2023ESTIMATE TAX FORM CCA Division of Taxation

Understanding the 2023 CCA City Tax Form

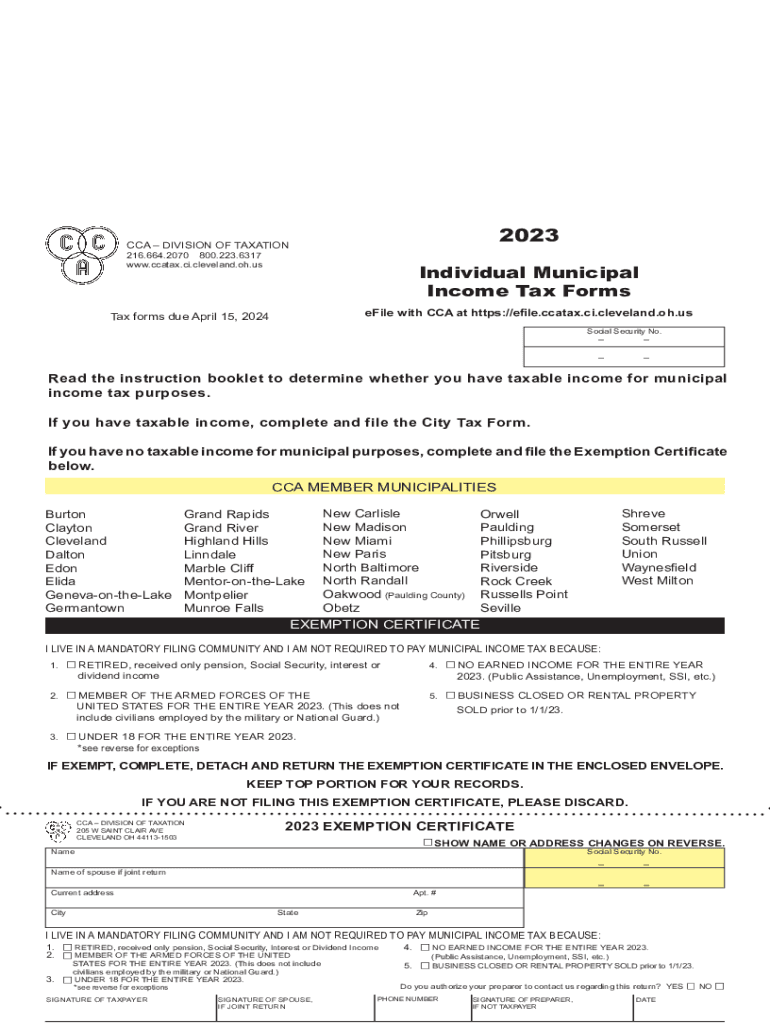

The 2023 CCA City Tax Form, also known as the CCA Form 120, is essential for individuals and businesses to report their city income tax obligations. This form is specifically designed for residents and non-residents who earn income within the city limits. It helps ensure compliance with local tax laws and is a critical component of the overall tax filing process.

Key Elements of the 2023 CCA City Tax Form

When filling out the 2023 CCA City Tax Form, several key elements must be accurately completed. These include:

- Personal Information: Name, address, and Social Security number or Employer Identification Number (EIN).

- Income Reporting: Total income earned, including wages, salaries, and other sources.

- Tax Calculation: The applicable city tax rate and the total tax due based on reported income.

- Deductions and Credits: Any eligible deductions or credits that can reduce the tax liability.

- Signature: A signature is required to validate the form and confirm the accuracy of the information provided.

Steps to Complete the 2023 CCA City Tax Form

Completing the 2023 CCA City Tax Form involves several straightforward steps:

- Gather all necessary documents, including W-2s, 1099s, and any relevant financial records.

- Fill in your personal information accurately at the top of the form.

- Report your total income, ensuring all sources are included.

- Calculate the tax due by applying the appropriate city tax rate to your income.

- Apply any deductions or credits you qualify for to lower your tax liability.

- Review the completed form for accuracy before signing and dating it.

- Submit the form via your chosen method — online, by mail, or in person.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines for the 2023 CCA City Tax Form to avoid penalties. Typically, the deadline for filing is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, any estimated tax payments may have different deadlines throughout the year, so it is important to stay informed about these dates.

Form Submission Methods

The 2023 CCA City Tax Form can be submitted through various methods, providing flexibility for taxpayers:

- Online Submission: Many cities offer an online portal for electronic filing, which is often the fastest method.

- Mail: You can print the completed form and send it to the designated address provided by the city’s tax authority.

- In-Person: Some taxpayers may prefer to submit their forms in person at local tax offices, where assistance may also be available.

Legal Use of the 2023 CCA City Tax Form

The 2023 CCA City Tax Form must be used in compliance with local tax regulations. Failure to file the form or providing false information can result in penalties, including fines and interest on unpaid taxes. It is important to ensure that the form is filled out accurately and submitted on time to avoid any legal repercussions.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2023estimate tax form cca division of taxation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2023 cca city tax form?

The 2023 cca city tax form is a document required by certain cities for residents to report their income and calculate their city tax obligations. It is essential for ensuring compliance with local tax laws and can vary by city. Understanding how to fill out this form correctly can help you avoid penalties.

-

How can airSlate SignNow help with the 2023 cca city tax form?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending the 2023 cca city tax form. Our solution streamlines the process, allowing you to complete and submit your tax documents quickly and securely. This can save you time and reduce the stress associated with tax season.

-

Is there a cost associated with using airSlate SignNow for the 2023 cca city tax form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our plans are designed to be cost-effective, ensuring you get the best value while managing your 2023 cca city tax form and other documents. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the 2023 cca city tax form?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage, all of which are beneficial for managing the 2023 cca city tax form. These features enhance efficiency and ensure that your documents are handled securely and professionally. You can also track the status of your forms in real-time.

-

Can I integrate airSlate SignNow with other software for the 2023 cca city tax form?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage your 2023 cca city tax form alongside your other business tools. This seamless integration helps streamline your workflow and ensures that all your documents are in one place.

-

What are the benefits of using airSlate SignNow for the 2023 cca city tax form?

Using airSlate SignNow for the 2023 cca city tax form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete and sign documents from anywhere, making it convenient for busy professionals. Additionally, our solution helps you stay organized during tax season.

-

Is airSlate SignNow secure for handling the 2023 cca city tax form?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your 2023 cca city tax form and other sensitive documents are protected. We use advanced encryption and security protocols to safeguard your information. You can trust that your data is safe with us.

Get more for 2023ESTIMATE TAX FORM CCA Division Of Taxation

- Nj dept of banking and insurance complaint form

- Naui medical form

- Restorative justice template form

- Hoja padronal madrid form

- Firearm training certificate in form s 1

- Cuna mutual life insurance death claim form 28865341

- Cursive practice upper and lower case letters lower case and upper case cursive letter practice form

- Mittarointipyynto vantaa form

Find out other 2023ESTIMATE TAX FORM CCA Division Of Taxation

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate