Form 1120 F U S Income Tax Return of a Foreign Corporation

What is the Form 1120 F U S Income Tax Return Of A Foreign Corporation

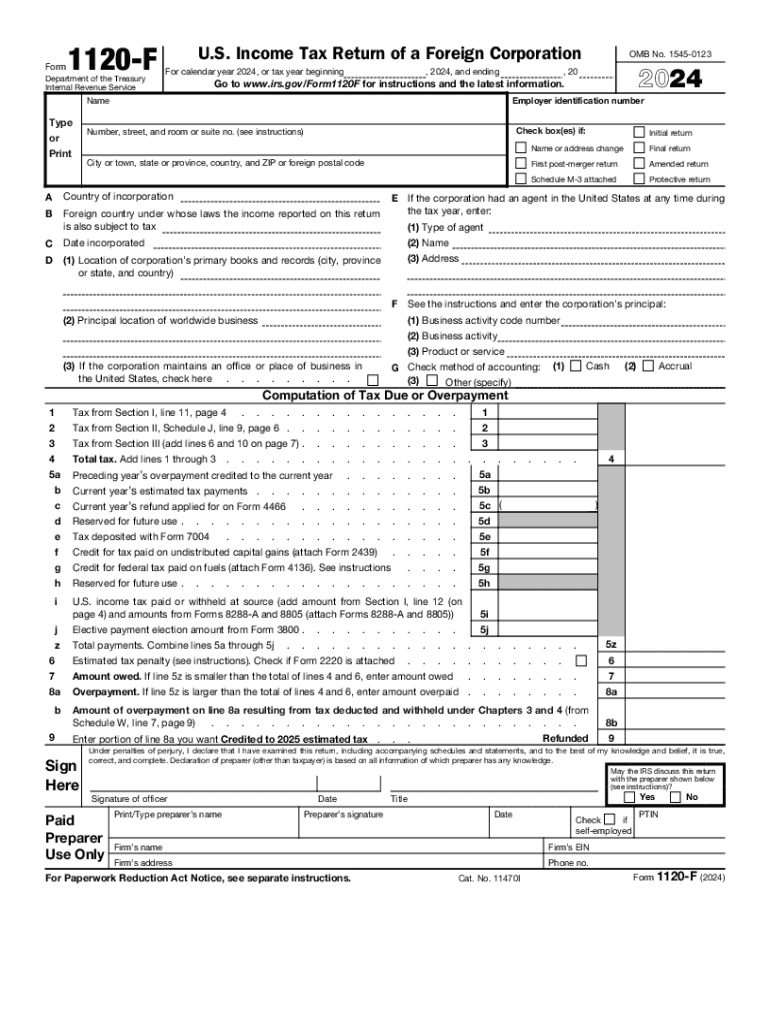

The Form 1120 F is the U.S. Income Tax Return for a Foreign Corporation. This form is specifically designed for foreign corporations that engage in business activities within the United States. It serves as a means for these entities to report their income, gains, losses, deductions, and credits, ensuring compliance with U.S. tax laws. The form is crucial for determining the corporation's tax liability and is a key component of the U.S. tax system, reflecting the income earned by foreign entities operating domestically.

How to obtain the Form 1120 F U S Income Tax Return Of A Foreign Corporation

To obtain the Form 1120 F, foreign corporations can access it through the Internal Revenue Service (IRS) website. The form is available for download in a fillable PDF format, allowing for easy completion. Additionally, corporations can request a paper version by contacting the IRS directly. It is important to ensure that the most current version of the form is used, as tax laws and requirements may change from year to year.

Steps to complete the Form 1120 F U S Income Tax Return Of A Foreign Corporation

Completing the Form 1120 F involves several key steps:

- Gather necessary financial documentation, including income statements, balance sheets, and records of deductions.

- Begin filling out the form by providing basic information about the corporation, such as its name, address, and Employer Identification Number (EIN).

- Report all sources of income earned in the U.S., including effectively connected income and fixed or determinable annual or periodical income.

- Detail any deductions the corporation is eligible to claim, ensuring that all expenses are properly documented.

- Calculate the total tax liability based on the reported income and applicable tax rates.

- Review the completed form for accuracy before submission.

Key elements of the Form 1120 F U S Income Tax Return Of A Foreign Corporation

The Form 1120 F includes several key elements that are essential for accurate reporting:

- Identification Information: This section requires the corporation's name, address, and EIN.

- Income Section: Corporations must report all income earned from U.S. sources, including effectively connected income.

- Deductions: This section allows for the listing of all deductible business expenses, which can reduce taxable income.

- Tax Computation: Corporations must calculate their tax liability based on the reported income and applicable tax rates.

- Signature Section: An authorized officer of the corporation must sign the form to certify its accuracy.

Filing Deadlines / Important Dates

The filing deadline for Form 1120 F is typically the 15th day of the sixth month after the end of the corporation's tax year. For corporations operating on a calendar year basis, this means the form is due by June 15. It is essential for foreign corporations to adhere to this deadline to avoid penalties and interest on any unpaid taxes. Extensions may be available, but they must be requested before the original deadline.

Penalties for Non-Compliance

Failure to file Form 1120 F on time or providing inaccurate information can result in significant penalties. The IRS may impose a failure-to-file penalty, which is calculated based on the number of months the return is late. Additionally, interest may accrue on any unpaid tax amounts. It is crucial for foreign corporations to understand these penalties and ensure timely and accurate filing to maintain compliance with U.S. tax regulations.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1120 f u s income tax return of a foreign corporation 767975868

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the f 1120 form and how does airSlate SignNow assist with it?

The f 1120 form is a U.S. corporate income tax return that businesses must file annually. airSlate SignNow simplifies the process by allowing users to easily eSign and send the f 1120 form securely, ensuring compliance and efficiency in document management.

-

How much does airSlate SignNow cost for filing the f 1120?

airSlate SignNow offers competitive pricing plans that cater to various business needs. Depending on the features you require for managing the f 1120 form, you can choose a plan that fits your budget while ensuring you have all the necessary tools for efficient document handling.

-

What features does airSlate SignNow provide for the f 1120 form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for the f 1120 form. These features enhance the user experience by streamlining the filing process and ensuring that all necessary signatures are collected promptly.

-

Can I integrate airSlate SignNow with other software for managing the f 1120?

Yes, airSlate SignNow offers seamless integrations with various accounting and document management software. This allows you to easily manage the f 1120 form alongside your other business processes, enhancing productivity and reducing the risk of errors.

-

What are the benefits of using airSlate SignNow for the f 1120 form?

Using airSlate SignNow for the f 1120 form provides numerous benefits, including time savings, enhanced security, and improved accuracy. The platform's user-friendly interface ensures that even those unfamiliar with eSigning can navigate the process with ease.

-

Is airSlate SignNow compliant with regulations for the f 1120 form?

Absolutely! airSlate SignNow is designed to comply with all relevant regulations for electronic signatures and document management. This compliance ensures that your f 1120 form is filed correctly and securely, meeting all legal requirements.

-

How does airSlate SignNow ensure the security of my f 1120 documents?

airSlate SignNow employs advanced encryption and security protocols to protect your f 1120 documents. This ensures that sensitive information remains confidential and secure throughout the signing and filing process.

Get more for Form 1120 F U S Income Tax Return Of A Foreign Corporation

Find out other Form 1120 F U S Income Tax Return Of A Foreign Corporation

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement