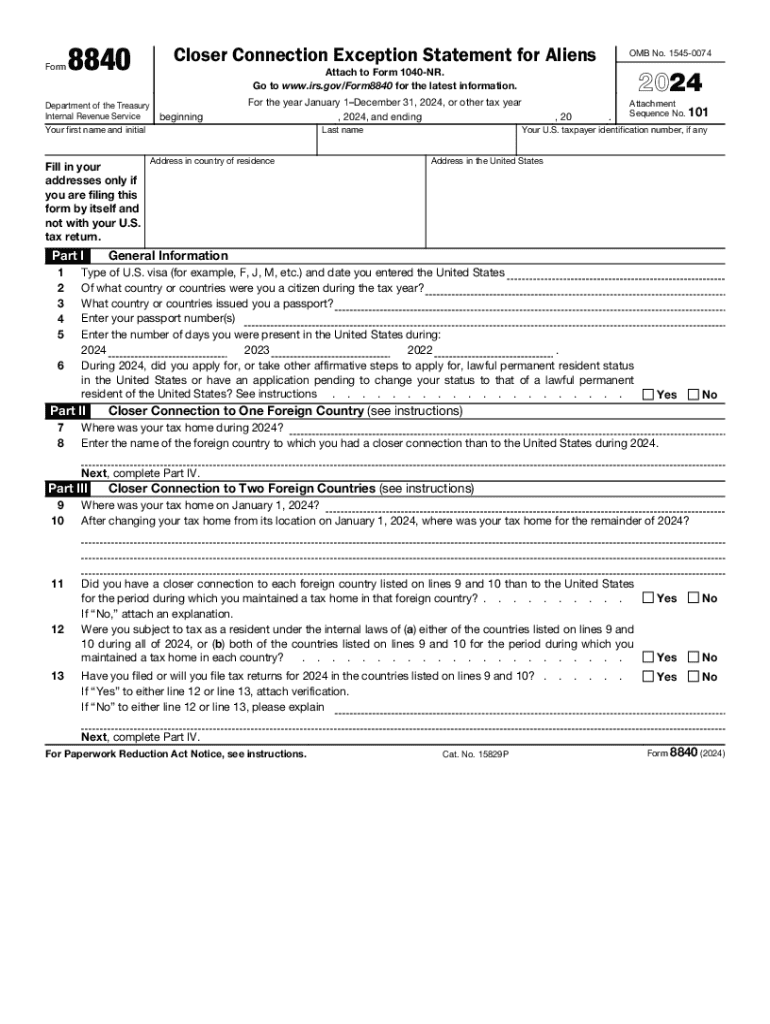

Form 8840 Closer Connection Exception Statement for Aliens

Understanding the Form 8840 Closer Connection Exception Statement for Aliens

The Form 8840, officially known as the Closer Connection Exception Statement for Aliens, is a crucial document for individuals who may be considered U.S. residents for tax purposes but wish to claim a closer connection to a foreign country. This form is particularly relevant for Canadian snowbirds and other expatriates who spend a significant amount of time in the United States. By filing Form 8840, these individuals can assert that they maintain a closer connection to their home country, which may exempt them from certain U.S. tax obligations.

Steps to Complete the Form 8840 Closer Connection Exception Statement for Aliens

Completing the Form 8840 involves several key steps:

- Gather necessary information, including personal details, residency status, and the number of days spent in the U.S. versus your home country.

- Fill out the form accurately, ensuring all sections are completed, particularly those related to your closer connection.

- Review the form for accuracy and completeness to avoid delays or issues with the IRS.

- Submit the form by the designated deadline, typically by June 15 for those who qualify for an automatic extension.

Key Elements of the Form 8840 Closer Connection Exception Statement for Aliens

Several critical elements must be included when filing Form 8840:

- Personal Information: This includes your name, address, and taxpayer identification number.

- Days Present in the U.S.: You must provide a detailed account of the days spent in the U.S. during the tax year.

- Closer Connection Details: Describe your ties to your home country, such as family, business interests, and property ownership.

Filing Deadlines and Important Dates

Understanding the filing deadlines for Form 8840 is essential for compliance. The form is generally due on June 15 of the year following the tax year in question. If you are unable to meet this deadline, you may apply for an extension using Form 4868. However, any taxes owed must still be paid by the original due date to avoid penalties and interest.

Legal Use of the Form 8840 Closer Connection Exception Statement for Aliens

The legal use of Form 8840 is to establish your claim for a closer connection to a foreign country, which can significantly impact your tax obligations in the United States. Filing this form correctly can help you avoid being classified as a U.S. resident for tax purposes, which would subject you to U.S. taxation on your worldwide income. It is advisable to consult with a tax professional to ensure compliance with IRS regulations and to understand the implications of your filing.

Eligibility Criteria for Form 8840

To be eligible to file Form 8840, you must meet specific criteria, including:

- You are a non-resident alien for tax purposes.

- You have been present in the U.S. for fewer than 183 days during the tax year.

- You can demonstrate a closer connection to a foreign country, which may include factors such as your permanent home, family, and social ties.

Handy tips for filling out Form 8840 Closer Connection Exception Statement For Aliens online

Quick steps to complete and e-sign Form 8840 Closer Connection Exception Statement For Aliens online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Obtain access to a HIPAA and GDPR compliant platform for optimum efficiency. Use signNow to electronically sign and send Form 8840 Closer Connection Exception Statement For Aliens for e-signing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8840 closer connection exception statement for aliens

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 8840 form for 2024 and who needs to file it?

The 8840 form for 2024 is used by individuals to claim the closer connection exception to the substantial presence test. This form is essential for non-resident aliens who meet specific criteria and want to avoid being classified as U.S. residents for tax purposes. Understanding the requirements for the 8840 form for 2024 can help you navigate your tax obligations effectively.

-

How can airSlate SignNow help with the 8840 form for 2024?

airSlate SignNow provides a seamless platform for electronically signing and sending the 8840 form for 2024. With our user-friendly interface, you can easily fill out, sign, and share your documents securely. This ensures that you meet your filing deadlines without the hassle of traditional paperwork.

-

What are the pricing options for using airSlate SignNow for the 8840 form for 2024?

airSlate SignNow offers flexible pricing plans that cater to various business needs, making it cost-effective for managing the 8840 form for 2024. You can choose from monthly or annual subscriptions, with options that include additional features like templates and integrations. This allows you to select a plan that fits your budget while ensuring you have the tools needed for efficient document management.

-

Are there any features specifically designed for the 8840 form for 2024?

Yes, airSlate SignNow includes features that streamline the process of completing the 8840 form for 2024. These features include customizable templates, automated reminders for filing deadlines, and secure cloud storage for your documents. This makes it easier to manage your tax forms and ensures you have everything you need at your fingertips.

-

Can I integrate airSlate SignNow with other software for the 8840 form for 2024?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to manage the 8840 form for 2024 alongside your existing tools. Whether you use CRM systems, accounting software, or cloud storage solutions, our platform can connect seamlessly to enhance your workflow and efficiency.

-

What are the benefits of using airSlate SignNow for the 8840 form for 2024?

Using airSlate SignNow for the 8840 form for 2024 provides numerous benefits, including time savings, enhanced security, and improved accuracy. Our electronic signature solution eliminates the need for printing and mailing, reducing the risk of errors. Additionally, your documents are stored securely, ensuring compliance and peace of mind.

-

Is airSlate SignNow compliant with regulations for the 8840 form for 2024?

Yes, airSlate SignNow is designed to comply with all relevant regulations for the 8840 form for 2024. Our platform adheres to industry standards for electronic signatures and data protection, ensuring that your documents are handled securely and legally. This compliance helps you focus on your tax filing without worrying about legal issues.

Get more for Form 8840 Closer Connection Exception Statement For Aliens

- Test anxiety inventory form

- Ga form 500 instructions 100049837

- Vehicle registration template form

- La county structural observation form

- Ae form 600 77a pdf

- Employment background check authorization form

- Official transcript request form macewan university official transcript request form macewan university

- Utm transcript form

Find out other Form 8840 Closer Connection Exception Statement For Aliens

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template