2 O0 2R 4 M Form

Understanding the DE2210 Estimated Taxes Form

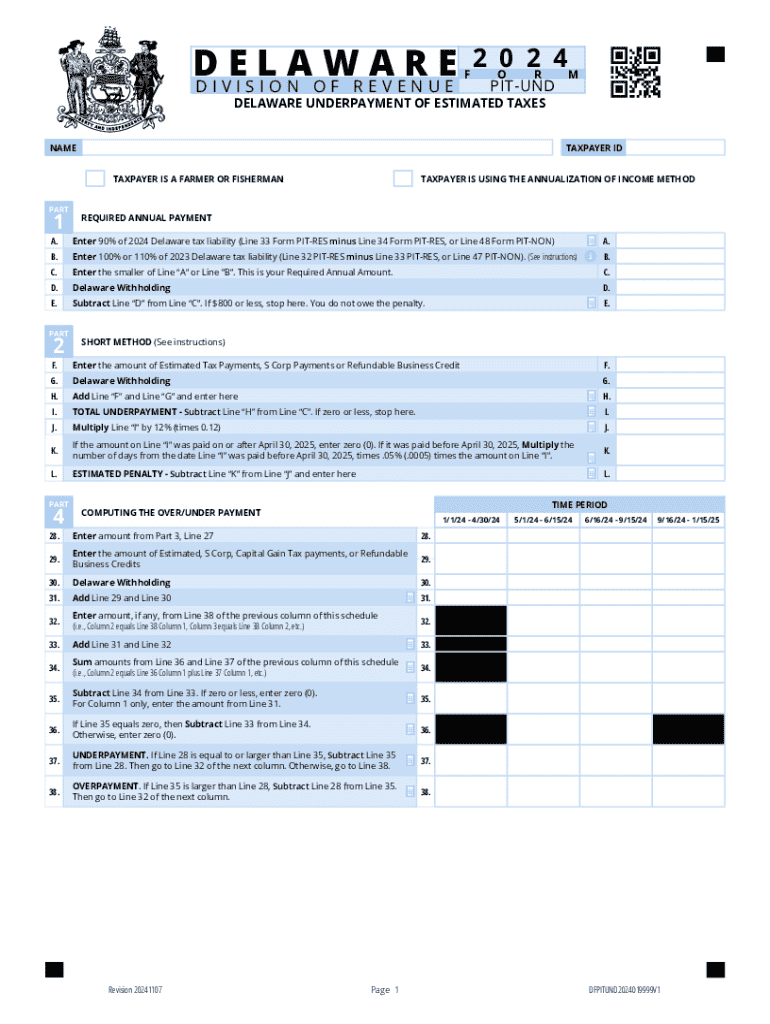

The DE2210 estimated taxes form is used by Delaware taxpayers to report underpayment of estimated tax. This form is essential for individuals and businesses that expect to owe a significant amount of tax when filing their annual return. It helps in calculating the amount of tax owed and determining if any penalties apply due to underpayment. Understanding this form is crucial for compliance with state tax laws and for avoiding unnecessary penalties.

Steps to Complete the DE2210 Estimated Taxes Form

Completing the DE2210 form involves several steps:

- Gather your income information, including wages, interest, and other sources of income.

- Calculate your total estimated tax liability for the year.

- Determine the amount of tax you have already paid through withholding or previous estimated payments.

- Use the DE2210 form to calculate any underpayment and the penalty, if applicable.

- Review the completed form for accuracy before submitting it.

Filing Deadlines for the DE2210 Form

It is important to be aware of the deadlines associated with the DE2210 estimated taxes form. Typically, estimated tax payments are due quarterly. The deadlines for these payments are:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

Filing the DE2210 form should coincide with these payment deadlines to ensure compliance and avoid penalties.

Penalties for Non-Compliance with the DE2210 Form

Failure to file the DE2210 form or to make estimated tax payments on time can result in penalties. Delaware imposes a penalty for underpayment, which is calculated based on the amount of tax owed and the duration of the underpayment. Taxpayers should be aware that these penalties can accumulate quickly, making timely filing and payment essential.

Eligibility Criteria for Using the DE2210 Form

Not all taxpayers need to file the DE2210 form. Eligibility typically includes:

- Taxpayers who expect to owe more than one thousand dollars in tax after subtracting withholding and refundable credits.

- Individuals or businesses that have not paid enough tax through withholding or estimated payments.

Understanding these criteria helps taxpayers determine if they need to file the DE2210 form to avoid penalties.

Obtaining the DE2210 Form

The DE2210 estimated taxes form can be obtained from the Delaware Division of Revenue's website. It is available in PDF format for download and can be printed for completion. Additionally, taxpayers may find the form at local tax offices or request it through mail if necessary.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2 o0 2r 4 m

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are de2210 estimated taxes?

De2210 estimated taxes refer to the estimated tax payments that individuals and businesses must make to the IRS to avoid penalties. These payments are typically required if you expect to owe $1,000 or more in taxes when you file your return. Understanding de2210 estimated taxes is crucial for effective tax planning.

-

How can airSlate SignNow help with de2210 estimated taxes?

AirSlate SignNow streamlines the process of signing and sending documents related to de2210 estimated taxes. With our easy-to-use platform, you can quickly eSign tax forms and ensure timely submissions. This efficiency helps you stay compliant and avoid penalties.

-

What features does airSlate SignNow offer for managing de2210 estimated taxes?

AirSlate SignNow offers features like document templates, automated reminders, and secure eSigning, all of which are beneficial for managing de2210 estimated taxes. These tools simplify the process of preparing and submitting your estimated tax forms, making it easier to stay organized.

-

Is airSlate SignNow cost-effective for handling de2210 estimated taxes?

Yes, airSlate SignNow provides a cost-effective solution for handling de2210 estimated taxes. Our pricing plans are designed to fit various business needs, ensuring you get the best value while managing your tax documentation efficiently. This affordability helps businesses save on administrative costs.

-

Can I integrate airSlate SignNow with my accounting software for de2210 estimated taxes?

Absolutely! AirSlate SignNow integrates seamlessly with popular accounting software, allowing you to manage your de2210 estimated taxes more effectively. This integration ensures that your financial data is synchronized, making it easier to track and submit your estimated tax payments.

-

What are the benefits of using airSlate SignNow for de2210 estimated taxes?

Using airSlate SignNow for de2210 estimated taxes offers numerous benefits, including enhanced efficiency, reduced paperwork, and improved compliance. Our platform allows you to quickly eSign and send documents, ensuring that you meet all deadlines and requirements without hassle.

-

How secure is airSlate SignNow when handling de2210 estimated taxes?

AirSlate SignNow prioritizes security, especially when dealing with sensitive information like de2210 estimated taxes. Our platform uses advanced encryption and secure storage to protect your documents, ensuring that your tax information remains confidential and safe from unauthorized access.

Get more for 2 O0 2R 4 M

- Illinois medical cannabis verification form

- Illinois medical cannibis verification form

- State of illinois unemployment formampquot keyword found

- State identity proofing request form dhs

- Other insurance questionnaire form

- Kansas maternal amp child health form

- Forms kansas board of pharmacy

- Kansas charitable health care provider program independent form

Find out other 2 O0 2R 4 M

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement