Instructions for Form 1040 X, Amended U S Individual Income

What is the Instructions for Form 1040X, Amended U.S. Individual Income

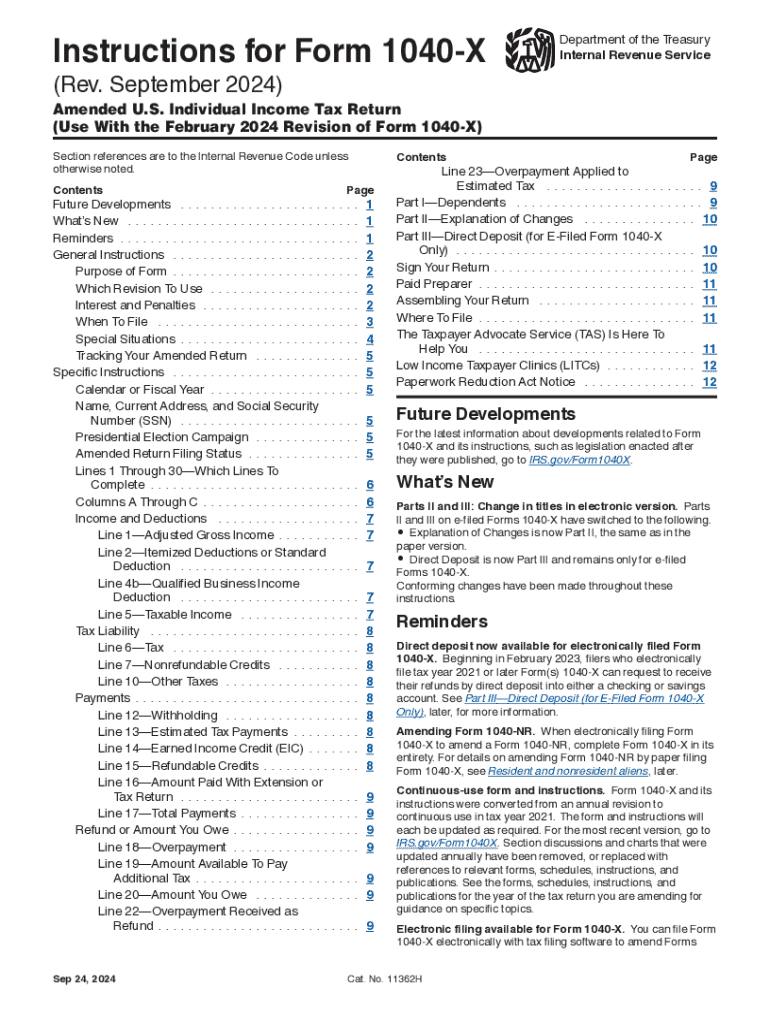

The Instructions for Form 1040X provide detailed guidance for individuals who need to amend their federal income tax returns. This form is essential for correcting errors or making changes to previously filed returns, such as adjusting income, deductions, or credits. The IRS allows taxpayers to amend their returns within three years of the original filing date, making it crucial to follow these instructions carefully to ensure compliance and accuracy.

Steps to Complete the Instructions for Form 1040X, Amended U.S. Individual Income

Completing Form 1040X involves several key steps:

- Gather necessary documents: Collect your original tax return and any supporting documents related to the changes you are making.

- Fill out the form: Use the 1040X to indicate the changes. You will need to provide information from your original return and explain the reasons for the amendments.

- Calculate your new tax liability: Adjust your income and deductions as necessary, and recalculate your tax obligation.

- Sign and date the form: Ensure that you sign and date the amended return before submission.

- Submit the form: Mail your completed Form 1040X to the appropriate IRS address based on your state of residence.

Required Documents for Form 1040X, Amended U.S. Individual Income

When preparing to file Form 1040X, it is important to have the following documents ready:

- Your original tax return (Form 1040, 1040A, or 1040EZ).

- Any W-2s or 1099s that pertain to the income you are amending.

- Documentation supporting the changes, such as receipts or statements.

- Any other relevant tax forms that may affect your amended return.

Filing Deadlines for Form 1040X, Amended U.S. Individual Income

Filing deadlines for Form 1040X are crucial to avoid penalties. Generally, you must file your amended return within three years from the original due date of your return or within two years from the date you paid the tax, whichever is later. It is important to keep track of these deadlines to ensure your amendments are accepted by the IRS.

IRS Guidelines for Form 1040X, Amended U.S. Individual Income

The IRS provides specific guidelines for completing and submitting Form 1040X. These guidelines include:

- Clearly indicating the changes made in the "Explanation of Changes" section.

- Using the correct tax year on the form.

- Not filing Form 1040X electronically; it must be mailed to the IRS.

- Checking for any additional forms that may need to accompany the 1040X, depending on the nature of the amendments.

Where to Mail Form 1040X, Amended U.S. Individual Income

Mailing addresses for Form 1040X vary based on your state of residence. It is important to refer to the IRS instructions for the correct address. Typically, if you are expecting a refund, you will mail it to a different address than if you are enclosing payment. Ensuring that you send your form to the correct location can expedite processing and help avoid delays.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 1040 x amended u s individual income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the form 1040x instructions for filing an amended tax return?

The form 1040x instructions provide detailed guidance on how to amend your tax return. They outline the necessary steps to complete the form accurately, including how to report changes in income, deductions, or credits. Following these instructions ensures that your amended return is processed smoothly.

-

How can airSlate SignNow assist with form 1040x instructions?

airSlate SignNow simplifies the process of completing form 1040x by allowing users to fill out and eSign documents electronically. Our platform provides templates and easy-to-follow instructions, making it easier to ensure that all necessary information is included. This streamlines the filing process and reduces the risk of errors.

-

Are there any costs associated with using airSlate SignNow for form 1040x instructions?

Yes, airSlate SignNow offers various pricing plans to suit different needs, including options for individuals and businesses. Each plan provides access to features that help with the completion of form 1040x instructions, such as document templates and eSignature capabilities. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing form 1040x instructions?

airSlate SignNow offers features such as document templates, eSignature capabilities, and secure cloud storage to help manage form 1040x instructions effectively. Users can easily collaborate with others, track document status, and ensure compliance with tax regulations. These features enhance the overall efficiency of the amendment process.

-

Can I integrate airSlate SignNow with other software for form 1040x instructions?

Yes, airSlate SignNow integrates seamlessly with various software applications, allowing you to enhance your workflow when dealing with form 1040x instructions. Whether you use accounting software or document management systems, our integrations help streamline the process and improve productivity. This flexibility makes it easier to manage your tax documents.

-

What are the benefits of using airSlate SignNow for form 1040x instructions?

Using airSlate SignNow for form 1040x instructions offers numerous benefits, including time savings, reduced paperwork, and enhanced accuracy. The platform's user-friendly interface allows you to complete forms quickly and efficiently. Additionally, eSigning documents eliminates the need for printing and mailing, making the process more environmentally friendly.

-

Is there customer support available for questions about form 1040x instructions?

Absolutely! airSlate SignNow provides dedicated customer support to assist users with any questions regarding form 1040x instructions. Our support team is available via chat, email, or phone to ensure you have the help you need when navigating the amendment process. We are committed to providing excellent service to our users.

Get more for Instructions For Form 1040 X, Amended U S Individual Income

Find out other Instructions For Form 1040 X, Amended U S Individual Income

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document