I 050 Form 1NPR Nonresident & Part Year Resident Wisconsin Income Tax Wisconsin Form 1NPR

Understanding the Wisconsin Form 1NPR

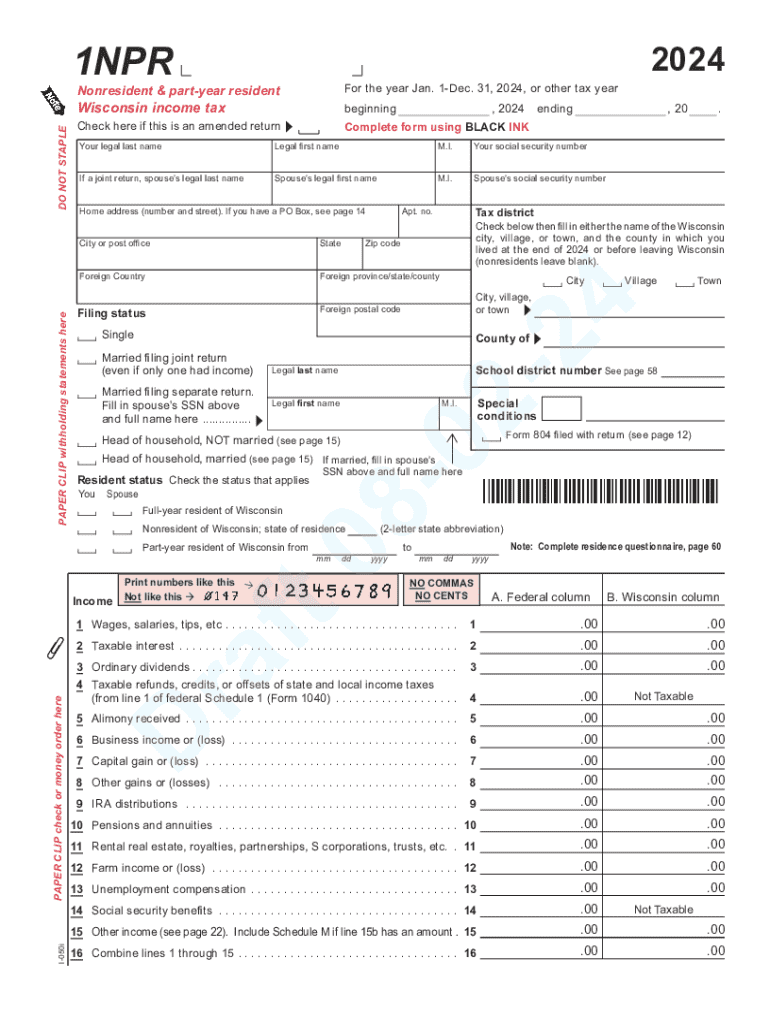

The Wisconsin Form 1NPR is designed for nonresidents and part-year residents to report their income and calculate their tax obligations in the state. This form is essential for individuals who have earned income in Wisconsin but do not reside there for the entire year. It allows taxpayers to determine their tax liability based on the income earned while in the state, ensuring compliance with Wisconsin tax laws.

Steps to Complete the Wisconsin Form 1NPR

Completing the Wisconsin Form 1NPR involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your residency status and the period you were a resident or nonresident.

- Fill out the personal information section, including your name, address, and Social Security number.

- Report your income earned in Wisconsin, using the appropriate lines for wages, interest, and other income types.

- Calculate your tax using the provided tax tables and instructions.

- Review your form for accuracy before submitting it.

Obtaining the Wisconsin Form 1NPR

The Wisconsin Form 1NPR can be obtained from the Wisconsin Department of Revenue's website. It is available for download in PDF format, allowing taxpayers to print and fill it out manually. Additionally, taxpayers may request a physical copy by contacting their local Department of Revenue office.

Key Elements of the Wisconsin Form 1NPR

The form includes several important sections:

- Personal Information: This section requires basic details such as your name and address.

- Income Reporting: Taxpayers must report all income earned while in Wisconsin.

- Tax Calculation: This section provides guidance on how to calculate the tax owed based on reported income.

- Signature: A signature is required to validate the form and confirm that the information provided is accurate.

Filing Deadlines for the Wisconsin Form 1NPR

The filing deadline for the Wisconsin Form 1NPR typically aligns with the federal tax deadline, which is usually April 15. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. Taxpayers should ensure they file on time to avoid penalties and interest on any taxes owed.

Eligibility Criteria for the Wisconsin Form 1NPR

To be eligible to use the Wisconsin Form 1NPR, taxpayers must meet specific criteria:

- Be a nonresident or part-year resident of Wisconsin.

- Have earned income from Wisconsin sources during the tax year.

- Not be eligible to file as a full-year resident of Wisconsin.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the i 050 form 1npr nonresident amp part year resident wisconsin income tax wisconsin form 1npr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the WI Form 1NPR and how can airSlate SignNow help?

The WI Form 1NPR is a document used for reporting non-resident withholding tax in Wisconsin. airSlate SignNow simplifies the process of completing and eSigning the WI Form 1NPR, ensuring that your documents are processed quickly and efficiently.

-

Is there a cost associated with using airSlate SignNow for the WI Form 1NPR?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that streamline the completion and eSigning of the WI Form 1NPR, making it a cost-effective solution for businesses.

-

What features does airSlate SignNow offer for the WI Form 1NPR?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for the WI Form 1NPR. These features enhance the user experience and ensure compliance with state regulations.

-

Can I integrate airSlate SignNow with other software for handling the WI Form 1NPR?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to manage the WI Form 1NPR seamlessly alongside your existing tools. This integration capability enhances workflow efficiency and document management.

-

How does airSlate SignNow ensure the security of the WI Form 1NPR?

airSlate SignNow prioritizes security by employing advanced encryption and compliance measures to protect your WI Form 1NPR and other sensitive documents. This ensures that your data remains confidential and secure throughout the signing process.

-

What are the benefits of using airSlate SignNow for the WI Form 1NPR?

Using airSlate SignNow for the WI Form 1NPR offers numerous benefits, including faster processing times, reduced paperwork, and improved accuracy. These advantages help businesses save time and resources while ensuring compliance with tax regulations.

-

Is airSlate SignNow user-friendly for completing the WI Form 1NPR?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to complete the WI Form 1NPR. The intuitive interface guides users through the process, ensuring a smooth experience for both senders and signers.

Get more for I 050 Form 1NPR Nonresident & Part year Resident Wisconsin Income Tax Wisconsin Form 1NPR

Find out other I 050 Form 1NPR Nonresident & Part year Resident Wisconsin Income Tax Wisconsin Form 1NPR

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy