Form W 9 Rev January

What is the Form W-9 Rev January

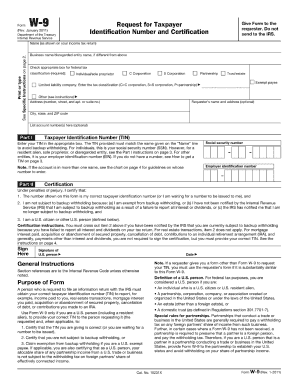

The Form W-9 Rev January is an official IRS document used primarily by individuals and businesses to provide their taxpayer identification information. This form is essential for reporting income to the Internal Revenue Service (IRS) and is commonly utilized by freelancers, contractors, and vendors who receive payments from businesses. The information collected on the W-9 includes the name, business name, address, taxpayer identification number (TIN), and certification of the taxpayer's status. This form ensures that the correct information is reported for tax purposes, helping to avoid potential issues with the IRS.

How to use the Form W-9 Rev January

Using the Form W-9 Rev January is straightforward. The form must be completed accurately and submitted to the entity requesting it, typically a business or financial institution. Once the form is filled out, it should be sent directly to the requester, not to the IRS. The requester will use the information provided to prepare tax documents, such as Form 1099, which reports income paid to the individual or business. It is important to ensure that the information is up-to-date and correct to prevent any tax discrepancies.

Steps to complete the Form W-9 Rev January

Completing the Form W-9 Rev January involves a few key steps:

- Provide your name: Enter your full legal name as it appears on your tax return.

- Business name (if applicable): If you operate under a business name, include it here.

- Check the appropriate box: Indicate whether you are an individual, corporation, partnership, or another entity type.

- Enter your address: Provide your complete mailing address.

- Taxpayer Identification Number: Include your Social Security Number (SSN) or Employer Identification Number (EIN).

- Certification: Sign and date the form to certify that the information provided is accurate.

Key elements of the Form W-9 Rev January

The Form W-9 Rev January contains several key elements that are crucial for proper completion:

- Name: The legal name of the individual or business.

- Business name: Optional, but necessary for businesses operating under a different name.

- Tax classification: Indicates the type of entity, such as individual, corporation, or partnership.

- Address: The physical address where the taxpayer can be reached.

- Taxpayer Identification Number: Essential for accurate tax reporting.

- Signature and date: Required to validate the information provided.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form W-9 Rev January. Taxpayers must ensure that the information is current and accurate to avoid penalties or issues with tax filings. The IRS recommends that the form be updated whenever there is a change in the taxpayer's information, such as a name change or change in business structure. Additionally, the IRS advises that the W-9 should only be provided to those entities that require it for tax reporting purposes.

Form Submission Methods

The Form W-9 Rev January can be submitted in various ways, depending on the requester's preferences:

- Online submission: Some businesses may allow electronic submission through secure portals.

- Email: The completed form can be sent as an attachment via email if the requester accepts this method.

- Mail: The form can be printed and mailed directly to the requester.

- In-person: In some cases, the form may be submitted in person, especially for local businesses.

Handy tips for filling out Form W 9 Rev January online

Quick steps to complete and e-sign Form W 9 Rev January online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Gain access to a GDPR and HIPAA compliant service for maximum efficiency. Use signNow to e-sign and send out Form W 9 Rev January for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 9 rev january

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form W 9 Rev January and why is it important?

The Form W 9 Rev January is a tax form used by individuals and businesses to provide their taxpayer identification information to the IRS. It is essential for ensuring accurate reporting of income and tax obligations. By using airSlate SignNow, you can easily manage and eSign your Form W 9 Rev January, streamlining your tax documentation process.

-

How does airSlate SignNow help with completing the Form W 9 Rev January?

airSlate SignNow simplifies the process of completing the Form W 9 Rev January by providing an intuitive interface for filling out and signing documents electronically. Our platform allows you to save time and reduce errors, ensuring that your tax forms are completed accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for the Form W 9 Rev January?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions provide access to features that make managing the Form W 9 Rev January and other documents easy. You can choose a plan that best fits your requirements and budget.

-

What features does airSlate SignNow offer for managing the Form W 9 Rev January?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking for the Form W 9 Rev January. These tools enhance your workflow, making it easier to send, sign, and store your tax documents securely.

-

Can I integrate airSlate SignNow with other software for handling the Form W 9 Rev January?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when managing the Form W 9 Rev January. This connectivity ensures that your documents are easily accessible and can be processed alongside your existing tools.

-

How secure is my information when using airSlate SignNow for the Form W 9 Rev January?

Security is a top priority at airSlate SignNow. When you use our platform for the Form W 9 Rev January, your information is protected with advanced encryption and secure storage solutions. We adhere to industry standards to ensure that your sensitive data remains confidential.

-

Can I access my Form W 9 Rev January documents from any device?

Yes, airSlate SignNow is designed to be accessible from any device with internet connectivity. Whether you're using a computer, tablet, or smartphone, you can easily access, complete, and eSign your Form W 9 Rev January documents on the go.

Get more for Form W 9 Rev January

- Triage checklist for nurse form

- Basketball roster sheet form

- How to get around certegy form

- Makeup artist consent form template

- Celebrate recovery step 1 worksheet form

- Skjemaet skal fylles ut av arbeidsgiveren elektronisk eller med form

- Home reading log form

- National community transportation roadeo guide 2018 pdf4pro form

Find out other Form W 9 Rev January

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now