S893 Insolvency Act Form

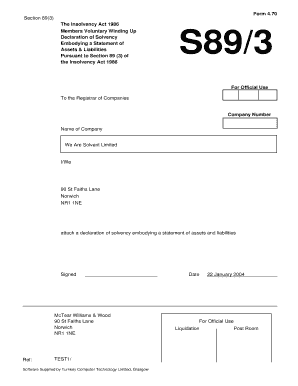

Understanding the S893 Insolvency Act Form

The S893 Insolvency Act Form is a legal document used in the context of insolvency proceedings in the United States. This form is crucial for individuals or businesses seeking to declare insolvency or manage their debts under the provisions of the Insolvency Act. It serves as a formal request for relief and outlines the financial status of the entity or individual involved. Understanding the purpose and implications of this form is essential for anyone navigating insolvency issues.

Steps to Complete the S893 Insolvency Act Form

Completing the S893 Insolvency Act Form involves several key steps to ensure accuracy and compliance with legal requirements. Begin by gathering all necessary financial documents, including income statements, balance sheets, and details of debts and assets. Carefully fill out each section of the form, providing clear and truthful information. It is important to double-check all entries for accuracy, as errors can lead to delays or complications in the insolvency process. Once completed, review the form thoroughly before submission.

Obtaining the S893 Insolvency Act Form

The S893 Insolvency Act Form can be obtained through various channels. Typically, it is available on official government websites or through legal service providers specializing in insolvency matters. Additionally, local courthouses may provide physical copies of the form. It is advisable to ensure that you are using the most current version of the form, as regulations and requirements may change over time.

Legal Use of the S893 Insolvency Act Form

The S893 Insolvency Act Form is legally binding and must be used in accordance with the laws governing insolvency in the United States. Proper use of this form can provide individuals and businesses with the opportunity to reorganize their debts, negotiate with creditors, and potentially discharge certain obligations. It is important to understand the legal implications of filing this form and to seek legal advice if necessary to navigate the complexities of insolvency law.

Required Documents for the S893 Insolvency Act Form

When preparing to submit the S893 Insolvency Act Form, several supporting documents are typically required. These may include proof of income, a list of creditors, statements of assets and liabilities, and any relevant tax documents. Providing comprehensive and accurate documentation is essential for the successful processing of the form and to demonstrate financial transparency to the court or relevant authorities.

Form Submission Methods

The S893 Insolvency Act Form can be submitted through various methods, depending on local regulations. Common submission methods include online filing through designated government portals, mailing the completed form to the appropriate court, or delivering it in person to the relevant office. Each method may have specific requirements, such as additional documentation or fees, so it is important to review the guidelines for your jurisdiction before submission.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the s893 insolvency act form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the S893 Insolvency Act Form?

The S893 Insolvency Act Form is a legal document required for certain insolvency proceedings in the UK. It provides essential information about the debtor's financial situation and is crucial for creditors and insolvency practitioners. Understanding this form is vital for anyone involved in insolvency matters.

-

How can airSlate SignNow help with the S893 Insolvency Act Form?

airSlate SignNow simplifies the process of completing and eSigning the S893 Insolvency Act Form. Our platform allows users to fill out the form electronically, ensuring accuracy and compliance with legal requirements. This streamlines the submission process, saving time and reducing errors.

-

Is there a cost associated with using airSlate SignNow for the S893 Insolvency Act Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective, providing excellent value for the features offered, including the ability to manage the S893 Insolvency Act Form efficiently. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for the S893 Insolvency Act Form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for the S893 Insolvency Act Form. These features enhance the user experience by making it easier to manage documents and ensuring that all parties can sign securely and efficiently.

-

Can I integrate airSlate SignNow with other tools for managing the S893 Insolvency Act Form?

Absolutely! airSlate SignNow offers integrations with various business tools and applications, allowing you to manage the S893 Insolvency Act Form seamlessly within your existing workflows. This flexibility helps streamline your processes and enhances productivity.

-

What are the benefits of using airSlate SignNow for the S893 Insolvency Act Form?

Using airSlate SignNow for the S893 Insolvency Act Form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled securely and that you can access them anytime, anywhere, making the insolvency process smoother.

-

Is airSlate SignNow compliant with legal standards for the S893 Insolvency Act Form?

Yes, airSlate SignNow is designed to comply with legal standards for electronic signatures and document management, including those related to the S893 Insolvency Act Form. We prioritize security and compliance to ensure that your documents meet all necessary legal requirements.

Get more for S893 Insolvency Act Form

Find out other S893 Insolvency Act Form

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney