Income Tax and Benefit Return for Non Residents Jeffcpa Ca Form

Understanding the Income Tax and Benefit Return for Non-Residents

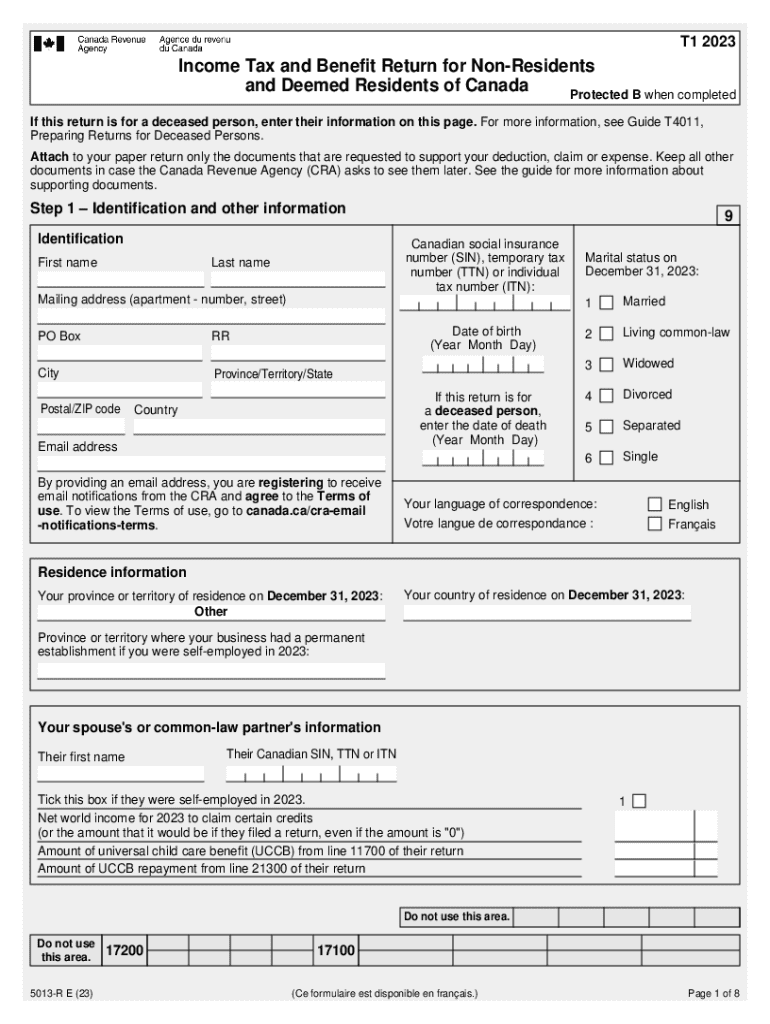

The Income Tax and Benefit Return for non-residents is a specific form used by individuals who do not reside in Canada but earn income from Canadian sources. This form is essential for reporting income and calculating any applicable benefits or tax credits. Non-residents must be aware of their tax obligations, as failure to file can lead to penalties and interest on unpaid taxes.

Steps to Complete the Income Tax and Benefit Return for Non-Residents

Completing the Income Tax and Benefit Return for non-residents involves several key steps:

- Gather all necessary documents, including income statements and any relevant tax forms.

- Determine your residency status and the type of income earned in Canada.

- Fill out the form accurately, ensuring all income sources are reported.

- Calculate any deductions or credits you may be eligible for.

- Review the completed form for accuracy before submission.

Required Documents for Filing

To successfully file the Income Tax and Benefit Return for non-residents, you will need to provide certain documents. These typically include:

- Income statements from Canadian employers or clients.

- Any relevant tax forms, such as T4 slips or T5 slips.

- Proof of residency status, if applicable.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines for the Income Tax and Benefit Return for non-residents. Generally, the deadline for filing is April 30 of the year following the tax year. However, if you are self-employed, the deadline extends to June 15. Late filings may incur penalties, so timely submission is essential.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the Income Tax and Benefit Return for non-residents can result in significant penalties. These may include:

- Late filing penalties, which can accumulate over time.

- Interest on any unpaid taxes, calculated from the due date.

- Potential legal action for persistent non-compliance.

Eligibility Criteria for Filing

To file the Income Tax and Benefit Return for non-residents, individuals must meet specific eligibility criteria. Generally, you must:

- Be a non-resident of Canada for tax purposes.

- Have earned income from Canadian sources during the tax year.

- Meet any additional requirements set by the Canada Revenue Agency.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the income tax and benefit return for non residents jeffcpa ca

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are income deemed residents and how does it affect my business?

Income deemed residents are individuals who are considered tax residents based on their income sources, regardless of their physical presence. Understanding this classification is crucial for businesses to ensure compliance with tax regulations and optimize their financial strategies.

-

How can airSlate SignNow help income deemed residents manage their documentation?

airSlate SignNow provides a seamless platform for income deemed residents to send and eSign important documents securely. Our user-friendly interface ensures that all necessary paperwork is handled efficiently, allowing you to focus on your business operations.

-

What pricing plans does airSlate SignNow offer for income deemed residents?

We offer flexible pricing plans tailored to the needs of income deemed residents. Whether you are a small business or a large enterprise, our cost-effective solutions ensure that you can manage your document signing needs without breaking the bank.

-

Are there any specific features in airSlate SignNow for income deemed residents?

Yes, airSlate SignNow includes features specifically designed for income deemed residents, such as customizable templates and advanced security options. These features help streamline the document signing process while ensuring compliance with relevant regulations.

-

Can airSlate SignNow integrate with other tools for income deemed residents?

Absolutely! airSlate SignNow offers integrations with various tools that income deemed residents commonly use, such as CRM systems and accounting software. This allows for a more cohesive workflow and enhances productivity.

-

What benefits do income deemed residents gain from using airSlate SignNow?

Income deemed residents benefit from increased efficiency and reduced turnaround times when managing documents. Our platform simplifies the eSigning process, ensuring that you can complete transactions quickly and securely.

-

Is airSlate SignNow compliant with regulations affecting income deemed residents?

Yes, airSlate SignNow is designed to comply with various regulations that impact income deemed residents. We prioritize security and compliance, ensuring that your documents are handled in accordance with legal standards.

Get more for Income Tax And Benefit Return For Non residents Jeffcpa ca

Find out other Income Tax And Benefit Return For Non residents Jeffcpa ca

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms

- How Can I Electronic signature Minnesota Rental lease agreement

- Electronic signature Arkansas Rental lease agreement template Computer

- Can I Electronic signature Mississippi Rental lease agreement

- Can I Electronic signature Missouri Rental lease contract

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple

- Electronic signature Rhode Island Residential lease agreement Online

- Electronic signature Florida Rental property lease agreement Free

- Can I Electronic signature Mississippi Rental property lease agreement

- Can I Electronic signature New York Residential lease agreement form

- eSignature Pennsylvania Letter Bankruptcy Inquiry Computer

- Electronic signature Virginia Residential lease form Free

- eSignature North Dakota Guarantee Agreement Easy

- Can I Electronic signature Indiana Simple confidentiality agreement