Complete and Attach the Statement Supporting Fuel Tax Credit FTC Computation 1 Form

Understanding the Fuel Tax Credit FTC Computation

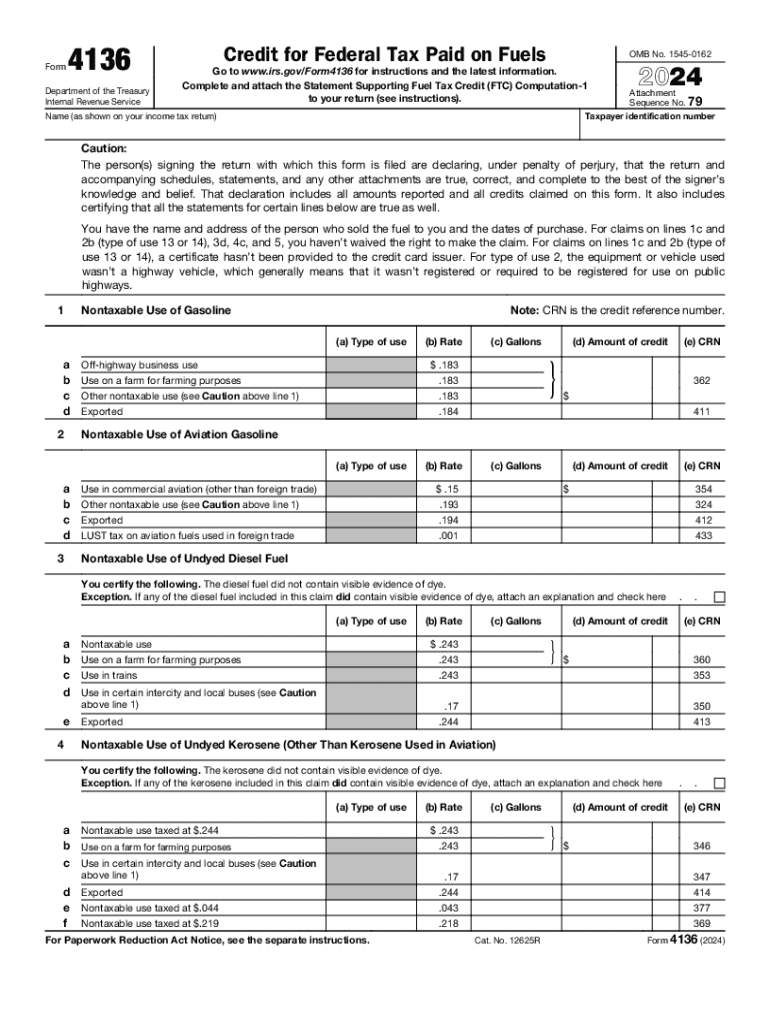

The Fuel Tax Credit (FTC) allows eligible taxpayers to claim a credit for certain fuel taxes paid. This credit can significantly reduce the overall tax liability for businesses that utilize fuel in their operations. The FTC computation involves a detailed analysis of the fuel used and the corresponding taxes paid. It is essential to understand the criteria and calculations involved to ensure accurate reporting and maximize potential benefits.

Steps to Complete the Fuel Tax Credit FTC Computation

Completing the FTC computation requires meticulous attention to detail. Here are the key steps involved:

- Gather all relevant documentation, including receipts for fuel purchases and any previous tax filings related to fuel taxes.

- Identify the types of fuel used and the corresponding federal excise tax rates applicable to each type.

- Calculate the total amount of fuel used during the tax period and multiply this by the applicable tax rates to determine the total credit.

- Complete the necessary IRS forms, such as IRS Form 4136, ensuring all calculations are accurate and well-documented.

- Review the completed forms for accuracy before submission.

Eligibility Criteria for the Fuel Tax Credit

To qualify for the Fuel Tax Credit, certain eligibility criteria must be met. These include:

- The fuel must be used in a qualifying manner, such as for business operations or certain exempt purposes.

- Taxpayers must maintain proper documentation to support their claims, including invoices and receipts.

- The credit is generally available to businesses and self-employed individuals who pay federal excise taxes on fuel.

IRS Guidelines for Fuel Tax Credit Submission

The IRS provides specific guidelines for submitting claims for the Fuel Tax Credit. These guidelines include:

- Filing the appropriate forms, such as IRS Form 4136, during the tax return process.

- Adhering to deadlines for submission to avoid penalties or delays in processing.

- Ensuring that all calculations are transparent and can be supported with documentation in case of an audit.

Required Documents for Fuel Tax Credit Claims

When filing for the Fuel Tax Credit, certain documents are required to substantiate the claim. These documents include:

- Receipts and invoices for fuel purchases, detailing the amount and type of fuel.

- Records of federal excise taxes paid on the fuel used.

- Any prior tax filings that may relate to the fuel tax credit.

Form Submission Methods for Fuel Tax Credit

Taxpayers have several options for submitting their Fuel Tax Credit claims. These methods include:

- Online submission through the IRS e-filing system, which offers a quick and efficient way to file.

- Mailing completed forms to the appropriate IRS address, ensuring that all documentation is included.

- In-person submission at designated IRS offices, if preferred.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the complete and attach the statement supporting fuel tax credit ftc computation 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is federal tax fuel and how does it affect my business?

Federal tax fuel refers to the taxes imposed on fuel by the federal government. Understanding these taxes is crucial for businesses that rely on fuel for operations, as it can impact overall costs and pricing strategies. By managing federal tax fuel effectively, businesses can optimize their expenses and improve profitability.

-

How can airSlate SignNow help with federal tax fuel documentation?

airSlate SignNow provides a streamlined solution for managing documents related to federal tax fuel. With our eSigning capabilities, you can quickly sign and send necessary forms, ensuring compliance and reducing delays. This efficiency helps businesses stay organized and focused on their core operations.

-

What features does airSlate SignNow offer for managing federal tax fuel documents?

Our platform includes features such as customizable templates, secure cloud storage, and real-time tracking for federal tax fuel documents. These tools simplify the process of document management, allowing businesses to easily access and manage their paperwork. This ensures that all federal tax fuel-related documents are handled efficiently.

-

Is airSlate SignNow cost-effective for businesses dealing with federal tax fuel?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses managing federal tax fuel documentation. Our pricing plans are competitive, allowing businesses of all sizes to benefit from our services without breaking the bank. This affordability helps companies allocate resources more effectively.

-

Can I integrate airSlate SignNow with other tools for federal tax fuel management?

Absolutely! airSlate SignNow offers integrations with various tools that can assist in managing federal tax fuel. This includes accounting software and fuel management systems, allowing for seamless data transfer and improved workflow. Integrating these tools enhances efficiency and accuracy in handling federal tax fuel documentation.

-

What are the benefits of using airSlate SignNow for federal tax fuel compliance?

Using airSlate SignNow for federal tax fuel compliance ensures that your documents are signed and stored securely, reducing the risk of errors. Our platform also provides audit trails, which are essential for compliance verification. This level of organization and security helps businesses maintain compliance with federal tax fuel regulations.

-

How does airSlate SignNow ensure the security of federal tax fuel documents?

airSlate SignNow prioritizes the security of all documents, including those related to federal tax fuel. We utilize advanced encryption and secure cloud storage to protect sensitive information. This commitment to security ensures that your federal tax fuel documents are safe from unauthorized access.

Get more for Complete And Attach The Statement Supporting Fuel Tax Credit FTC Computation 1

- Bank account details updation form pnb met life insurance

- Lyceum registration form

- Confirm of joint address form investec

- Application for initial smog check inspector bureau of automotive bar ca form

- California teleconnect fund form

- California teleconnect fund applicant amp participant guidebook form

- How to file an insurance claim everything you need to form

- How long after a car accident can you file a claim form

Find out other Complete And Attach The Statement Supporting Fuel Tax Credit FTC Computation 1

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF