Frequently Asked Questions IRS Form 1095 C Employer

What is the 1095 C Form?

The 1095 C form is a tax document provided by employers to their employees under the Affordable Care Act (ACA). It serves as proof of health insurance coverage and is essential for reporting purposes to the Internal Revenue Service (IRS). Employers with fifty or more full-time employees are required to complete and distribute this form, detailing the health insurance offered to employees and their dependents throughout the previous year.

Key Elements of the 1095 C Form

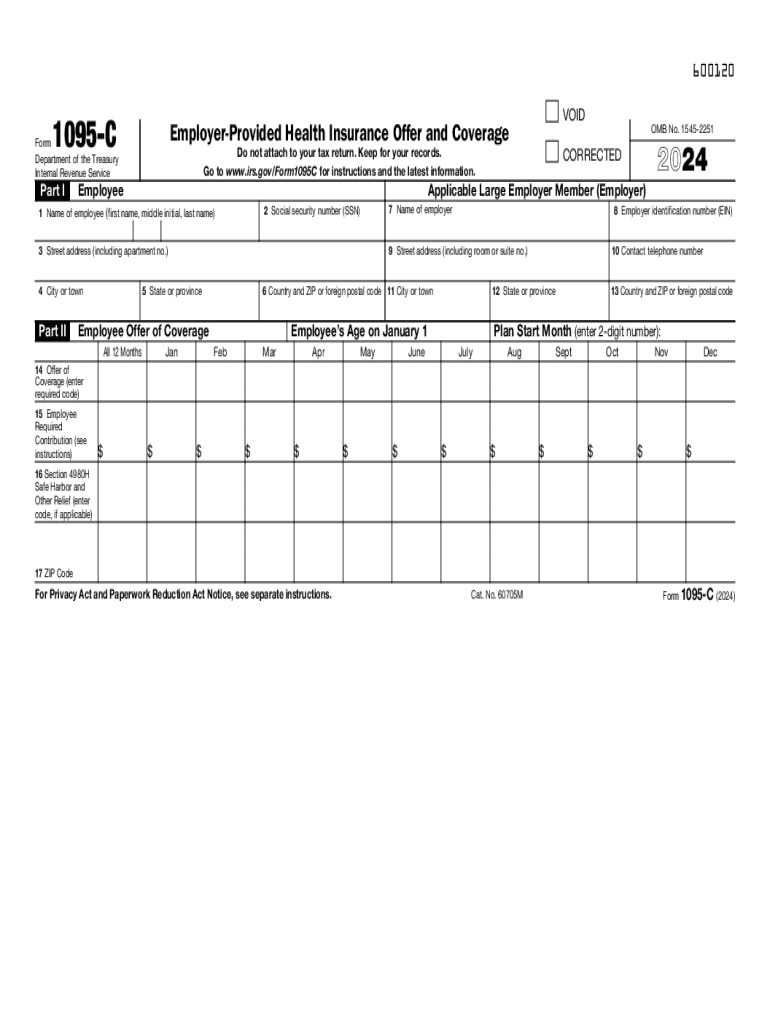

The 1095 C form includes several critical sections that provide information about the employer and the health coverage offered. Key elements include:

- Employer Information: Name, address, and Employer Identification Number (EIN).

- Employee Information: Name, address, and Social Security Number (SSN) of the employee.

- Coverage Information: Details about the health insurance coverage provided, including months of coverage and the type of coverage offered.

- Applicable Codes: Specific codes that indicate the type of health coverage offered and whether it met ACA requirements.

Steps to Complete the 1095 C Form

Completing the 1095 C form involves several steps to ensure accuracy and compliance with IRS regulations:

- Gather necessary information about the employer and employees.

- Determine the type of health coverage offered to each employee.

- Fill out the form accurately, ensuring all sections are completed.

- Review the form for any errors or omissions.

- Distribute copies to employees and submit the form to the IRS by the deadline.

Filing Deadlines for the 1095 C Form

It is crucial for employers to be aware of the filing deadlines for the 1095 C form to avoid penalties. The deadlines are typically as follows:

- Forms must be provided to employees by January thirty-first of the year following the coverage year.

- Forms must be filed with the IRS by February twenty-eighth if filing by paper, or by March thirty-first if filing electronically.

Legal Use of the 1095 C Form

The 1095 C form is not only a reporting tool but also serves legal purposes. It helps employees verify their health coverage when filing their taxes. Additionally, it provides the IRS with information necessary to enforce the ACA's individual mandate, ensuring that individuals maintain minimum essential coverage.

Penalties for Non-Compliance

Employers who fail to file the 1095 C form or provide it to employees may face penalties from the IRS. These penalties can accumulate quickly, emphasizing the importance of timely and accurate filing. Penalties can vary based on the size of the employer and the duration of non-compliance.

Handy tips for filling out Frequently Asked Questions IRS Form 1095 C Employer online

Quick steps to complete and e-sign Frequently Asked Questions IRS Form 1095 C Employer online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Obtain access to a HIPAA and GDPR compliant solution for optimum efficiency. Use signNow to e-sign and send Frequently Asked Questions IRS Form 1095 C Employer for e-signing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the frequently asked questions irs form 1095 c employer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 1095 c form?

The 1095 c form is a tax document that provides information about health insurance coverage offered by employers. It is essential for employees to understand their health coverage and for tax reporting purposes. Using airSlate SignNow, you can easily eSign and manage your 1095 c forms securely and efficiently.

-

How can airSlate SignNow help with 1095 c forms?

airSlate SignNow simplifies the process of sending and eSigning 1095 c forms. Our platform allows businesses to create, send, and track these documents seamlessly, ensuring compliance and accuracy. With our user-friendly interface, managing 1095 c forms has never been easier.

-

Is airSlate SignNow cost-effective for handling 1095 c forms?

Yes, airSlate SignNow offers a cost-effective solution for managing 1095 c forms. Our pricing plans are designed to fit various business sizes and needs, allowing you to save on administrative costs while ensuring compliance. You can streamline your document processes without breaking the bank.

-

What features does airSlate SignNow offer for 1095 c forms?

airSlate SignNow provides features such as customizable templates, secure eSigning, and real-time tracking for 1095 c forms. These tools help ensure that your documents are completed accurately and on time. Additionally, our platform integrates with various applications to enhance your workflow.

-

Can I integrate airSlate SignNow with other software for 1095 c management?

Absolutely! airSlate SignNow offers integrations with popular software solutions, making it easy to manage your 1095 c forms alongside your existing tools. This flexibility allows for a more streamlined workflow, ensuring that your document management is efficient and effective.

-

What are the benefits of using airSlate SignNow for 1095 c forms?

Using airSlate SignNow for your 1095 c forms provides numerous benefits, including enhanced security, improved efficiency, and reduced paper usage. Our platform ensures that your documents are securely stored and easily accessible. Plus, the eSigning feature speeds up the process, allowing for quicker turnaround times.

-

How does airSlate SignNow ensure the security of 1095 c forms?

airSlate SignNow prioritizes the security of your 1095 c forms with advanced encryption and secure storage solutions. We comply with industry standards to protect sensitive information, ensuring that your documents are safe from unauthorized access. Trust us to keep your data secure while you manage your forms.

Get more for Frequently Asked Questions IRS Form 1095 C Employer

- A visit to the water park story form

- Powergrid vendor portal form

- Atestado de vida form

- C63 form

- University of wisconsin integrative medicine program www form

- Petition for conciliation arizona superior court in pima county sc pima form

- Scca 478 south carolina judicial department judicial state sc form

- Termination form south carolina law enforcement division sled sc

Find out other Frequently Asked Questions IRS Form 1095 C Employer

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free