongside your existing workflows. This integration capability enhances productivity and ensures that all your documents are in one place.

-

How does airSlate SignNow ensure the security of my IRS 5405 fill documents?

Security is a top priority for airSlate SignNow. The platform uses advanced encryption and secure cloud storage to protect your IRS 5405 fill documents, ensuring that your sensitive information remains confidential and safe from unauthorized access.

-

Can I access my IRS 5405 fill documents on mobile devices?

Yes, airSlate SignNow is mobile-friendly, allowing you to access and manage your IRS 5405 fill documents from any device. This flexibility ensures that you can complete your forms anytime, anywhere, making the process more convenient.

-

What are the benefits of using airSlate SignNow for IRS 5405 fill?

Using airSlate SignNow for IRS 5405 fill offers numerous benefits, including time savings, reduced paperwork, and improved accuracy. The platform streamlines the entire process, making it easier for users to complete and submit their forms efficiently.

Get more for 18 Printable Form 1040x Instructions Templates

- Ambetter prior authorization form texas

- Pacra form

- Borang pa 2 13 form

- Pmkvy certificate download pdf form

- Cps application form 2021 pdf

- Bpl certificate format

- Medtronic plc mdt product pipeline analysis 2015 update market research report form

- How to contact us pennsylvania gaming control board form

Find out other 18 Printable Form 1040x Instructions Templates

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple