Form W 2AS American Samoa Wage and Tax Statement

What is the Form W-2AS American Samoa Wage and Tax Statement

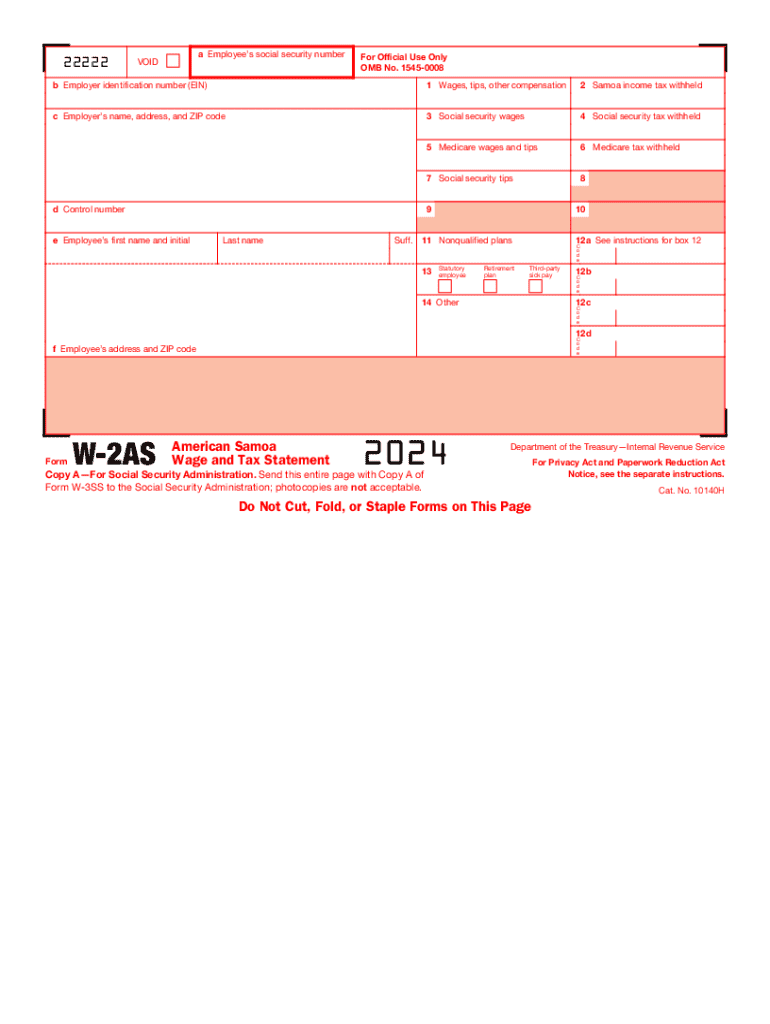

The Form W-2AS is a wage and tax statement specifically designed for employees working in American Samoa. This form reports the wages earned by an employee and the taxes withheld by the employer. It is similar to the standard W-2 form but tailored to meet the specific tax regulations and requirements of American Samoa. The W-2AS includes information such as the employee's name, Social Security number, and the total amount of wages paid during the tax year, along with any federal and territorial taxes withheld.

How to use the Form W-2AS American Samoa Wage and Tax Statement

Employers must provide the Form W-2AS to their employees by the end of January each year. Employees use this form to file their annual tax returns. The information on the W-2AS helps determine the amount of tax owed or the refund due. When filling out the tax return, employees should ensure that the details on the W-2AS match their records. This form is essential for accurately reporting income to the Internal Revenue Service (IRS) and the local tax authority.

Steps to complete the Form W-2AS American Samoa Wage and Tax Statement

Completing the Form W-2AS involves several steps:

- Gather necessary information, including employee details and wage information.

- Fill out the employee's name, address, and Social Security number accurately.

- Report the total wages paid in Box 1 and any federal income tax withheld in Box 2.

- Include any territorial taxes withheld in the appropriate boxes.

- Review the completed form for accuracy before submission.

Key elements of the Form W-2AS American Samoa Wage and Tax Statement

The Form W-2AS contains several key elements that are crucial for accurate reporting:

- Employee Information: This includes the employee's name, address, and Social Security number.

- Employer Information: The employer's name, address, and Employer Identification Number (EIN) must be included.

- Wage Information: Total wages paid and the amount of federal and territorial taxes withheld are reported.

- Boxes for Additional Information: There are specific boxes for reporting retirement plan contributions and other deductions.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Form W-2AS. Employers must provide the W-2AS to employees by January 31 of the following year. Additionally, employers must submit copies of the W-2AS to the IRS and the local tax authority by the end of February if filing by paper, or by the end of March if filing electronically. Staying informed about these deadlines helps avoid penalties and ensures compliance with tax regulations.

Penalties for Non-Compliance

Failure to comply with the requirements for the Form W-2AS can result in significant penalties. Employers may face fines for not providing the form to employees on time or for incorrect reporting. The IRS imposes penalties based on the number of forms that are not filed or filed incorrectly. It is crucial for employers to ensure accurate and timely submission of the W-2AS to avoid these potential financial consequences.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 2as american samoa wage and tax statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a W2 form 2024?

The W2 form 2024 is a tax document that employers must provide to their employees, detailing the wages earned and taxes withheld for the year. It is essential for filing income tax returns accurately. Understanding the W2 form 2024 is crucial for both employees and employers to ensure compliance with tax regulations.

-

How can airSlate SignNow help with W2 form 2024 management?

airSlate SignNow simplifies the process of sending and eSigning W2 form 2024 documents. Our platform allows businesses to manage their W2 forms efficiently, ensuring that all necessary signatures are obtained quickly and securely. This streamlines the workflow and reduces the time spent on paperwork.

-

What are the pricing options for using airSlate SignNow for W2 form 2024?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features specifically designed for managing W2 form 2024, ensuring you get the best value for your investment. You can choose a plan that fits your budget and requirements.

-

Is airSlate SignNow compliant with tax regulations for W2 form 2024?

Yes, airSlate SignNow is designed to comply with all relevant tax regulations, including those pertaining to the W2 form 2024. Our platform ensures that your documents are securely stored and managed, helping you maintain compliance and avoid potential penalties. Trust us to handle your W2 forms with care.

-

Can I integrate airSlate SignNow with other software for W2 form 2024 processing?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and HR software, making it easy to manage your W2 form 2024 processing. This integration allows for a more streamlined workflow, reducing manual data entry and improving overall efficiency.

-

What features does airSlate SignNow offer for W2 form 2024 eSigning?

airSlate SignNow provides a range of features for W2 form 2024 eSigning, including customizable templates, secure storage, and real-time tracking of document status. These features enhance the signing experience for both employers and employees, ensuring that all necessary steps are completed promptly.

-

How does airSlate SignNow ensure the security of W2 form 2024 documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your W2 form 2024 documents from unauthorized access. Our platform also includes audit trails to track all actions taken on your documents, ensuring complete transparency and security.

Get more for Form W 2AS American Samoa Wage And Tax Statement

- California quitclaim deed by two individuals to llc form

- New york assumption agreement of mortgage and release of original mortgagors form

- Agent checklistthis listing will not be entered into form

- Agreement merging two law firms form

- Delaware complex will with credit shelter marital trust for large estates form

- Ny wil 1703pdf form

- Hampshire being of legal age and of sound and disposing mind and memory and not acting form

- Oh complex2pdf form

Find out other Form W 2AS American Samoa Wage And Tax Statement

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement