Form 8879SP Rev January IRS E File Signature Authorization Spanish Version

What is the Form 8879SP Rev January IRS E-file Signature Authorization Spanish Version

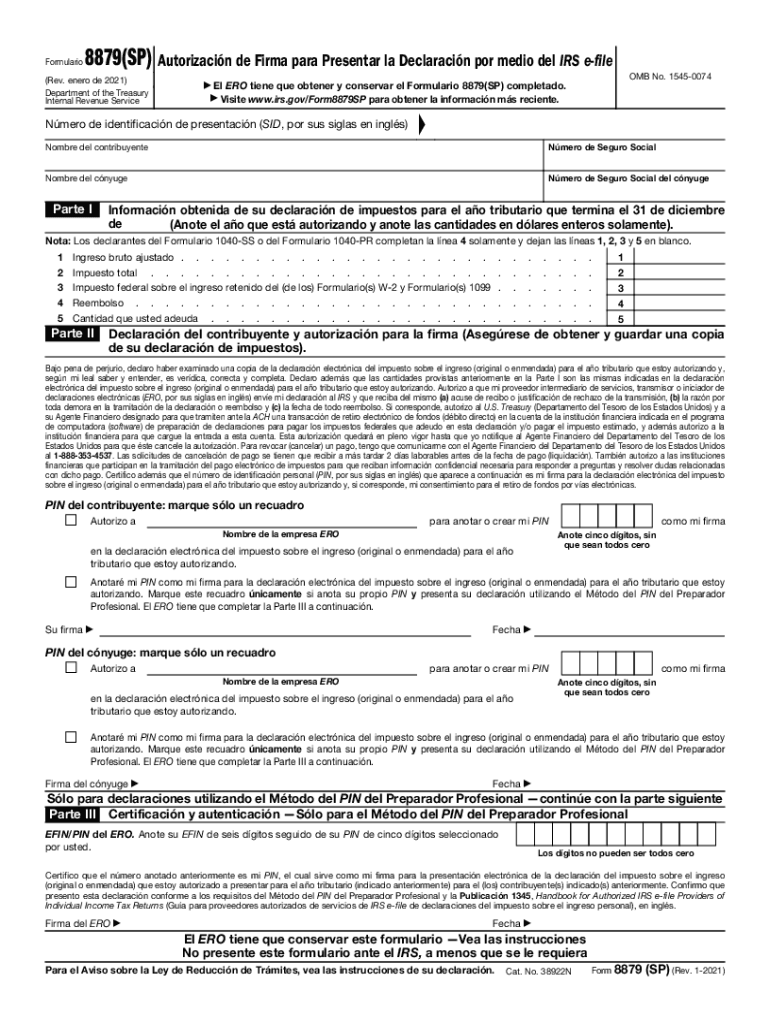

The Form 8879SP Rev January IRS E-file Signature Authorization Spanish Version is a tax form used by taxpayers in the United States to authorize an electronic filing of their tax return. This form is specifically designed for Spanish-speaking individuals, ensuring they can easily understand and complete the authorization process. It serves as a declaration that the taxpayer has reviewed their tax return and gives permission to the tax preparer to submit it electronically to the IRS. This version is crucial for maintaining compliance with IRS regulations while accommodating the needs of Spanish-speaking taxpayers.

How to use the Form 8879SP Rev January IRS E-file Signature Authorization Spanish Version

To use the Form 8879SP Rev January IRS E-file Signature Authorization Spanish Version, taxpayers should first ensure they have completed their tax return accurately. Once the return is prepared, the taxpayer must review it thoroughly. After confirming the information is correct, the taxpayer can fill out the 8879SP form, providing necessary details such as their name, Social Security number, and the tax preparer's information. This form must then be signed and dated by the taxpayer, indicating their consent for electronic submission. The signed form should be provided to the tax preparer, who will use it to file the return electronically with the IRS.

Steps to complete the Form 8879SP Rev January IRS E-file Signature Authorization Spanish Version

Completing the Form 8879SP Rev January IRS E-file Signature Authorization Spanish Version involves several clear steps:

- Review your completed tax return for accuracy.

- Obtain the Form 8879SP from a reliable source.

- Fill in your personal information, including name and Social Security number.

- Provide the tax preparer's details, including their name and PTIN (Preparer Tax Identification Number).

- Sign and date the form, confirming your authorization for electronic filing.

- Submit the signed form to your tax preparer.

Legal use of the Form 8879SP Rev January IRS E-file Signature Authorization Spanish Version

The Form 8879SP Rev January IRS E-file Signature Authorization Spanish Version is legally binding and serves as an official authorization for electronic filing of tax returns. By signing this form, the taxpayer certifies that they have reviewed their return and agree to its submission. The IRS requires this authorization to ensure that taxpayers are aware of and consent to the electronic filing process, which helps to prevent fraud and unauthorized submissions. It is important for taxpayers to keep a copy of the signed form for their records.

Key elements of the Form 8879SP Rev January IRS E-file Signature Authorization Spanish Version

Key elements of the Form 8879SP Rev January IRS E-file Signature Authorization Spanish Version include:

- Taxpayer's name and Social Security number.

- Tax preparer's name and PTIN.

- Tax year for which the return is being filed.

- Signature and date by the taxpayer.

- Certification statement affirming the accuracy of the information provided.

Examples of using the Form 8879SP Rev January IRS E-file Signature Authorization Spanish Version

Examples of using the Form 8879SP Rev January IRS E-file Signature Authorization Spanish Version include scenarios where a Spanish-speaking taxpayer engages a tax professional to prepare their tax return. After the tax return is completed, the taxpayer reviews it and signs the 8879SP form to authorize the electronic filing. This process ensures that the taxpayer's consent is documented and complies with IRS regulations. Another example is when a taxpayer uses tax preparation software that requires the submission of the 8879SP form for e-filing, allowing for a smooth and efficient filing process.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8879sp rev january irs e file signature authorization spanish version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 8879SP Rev January IRS E file Signature Authorization Spanish Version?

The Form 8879SP Rev January IRS E file Signature Authorization Spanish Version is a document that allows taxpayers to authorize an electronic return to be filed on their behalf. This form is specifically designed for Spanish-speaking individuals, ensuring they can easily understand and complete the e-filing process.

-

How can airSlate SignNow help with the Form 8879SP Rev January IRS E file Signature Authorization Spanish Version?

airSlate SignNow provides a user-friendly platform to electronically sign and send the Form 8879SP Rev January IRS E file Signature Authorization Spanish Version. Our solution simplifies the e-signing process, making it quick and efficient for users to complete their tax filings.

-

Is there a cost associated with using airSlate SignNow for the Form 8879SP Rev January IRS E file Signature Authorization Spanish Version?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs. Our plans are designed to be cost-effective, ensuring that you can easily manage the e-signing of the Form 8879SP Rev January IRS E file Signature Authorization Spanish Version without breaking the bank.

-

What features does airSlate SignNow offer for the Form 8879SP Rev January IRS E file Signature Authorization Spanish Version?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking for the Form 8879SP Rev January IRS E file Signature Authorization Spanish Version. These features enhance the signing experience and ensure that your documents are handled securely and efficiently.

-

Can I integrate airSlate SignNow with other software for the Form 8879SP Rev January IRS E file Signature Authorization Spanish Version?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, allowing you to streamline your workflow when handling the Form 8879SP Rev January IRS E file Signature Authorization Spanish Version. This integration capability enhances productivity and ensures a smooth e-signing process.

-

What are the benefits of using airSlate SignNow for the Form 8879SP Rev January IRS E file Signature Authorization Spanish Version?

Using airSlate SignNow for the Form 8879SP Rev January IRS E file Signature Authorization Spanish Version provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete your tax filings quickly and securely, saving you time and effort.

-

Is airSlate SignNow secure for signing the Form 8879SP Rev January IRS E file Signature Authorization Spanish Version?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your data is protected when signing the Form 8879SP Rev January IRS E file Signature Authorization Spanish Version. We utilize advanced encryption and security protocols to safeguard your sensitive information throughout the signing process.

Get more for Form 8879SP Rev January IRS E file Signature Authorization Spanish Version

- Caregiver study guide form

- Noc from landlord for moving out form

- Georgia purchase and sale agreement pdf 40148681 form

- Allied masonic degrees ritual pdf form

- Bgpost form

- Emergency room discharge papers printable form

- Authorized representative form 05 21

- Disaster program virginia department of social services form

Find out other Form 8879SP Rev January IRS E file Signature Authorization Spanish Version

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed