Publication 1321 Rev 10 Special Instructions for Bona Fide Residents of Puerto Rico Who Must File a U S Individual Income Tax Re Form

Understanding Publication 1321 Rev 10

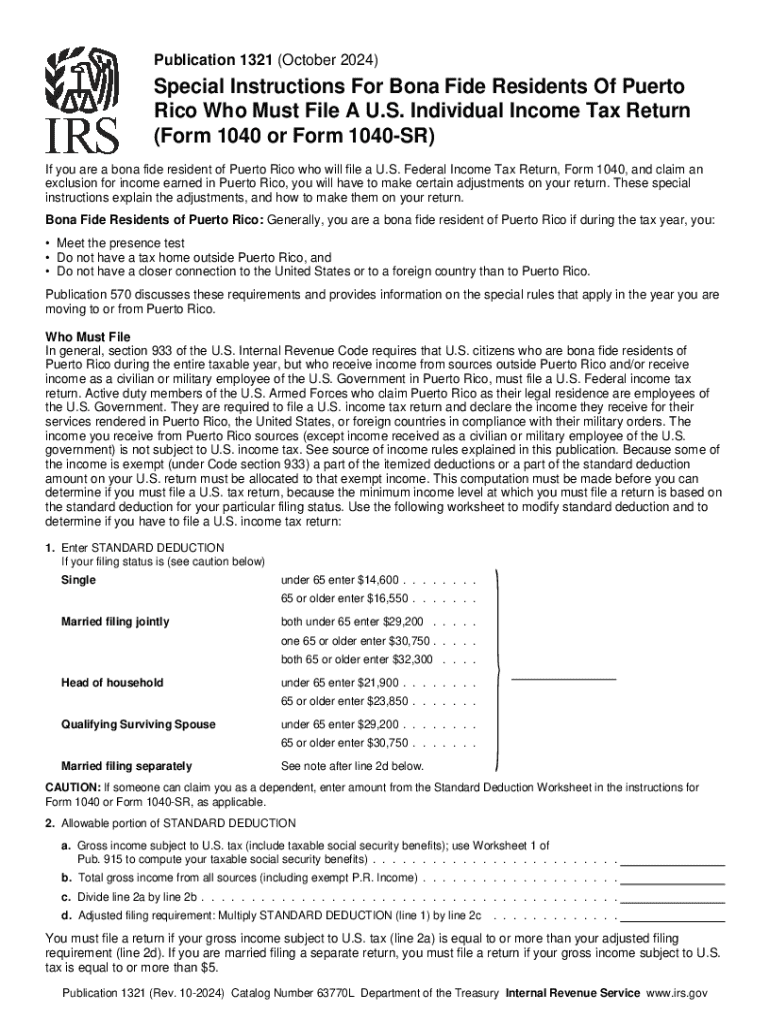

Publication 1321 Rev 10 provides essential instructions for bona fide residents of Puerto Rico who are required to file a U.S. Individual Income Tax Return using Form 1040 or Form 1040-SR. This publication outlines specific guidelines that differentiate the tax obligations of Puerto Rican residents from those of residents in the 50 states. It is crucial for individuals in Puerto Rico to understand these instructions to ensure compliance with U.S. tax laws while accurately reporting their income and claiming eligible deductions.

How to Use Publication 1321 Rev 10

To effectively use Publication 1321 Rev 10, residents should first familiarize themselves with the document's structure and key sections. The publication includes detailed explanations of filing requirements, eligibility criteria for various deductions, and special considerations for residents of Puerto Rico. It is advisable to read through the entire publication to understand how the information applies to individual circumstances. Additionally, residents should keep this publication handy while completing their tax returns to reference specific instructions as needed.

Steps to Complete Your Tax Return Using Publication 1321 Rev 10

Completing your tax return as a bona fide resident of Puerto Rico involves several steps:

- Gather all necessary financial documents, including income statements and records of deductions.

- Review the instructions in Publication 1321 Rev 10 to determine which forms are applicable to your situation.

- Complete Form 1040 or Form 1040-SR, ensuring to follow the specific guidelines outlined in the publication.

- Double-check your calculations and ensure all required information is included.

- Submit your completed tax return by the designated deadline, either electronically or by mail.

Key Elements of Publication 1321 Rev 10

Key elements of Publication 1321 Rev 10 include:

- Definitions of bona fide residency and its implications for tax filing.

- Specific income sources that must be reported by Puerto Rican residents.

- Eligibility criteria for claiming various tax credits and deductions.

- Instructions for reporting income earned outside of Puerto Rico.

Eligibility Criteria for Filing

To be eligible to file using Publication 1321 Rev 10, individuals must meet certain criteria. Primarily, they must be bona fide residents of Puerto Rico for the entire tax year. This status is determined by factors such as the physical presence test, tax home, and closer connection to Puerto Rico compared to other locations. Understanding these criteria is essential to ensure compliance and to take advantage of any applicable tax benefits.

Required Documents for Filing

When preparing to file a tax return using Publication 1321 Rev 10, residents should gather the following documents:

- W-2 forms from employers.

- 1099 forms for any additional income received.

- Records of any deductions or credits being claimed.

- Proof of residency in Puerto Rico, if necessary.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the publication 1321 rev 10 special instructions for bona fide residents of puerto rico who must file a u s individual income tax 771143234

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Publication 1321 Rev 10 and why is it important for residents of Puerto Rico?

Publication 1321 Rev 10 provides essential instructions for bona fide residents of Puerto Rico who must file a U.S. Individual Income Tax Return using Form 1040 or Form 1040 SR. Understanding this publication is crucial for ensuring compliance with U.S. tax laws and maximizing potential tax benefits.

-

How can airSlate SignNow assist with filing taxes using Publication 1321 Rev 10?

airSlate SignNow offers a streamlined platform for eSigning and sending documents, making it easier for users to manage their tax filings, including those related to Publication 1321 Rev 10. Our solution simplifies the process of gathering signatures and submitting necessary forms securely.

-

What features does airSlate SignNow provide for tax document management?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking of document status. These features are particularly beneficial for managing tax documents related to Publication 1321 Rev 10, ensuring that all necessary paperwork is completed accurately and on time.

-

Is airSlate SignNow cost-effective for individuals filing taxes?

Yes, airSlate SignNow is designed to be a cost-effective solution for individuals, including those needing to file taxes under Publication 1321 Rev 10. Our pricing plans are competitive, providing excellent value for the features and support offered, making tax filing more accessible.

-

Can I integrate airSlate SignNow with other tax software?

Absolutely! airSlate SignNow integrates seamlessly with various tax software solutions, enhancing your ability to manage documents related to Publication 1321 Rev 10. This integration allows for a more efficient workflow, ensuring that all tax-related documents are easily accessible and organized.

-

What are the benefits of using airSlate SignNow for tax filings?

Using airSlate SignNow for tax filings offers numerous benefits, including increased efficiency, enhanced security, and reduced paperwork. For those dealing with Publication 1321 Rev 10, our platform ensures that all documents are handled securely and can be signed electronically, saving time and effort.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your documents by employing advanced encryption and secure cloud storage. When dealing with sensitive information related to Publication 1321 Rev 10, you can trust that your data is protected against unauthorized access.

Get more for Publication 1321 Rev 10 Special Instructions For Bona Fide Residents Of Puerto Rico Who Must File A U S Individual Income Tax Re

Find out other Publication 1321 Rev 10 Special Instructions For Bona Fide Residents Of Puerto Rico Who Must File A U S Individual Income Tax Re

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online