Nebraska Individual Income Tax Booklet Form

What is the Nebraska Individual Income Tax Booklet

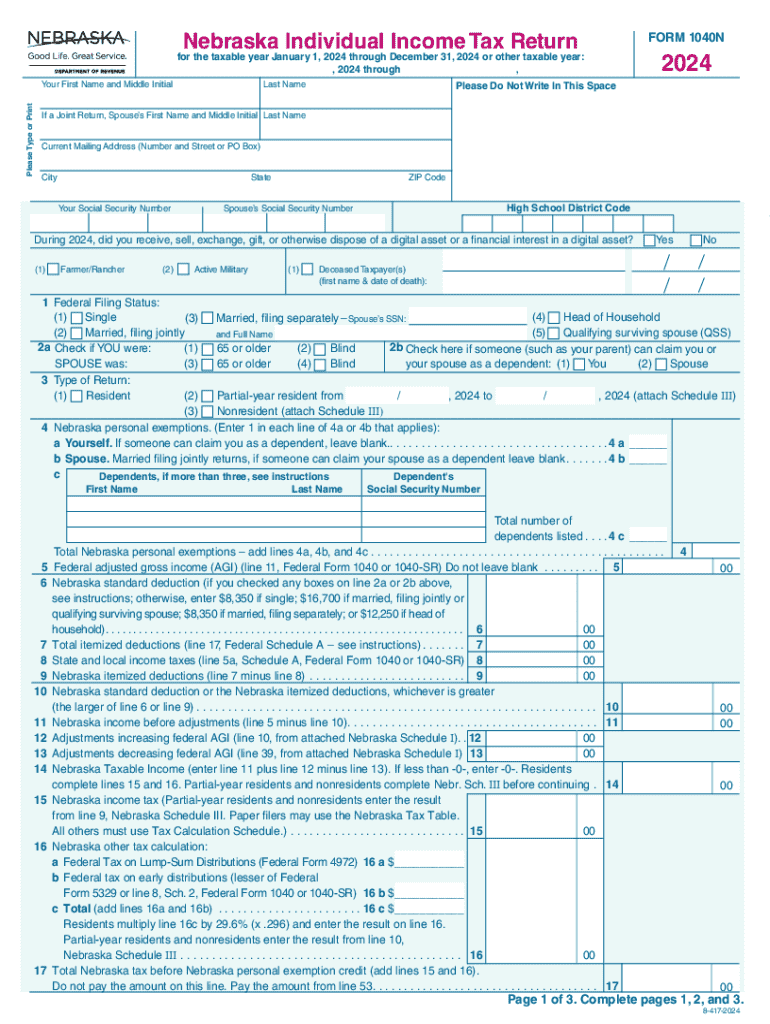

The Nebraska Individual Income Tax Booklet provides essential information and instructions for residents filing their state income taxes. It includes the necessary forms, such as the 1040N form, and guidelines on how to complete them accurately. This booklet is crucial for ensuring compliance with Nebraska tax laws and helps taxpayers understand their obligations and rights.

Steps to complete the Nebraska Individual Income Tax Booklet

Completing the Nebraska Individual Income Tax Booklet involves several clear steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Review the instructions provided in the booklet to understand the specific requirements for your situation.

- Fill out the 1040N form, ensuring that all information is accurate and complete.

- Calculate your total income, deductions, and credits as outlined in the booklet.

- Double-check your calculations and ensure all required signatures are included.

- Submit the completed form by the deadline, using the preferred submission method.

How to obtain the Nebraska Individual Income Tax Booklet

Taxpayers can obtain the Nebraska Individual Income Tax Booklet through various means. It is available online on the Nebraska Department of Revenue website, where individuals can download and print it. Additionally, physical copies can be requested from local tax offices or public libraries throughout the state. Ensuring you have the latest version is essential for accurate filing.

Filing Deadlines / Important Dates

Staying aware of filing deadlines is crucial for taxpayers. The standard deadline for submitting the Nebraska 1040N form is typically April 15, unless it falls on a weekend or holiday. In such cases, the deadline may be extended to the next business day. Taxpayers should also be mindful of any extensions that may apply and the specific dates for estimated tax payments if applicable.

Required Documents

To complete the Nebraska Individual Income Tax Booklet, several documents are necessary:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits you plan to claim

- Identification information, including Social Security numbers for all dependents

Having these documents ready will streamline the filing process and help ensure accuracy.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have multiple options for submitting the Nebraska 1040N form:

- Online: Many taxpayers choose to file electronically through approved software.

- Mail: Completed forms can be sent to the Nebraska Department of Revenue via postal service.

- In-Person: Taxpayers may also submit their forms at designated state tax offices.

Choosing the right submission method can depend on personal preference and the complexity of the tax situation.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nebraska individual income tax booklet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Nebraska 1040N instructions for filing my state taxes?

The Nebraska 1040N instructions provide detailed guidance on how to complete your state tax return. This includes information on eligibility, required forms, and deadlines. Following these instructions carefully ensures that you file accurately and avoid penalties.

-

How can airSlate SignNow help with Nebraska 1040N instructions?

airSlate SignNow simplifies the process of signing and sending documents related to your Nebraska 1040N instructions. With our platform, you can easily eSign your tax forms and share them securely with your accountant or tax preparer. This streamlines your filing process and ensures compliance.

-

Are there any costs associated with using airSlate SignNow for Nebraska 1040N instructions?

Yes, airSlate SignNow offers various pricing plans to suit different needs. Our cost-effective solutions allow you to manage your document signing efficiently, including those related to Nebraska 1040N instructions. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing Nebraska 1040N instructions?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking. These tools help you manage your Nebraska 1040N instructions effectively, ensuring that you have everything you need for a smooth filing process. Our user-friendly interface makes it easy to navigate.

-

Can I integrate airSlate SignNow with other software for Nebraska 1040N instructions?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your workflow for Nebraska 1040N instructions. This integration allows you to import data directly, reducing manual entry and minimizing errors in your tax filings.

-

What are the benefits of using airSlate SignNow for Nebraska 1040N instructions?

Using airSlate SignNow for your Nebraska 1040N instructions offers numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform allows you to eSign documents quickly and securely, ensuring that your tax filings are completed on time and without hassle.

-

Is airSlate SignNow user-friendly for those unfamiliar with Nebraska 1040N instructions?

Yes, airSlate SignNow is designed to be user-friendly, even for those who may not be familiar with Nebraska 1040N instructions. Our intuitive interface guides you through the eSigning process, making it accessible for everyone. Additionally, our customer support team is available to assist with any questions.

Get more for Nebraska Individual Income Tax Booklet

- Divorce decree without minor andor dependent children form

- Browse all court forms california courts 573563623

- Emergency declarations waivers exemptions and permits form

- Updated final lien request fax form fax city of new york

- Illinoistemporary visitor drivers license tvdl flyer englsih form

- Statement of affirmation indiana department of natural form

- To farm vehicle compliance the texas department of public form

- Illinois parking program for persons with disabilities abuse complaint form

Find out other Nebraska Individual Income Tax Booklet

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form