Form 843 Rev December

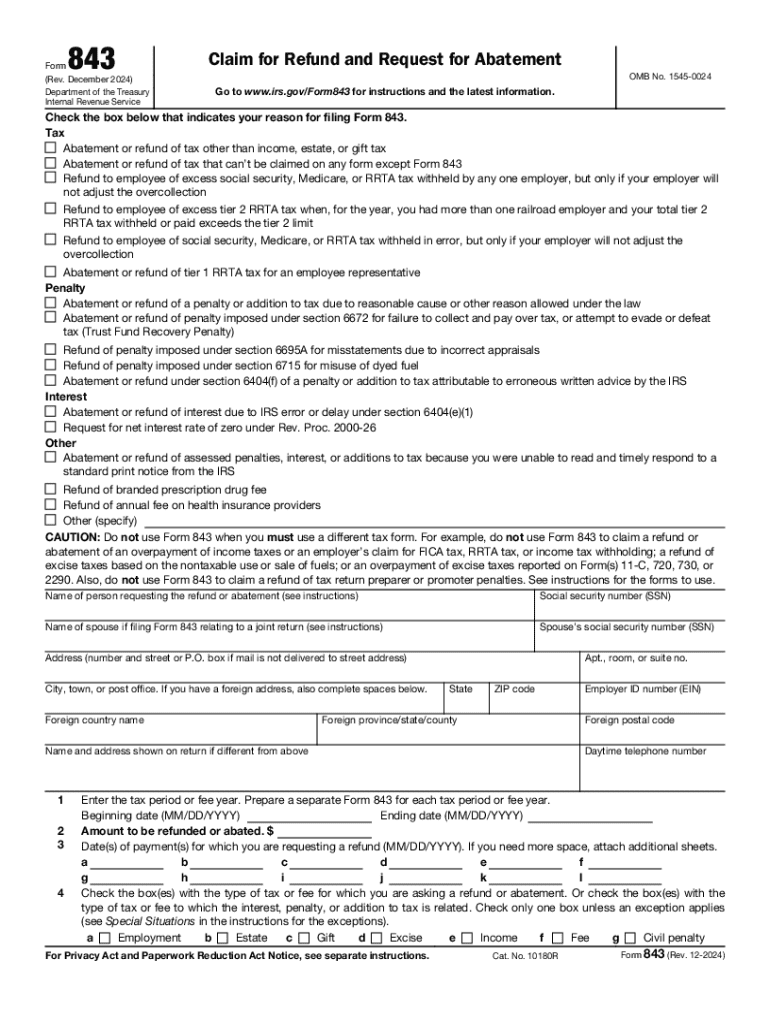

What is the Form 843?

The Form 843, officially known as the IRS Form 843, is a request for a refund or abatement of certain taxes, penalties, or interest. This form is primarily used by taxpayers who believe they have overpaid their taxes or are eligible for a penalty abatement. The IRS provides this form to facilitate the process of claiming refunds for various tax-related issues, including erroneous penalties or excessive tax payments.

How to Use the Form 843

To effectively use the Form 843, taxpayers should first ensure they meet the eligibility criteria for filing. This form can be submitted for various reasons, including requesting a refund for overpaid taxes or seeking relief from penalties. It's essential to provide accurate and complete information on the form, including the reason for the request and any supporting documentation. Taxpayers should also be aware of the specific IRS guidelines that apply to their situation.

Steps to Complete the Form 843

Completing the Form 843 involves several key steps:

- Obtain the latest version of the form from the IRS website or a trusted source.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Clearly state the reason for your request in the appropriate section.

- Attach any necessary supporting documents that validate your claim.

- Review the form for accuracy before submission.

Following these steps helps ensure a smoother processing experience with the IRS.

Required Documents

When submitting the Form 843, it is crucial to include any required documents that support your request. This may include:

- Proof of payment or overpayment, such as bank statements or IRS payment confirmations.

- Documentation supporting your claim for penalty abatement, like correspondence from the IRS.

- Any relevant tax returns or forms that pertain to the request.

Providing comprehensive documentation can significantly enhance the chances of approval for your request.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form 843 is essential to ensure timely processing. Generally, the IRS requires that the form be filed within three years from the date the tax return was filed or within two years from the date the tax was paid, whichever is later. It is advisable to check for any specific deadlines related to your particular situation, as these can vary based on the type of claim being made.

IRS Guidelines

The IRS has established specific guidelines for completing and submitting the Form 843. Taxpayers should familiarize themselves with these guidelines to avoid common pitfalls. This includes understanding the acceptable reasons for filing the form, the necessary documentation, and the correct mailing address for submission. Adhering to these guidelines helps ensure that your request is processed efficiently.

Handy tips for filling out Form 843 Rev December online

Quick steps to complete and e-sign Form 843 Rev December online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Get access to a GDPR and HIPAA compliant service for optimum efficiency. Use signNow to electronically sign and share Form 843 Rev December for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 843 rev december

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 843 and how can airSlate SignNow help?

Form 843 is a request for the abatement of certain taxes, penalties, or interest. airSlate SignNow simplifies the process of completing and submitting Form 843 by providing an intuitive platform for eSigning and document management, ensuring your requests are processed efficiently.

-

Is there a cost associated with using airSlate SignNow for Form 843?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that streamline the completion and eSigning of Form 843, making it a cost-effective solution for managing your documents.

-

What features does airSlate SignNow offer for Form 843?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically designed for Form 843. These tools enhance the user experience, allowing for quick and efficient processing of your requests.

-

Can I integrate airSlate SignNow with other applications for Form 843?

Absolutely! airSlate SignNow offers integrations with popular applications like Google Drive, Dropbox, and CRM systems. This allows you to seamlessly manage your Form 843 alongside other business processes, enhancing productivity.

-

How does airSlate SignNow ensure the security of my Form 843?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption and compliance measures to protect your Form 843 and other sensitive documents, ensuring that your information remains confidential and secure.

-

Can I track the status of my Form 843 with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for your Form 843. You can easily monitor the status of your document, receive notifications when it is viewed or signed, and ensure that your requests are handled promptly.

-

Is airSlate SignNow user-friendly for completing Form 843?

Definitely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete and eSign Form 843. The intuitive interface guides you through the process, ensuring that you can manage your documents without any hassle.

Get more for Form 843 Rev December

- Lpc hours log template excel form

- Medical practice new patient application form

- Sui northern gas pipelines limited form

- City of new york office of central processing form

- Corporation of the city of kingston certificate of insurance form

- Wc 240 easyfillforms com

- Dv dash risk assessment and referral form oct equation org

- Commitment to purchase agreement template form

Find out other Form 843 Rev December

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word