Establishing secure connection…Loading editor…Preparing document…

We are not affiliated with any brand or entity on this form.

What is IRMAA and Am I Eligible for an Adjustment? Form

Handy tips for filling out What Is IRMAA And Am I Eligible For An Adjustment? online

Quick steps to complete and e-sign What Is IRMAA And Am I Eligible For An Adjustment? online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Obtain access to a HIPAA and GDPR compliant platform for optimum efficiency. Use signNow to electronically sign and share What Is IRMAA And Am I Eligible For An Adjustment? for e-signing.

be ready to get more

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the what is irmaa and am i eligible for an adjustment

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How do I know if I qualify for Irmaa?

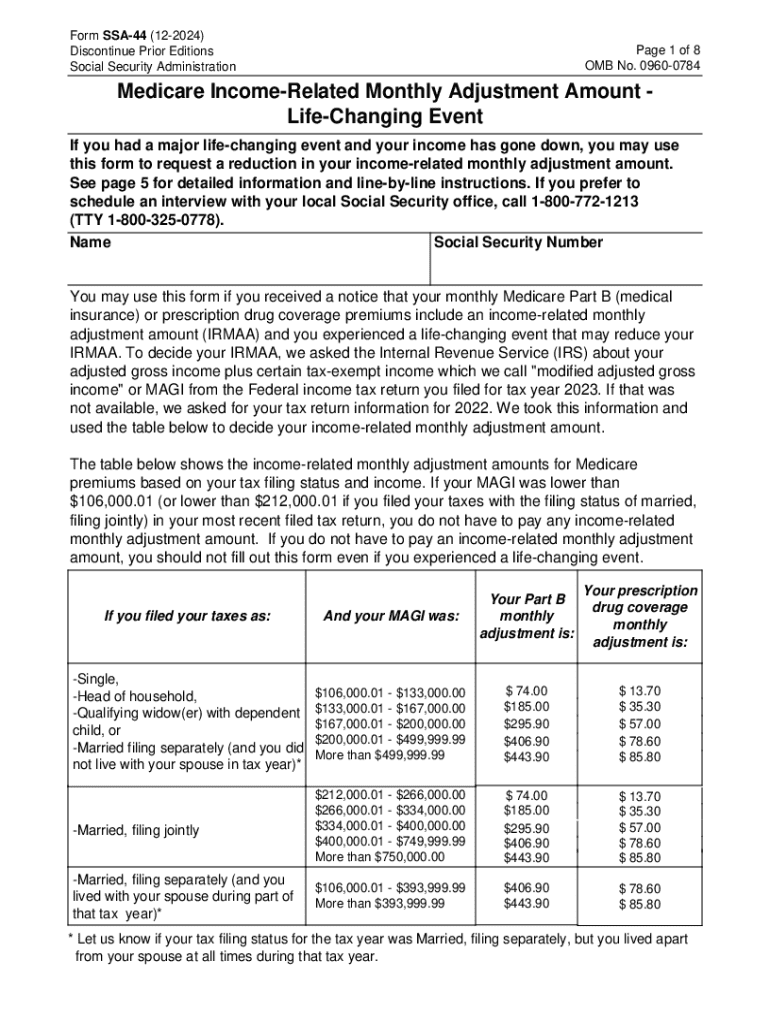

The Social Security Administration (SSA) sets four income brackets that determine your (or you and your spouse's) IRMAA. SSA determines if you owe an IRMAA based on the income you reported on your IRS tax return two years prior, meaning two years before the year that you start paying IRMAA.

-

How do I know if I have to pay Irmaa?

IRMAA is determined by income from your income tax returns two years prior. This means that for your 2024 Medicare premiums, your 2022 income tax return was used. And for your 2025 premiums, your 2023 tax return will be used. IRMAA applicability and amounts are recalculated annually.

-

What is the Irmaa for part B and D in 2024?

Their 2024 Medicare Part B total premium will be $244.60 per month (base premium of $174.70 + IRMAA surcharge of $69.90). Their 2024 Medicare Part D total premium will be the base policy cost (a.k.a. “Plan Premium”) + a surcharge of $12.90 per month.

-

Who is eligible for Irmaa reimbursement?

Understanding IRMAA and Its Reimbursement Process If you've been paying more than the standard amount for your premiums, you might be eligible for an IRMAA refund. Let's dive into how this process works. If you're a retiree or have dependents who are qualified for Medicare, then you can be pleased.

-

What income triggers Irmaa?

In 2024, you'll be charged an IRMAA if your modified-adjusted gross income is over $103,000 for a single filer and $206,000 for married couples filing jointly. Understanding how your retirement income impacts your healthcare costs can help you protect the retirement savings you've built.

-

Do Social Security payments count toward Irmaa?

Do Social Security benefits count toward IRMAA? Yes, the taxable portion of your Social Security benefits is used to calculate your MAGI, and MAGI determines your IRMAA.

-

Who determines Irmaa eligibility?

The Social Security Administration (SSA) sets four income brackets that determine your (or you and your spouse's) IRMAA. SSA determines if you owe an IRMAA based on the income you reported on your IRS tax return two years prior, meaning two years before the year that you start paying IRMAA.

-

What is an Irmaa adjustment?

The income-related monthly adjustment amount (IRMAA) sliding scale is a set of statutory percentage-based tables used to adjust Medicare Part B and Part D prescription drug coverage premiums. The higher the beneficiary's range of modified adjusted gross income (MAGI), the higher the IRMAA.

-

What is the Irmaa adjustment?

The income-related monthly adjustment amount (IRMAA) sliding scale is a set of statutory percentage-based tables used to adjust Medicare Part B and Part D prescription drug coverage premiums. The higher the beneficiary's range of modified adjusted gross income (MAGI), the higher the IRMAA.

-

How do I know if I have to pay Irmaa?

IRMAA is determined by income from your income tax returns two years prior. This means that for your 2024 Medicare premiums, your 2022 income tax return was used. And for your 2025 premiums, your 2023 tax return will be used. IRMAA applicability and amounts are recalculated annually.

Get more for What Is IRMAA And Am I Eligible For An Adjustment?

Find out other What Is IRMAA And Am I Eligible For An Adjustment?

- Sign Virginia Lodger Agreement Template Safe

- Can I Sign Michigan Home Loan Application

- Sign Arkansas Mortgage Quote Request Online

- Sign Nebraska Mortgage Quote Request Simple

- Can I Sign Indiana Temporary Employment Contract Template

- How Can I Sign Maryland Temporary Employment Contract Template

- How Can I Sign Montana Temporary Employment Contract Template

- How Can I Sign Ohio Temporary Employment Contract Template

- Sign Mississippi Freelance Contract Online

- Sign Missouri Freelance Contract Safe

- How Do I Sign Delaware Email Cover Letter Template

- Can I Sign Wisconsin Freelance Contract

- Sign Hawaii Employee Performance Review Template Simple

- Sign Indiana Termination Letter Template Simple

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

be ready to get more

Get this form now!

If you believe that this page should be taken down, please follow our DMCA take down process here.