Form 14242 Rev 7 Report Suspected Abusive Tax Promotions or Preparers

What is the Form 14242?

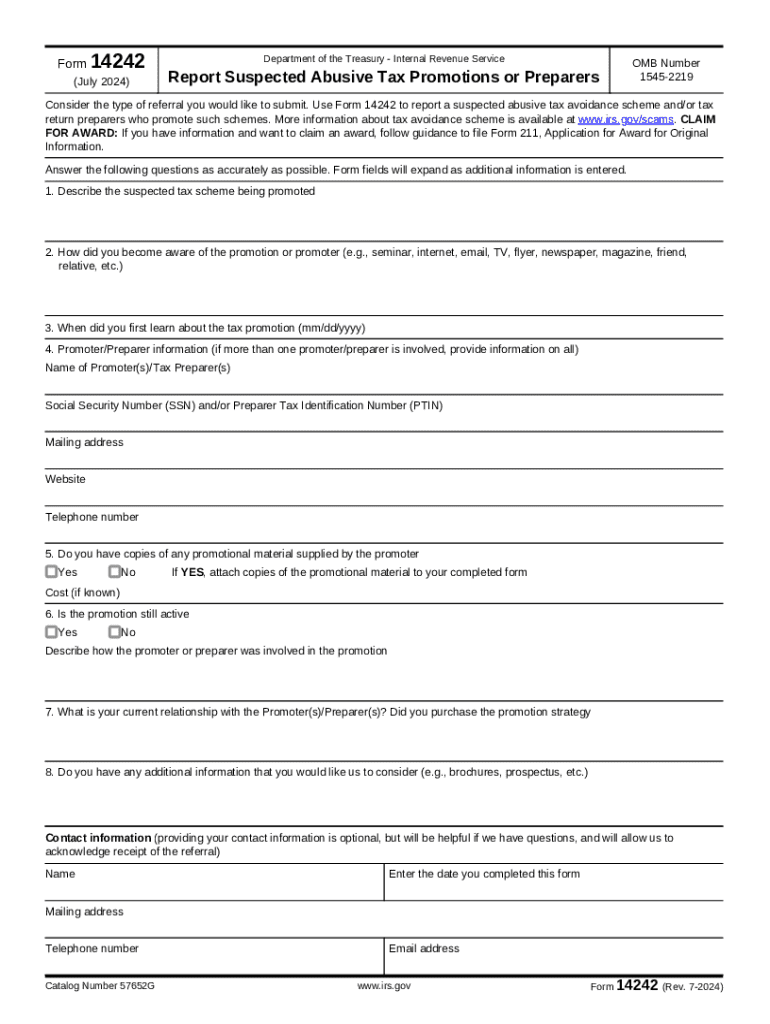

The Form 14242, also known as the Report Suspected Abusive Tax Promotions or Preparers, is a document used to report suspected tax fraud or abusive tax schemes to the IRS. This form is particularly relevant for individuals who wish to report tax preparers who may be engaging in unethical or illegal practices. It allows the IRS to investigate these claims and take appropriate action against individuals or businesses that violate tax laws.

How to use the Form 14242

Using the Form 14242 involves a few straightforward steps. First, gather all relevant information about the suspected abusive tax promoter or preparer, including their name, address, and any specific details about the fraudulent activities. Next, fill out the form with accurate and detailed information, ensuring that you provide as much context as possible about the situation. After completing the form, you can submit it to the IRS either by mail or electronically, depending on the submission methods available.

Steps to complete the Form 14242

Completing the Form 14242 requires careful attention to detail. Start by downloading the form from the IRS website. Fill in your personal information, including your name and contact details, as well as the information of the individual or entity you are reporting. Be specific about the nature of the abuse, including any relevant dates and descriptions of the fraudulent activities. Make sure to review the form for accuracy before submitting it to ensure that all information is correct and complete.

IRS Guidelines for Reporting

The IRS has specific guidelines for reporting suspected tax fraud. It is essential to provide clear and concise information to facilitate the investigation. The IRS encourages individuals to report any suspicious activities, including tax evasion or fraudulent tax preparation. When submitting Form 14242, ensure that you are not submitting anonymous tips that lack sufficient detail, as these may not be actionable. Providing as much context as possible increases the likelihood of a thorough investigation.

Form Submission Methods

You can submit the Form 14242 to the IRS through various methods. The primary method is by mailing the completed form to the designated IRS address. Additionally, some individuals may have the option to submit the form electronically, depending on the IRS's current capabilities. Always check the IRS website for the most up-to-date submission methods and any specific instructions related to your situation.

Legal use of the Form 14242

The Form 14242 is legally recognized for reporting tax fraud and abuse. Using this form protects your rights as a whistleblower, allowing you to report unethical practices without fear of retaliation. It is important to ensure that the information you provide is truthful and accurate, as submitting false information can have legal consequences. Understanding the legal framework surrounding whistleblowing can help you navigate the reporting process effectively.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 14242 rev 7 report suspected abusive tax promotions or preparers

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for how to report someone to the IRS anonymously?

To report someone to the IRS anonymously, you can use Form 3949-A, which allows you to provide information about suspected tax fraud. Ensure you include as much detail as possible, such as the individual's name, address, and the nature of the fraud. Submitting this form does not require you to disclose your identity.

-

Can I use airSlate SignNow to send my IRS report securely?

Yes, airSlate SignNow provides a secure platform for sending documents, including your IRS report. You can eSign and send your Form 3949-A safely, ensuring that your information remains confidential. This makes it easier to report someone to the IRS anonymously without compromising your privacy.

-

Is there a cost associated with using airSlate SignNow for reporting to the IRS?

airSlate SignNow offers a cost-effective solution with various pricing plans. You can choose a plan that fits your needs, whether you are an individual or a business. The pricing is transparent, and you can start with a free trial to explore its features before committing.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as eSigning, document templates, and secure cloud storage. These tools streamline the process of preparing and submitting documents, making it easier to report someone to the IRS anonymously. The user-friendly interface ensures that you can manage your documents efficiently.

-

How does airSlate SignNow ensure the security of my documents?

airSlate SignNow employs advanced encryption and security protocols to protect your documents. This ensures that any sensitive information, including IRS reports, is kept confidential. You can confidently report someone to the IRS anonymously, knowing that your data is secure.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers integrations with various applications, enhancing your workflow. You can connect it with tools like Google Drive, Dropbox, and more, making it easier to manage your documents. This flexibility allows you to streamline the process of reporting someone to the IRS anonymously.

-

What benefits does airSlate SignNow provide for businesses?

For businesses, airSlate SignNow offers increased efficiency in document handling and improved compliance with legal requirements. By using this platform, you can easily manage and eSign documents, which is particularly useful when reporting someone to the IRS anonymously. The cost-effective solution helps save time and resources.

Get more for Form 14242 Rev 7 Report Suspected Abusive Tax Promotions Or Preparers

- Maxpreps bbasketballb stat bsheetb form

- Ahmadiyya bait form

- Group therapy screening form

- John lewis pet insurance claim form 441457053

- Energizer 5 rebate form

- Macomb county fax filing form

- To download job application announcement pss edu form

- Instructions for form 720 v electronic filing payment voucher

Find out other Form 14242 Rev 7 Report Suspected Abusive Tax Promotions Or Preparers

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application