Form 8846 Credit for Employer Social Security and

What is the Form 8846 Credit for Employer Social Security and Medicare Taxes?

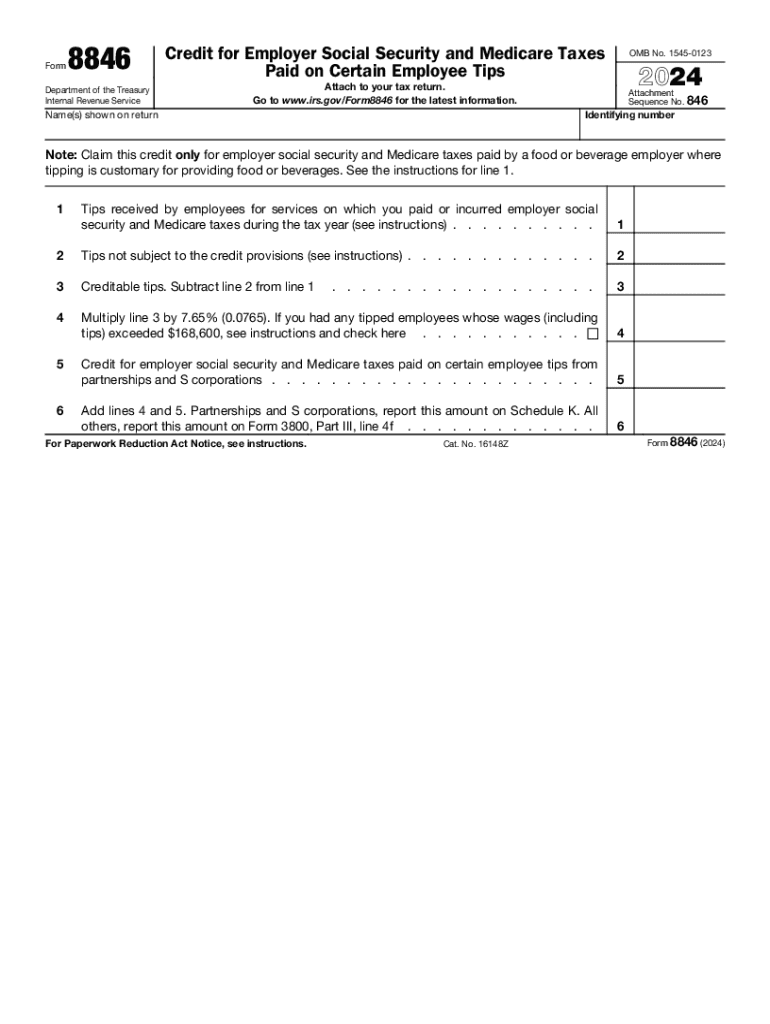

The Form 8846, officially known as the Credit for Employer Social Security and Medicare Taxes, is a tax form used by employers to claim a credit for certain social security and Medicare taxes paid on behalf of their employees. This form is particularly relevant for businesses that provide tips to their employees, such as restaurants or hospitality services. By filing this form, employers can potentially reduce their overall tax liability, making it a valuable tool for managing business finances.

How to Use the Form 8846 Credit for Employer Social Security and Medicare Taxes

Utilizing the Form 8846 involves several steps to ensure accurate completion and submission. Employers must first gather all necessary information, including total tips received by employees and the corresponding social security and Medicare taxes paid. Once this data is collected, the employer can fill out the form by providing details such as the business name, employer identification number, and the total amount of tips reported. After completing the form, it should be submitted alongside the employer's tax return to the IRS.

Steps to Complete the Form 8846 Credit for Employer Social Security and Medicare Taxes

Completing the Form 8846 requires careful attention to detail. Here are the essential steps:

- Gather all relevant financial records, including payroll information and tip reports.

- Fill in the employer's information, including the business name and identification number.

- Calculate the total amount of tips received by employees during the tax year.

- Determine the social security and Medicare taxes owed based on the reported tips.

- Complete the form by entering the calculated amounts in the appropriate fields.

- Review the form for accuracy before submission.

Eligibility Criteria for Using Form 8846

To qualify for the credit claimed on Form 8846, employers must meet specific eligibility criteria. Primarily, the business must have employees who receive tips as part of their compensation. Additionally, the employer must have paid social security and Medicare taxes on those tips. It is essential for employers to maintain accurate records of all tips received and taxes paid to substantiate their claims when filing.

Filing Deadlines for Form 8846

Employers must adhere to specific filing deadlines when submitting Form 8846. Generally, the form should be filed with the employer's annual tax return, which is typically due on April fifteenth of the following year. However, if an employer has a fiscal year that differs from the calendar year, the deadline will vary accordingly. It is crucial to stay informed about any changes to tax deadlines to avoid penalties.

IRS Guidelines for Form 8846

The IRS provides comprehensive guidelines for completing and submitting Form 8846. These guidelines include instructions on eligibility, required documentation, and the calculation of the credit. Employers should refer to the IRS instructions for Form 8846 to ensure compliance with all regulations and to maximize their potential benefits. Following these guidelines helps to minimize the risk of errors that could lead to audits or penalties.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8846 credit for employer social security and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are some essential taxes certain tips for using airSlate SignNow?

When using airSlate SignNow, it's crucial to keep track of your document signing dates and ensure that all parties have signed before filing taxes. Additionally, maintaining organized records of signed documents can help streamline your tax preparation process. Utilizing our platform's features can simplify compliance with tax regulations.

-

How does airSlate SignNow help with tax-related document management?

airSlate SignNow offers a user-friendly interface that allows you to manage tax-related documents efficiently. You can easily send, sign, and store important tax documents securely. This helps ensure that you have all necessary paperwork ready for tax season, following essential taxes certain tips.

-

What pricing plans does airSlate SignNow offer for businesses handling taxes?

airSlate SignNow provides flexible pricing plans tailored to meet the needs of businesses managing taxes. Our plans are designed to be cost-effective, ensuring you get the best value while adhering to essential taxes certain tips. You can choose a plan that fits your budget and document signing requirements.

-

Can airSlate SignNow integrate with accounting software for tax purposes?

Yes, airSlate SignNow seamlessly integrates with various accounting software, making it easier to manage your tax documents. This integration allows for automatic syncing of signed documents, ensuring you have everything you need for tax filing. Following essential taxes certain tips, this feature enhances your overall efficiency.

-

What are the benefits of using airSlate SignNow for tax document signing?

Using airSlate SignNow for tax document signing offers numerous benefits, including increased efficiency and reduced turnaround times. Our platform ensures that all signatures are legally binding and securely stored, which is vital for tax compliance. These advantages align with essential taxes certain tips for businesses.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely, airSlate SignNow prioritizes security, employing advanced encryption methods to protect your sensitive tax documents. This ensures that your data remains confidential and secure throughout the signing process. Following essential taxes certain tips, you can trust our platform for your tax-related needs.

-

How can I ensure compliance with tax regulations using airSlate SignNow?

To ensure compliance with tax regulations using airSlate SignNow, make use of our audit trail feature, which tracks all document activities. This feature provides a clear record of who signed what and when, helping you adhere to essential taxes certain tips. Staying organized and maintaining accurate records is key to compliance.

Get more for Form 8846 Credit For Employer Social Security And

- Mittaturva form

- Ssa form omb 09600511

- Lvl span chart form

- Vaf8 visa download form

- Motion for summary judgment 16968862 form

- Municipal court citizen complaint form

- Www mass govthe initiative petition processthe initiative petition processmass gov form

- Sponsoring a statewide initiative referendum or michigan form

Find out other Form 8846 Credit For Employer Social Security And

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe

- Sign Hawaii Notice of Rescission Later

- Sign Missouri Demand Note Online