About Form 4868, Application for Automatic Extension

What is Form 4868, Application for Automatic Extension

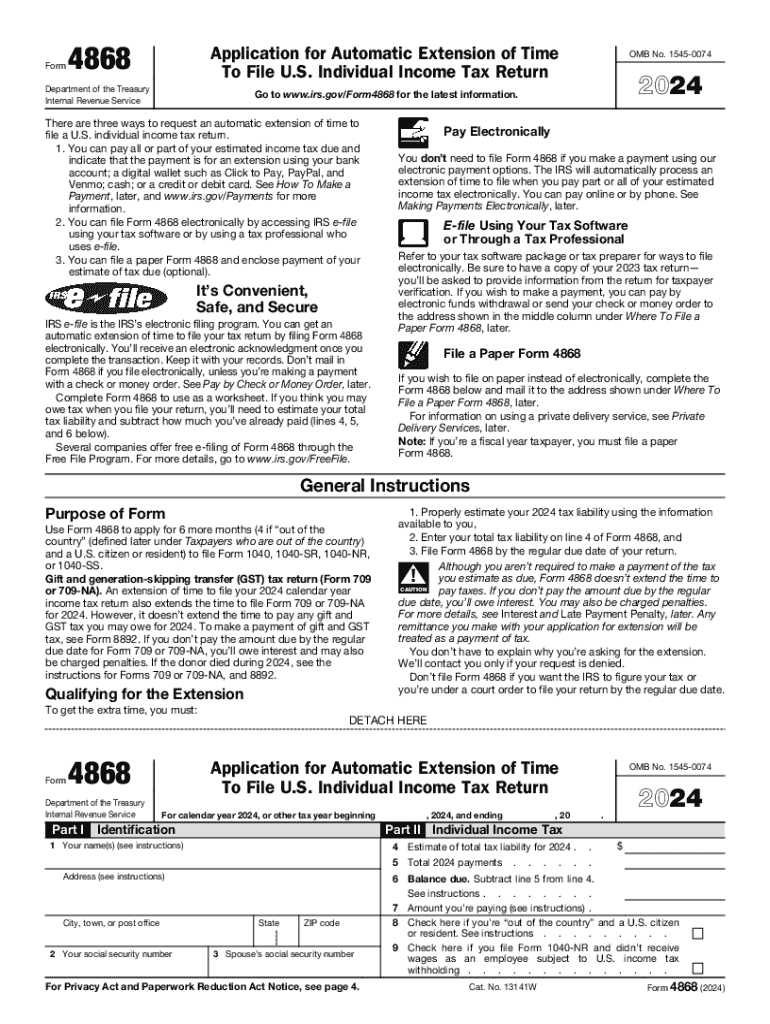

Form 4868 is a document used by taxpayers in the United States to request an automatic extension of time to file their individual income tax returns. By submitting this form, taxpayers can extend their filing deadline by six months, allowing them additional time to prepare their returns. It's important to note that while this extension gives more time to file, it does not extend the time to pay any taxes owed. Taxpayers are still required to estimate their tax liability and pay any amount due by the original filing deadline to avoid penalties and interest.

Steps to Complete Form 4868

Completing Form 4868 involves several straightforward steps:

- Begin by entering your name, address, and Social Security number at the top of the form.

- Provide your spouse's information if you are filing jointly.

- Estimate your total tax liability for the year and any payments you have already made.

- Calculate the balance due, if any, and ensure you include this amount with your payment.

- Sign and date the form, confirming the information is accurate.

Filing Deadlines / Important Dates

The deadline for submitting Form 4868 is typically the same as the due date for your tax return, which is usually April 15. If this date falls on a weekend or holiday, the deadline is extended to the next business day. It is essential to file Form 4868 by this date to avoid penalties. The extended deadline for filing your tax return will then be October 15, giving you additional time to complete your filing.

Required Documents

When filing Form 4868, you do not need to submit any additional documents with the form itself. However, it is advisable to have the following information on hand:

- Your previous year's tax return for reference.

- Any W-2s, 1099s, or other income statements for the current tax year.

- Records of any estimated tax payments made during the year.

Form Submission Methods

Form 4868 can be submitted in several ways:

- Online: You can file electronically using IRS e-file or tax software that supports Form 4868.

- By Mail: You can print the form and send it to the appropriate address listed in the form instructions based on your location.

- In-Person: You may also file the form at designated IRS offices, though this is less common.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting Form 4868. Taxpayers should ensure that they accurately estimate their tax liability and make any necessary payments to avoid interest and penalties. The IRS also advises that if you are unable to pay the full amount due, you should still file Form 4868 to avoid a failure-to-file penalty. It is essential to keep a copy of the filed form for your records.

Handy tips for filling out About Form 4868, Application For Automatic Extension online

Quick steps to complete and e-sign About Form 4868, Application For Automatic Extension online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Obtain access to a HIPAA and GDPR compliant platform for maximum efficiency. Use signNow to e-sign and send About Form 4868, Application For Automatic Extension for e-signing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the about form 4868 application for automatic extension

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how can it help with my tax return?

airSlate SignNow is a powerful eSignature solution that simplifies the process of sending and signing documents. When it comes to how to tax return, our platform allows you to securely collect signatures on tax-related documents, ensuring a smooth and efficient filing process.

-

How does airSlate SignNow ensure the security of my tax return documents?

Security is a top priority for airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your documents. This means that when you're figuring out how to tax return, you can trust that your sensitive information is safe and secure.

-

What features does airSlate SignNow offer for managing tax return documents?

airSlate SignNow offers a range of features designed to streamline document management, including templates, automated workflows, and real-time tracking. These tools can signNowly enhance your understanding of how to tax return efficiently and effectively.

-

Is airSlate SignNow cost-effective for small businesses handling tax returns?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. With flexible pricing plans, you can choose the option that best fits your needs while learning how to tax return without breaking the bank.

-

Can I integrate airSlate SignNow with other software for tax return preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software. This integration can simplify your workflow and help you understand how to tax return more efficiently by connecting all your tools in one place.

-

What are the benefits of using airSlate SignNow for tax returns?

Using airSlate SignNow for your tax returns offers numerous benefits, including faster processing times, reduced paperwork, and improved accuracy. By leveraging our platform, you can focus on how to tax return effectively while minimizing the hassle of traditional methods.

-

How can I get started with airSlate SignNow for my tax return needs?

Getting started with airSlate SignNow is easy! Simply sign up for an account, explore our features, and begin uploading your tax documents. You'll quickly learn how to tax return with our user-friendly interface and helpful resources.

Get more for About Form 4868, Application For Automatic Extension

Find out other About Form 4868, Application For Automatic Extension

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online