Schedule I Nebraska Adjustments to Income Form

What is the Nebraska Schedule I Adjustments To Income

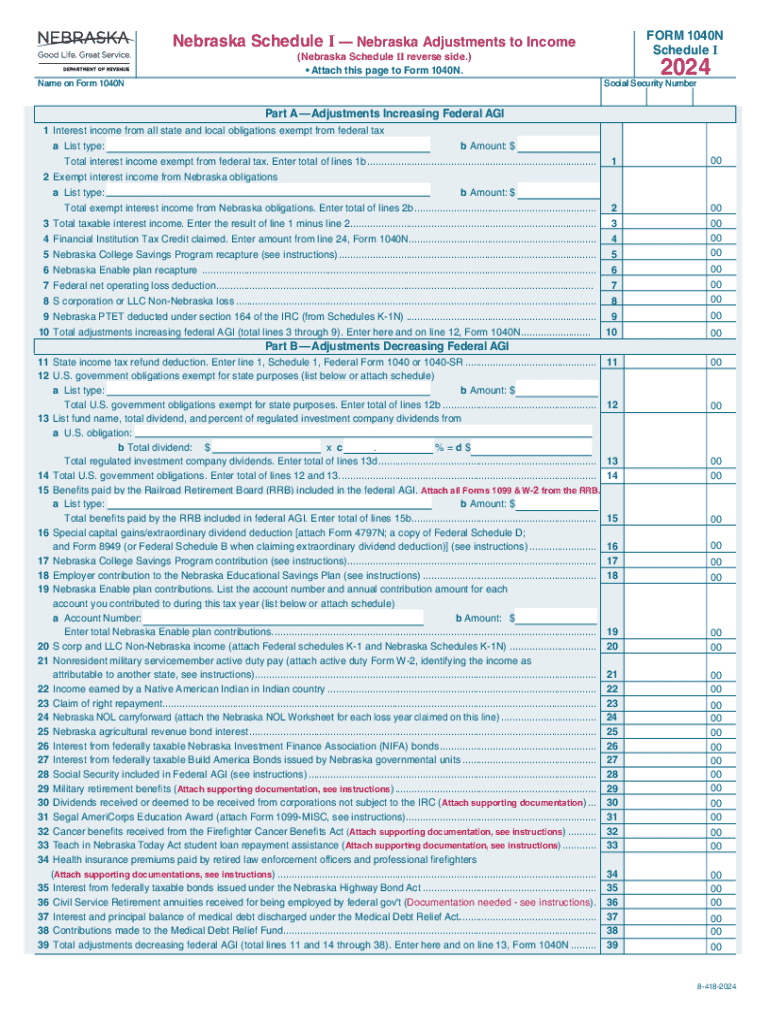

The Nebraska Schedule I is a form used by taxpayers to report adjustments to their income when filing the Nebraska 1040N tax return. This form allows individuals to make specific adjustments, such as adding or subtracting certain types of income or deductions that are not included in the federal adjusted gross income. Understanding the purpose of this form is crucial for ensuring accurate tax filings and compliance with state tax regulations.

How to Use the Nebraska Schedule I Adjustments To Income

To effectively use the Nebraska Schedule I, taxpayers should first gather all necessary financial documents, including W-2s, 1099s, and any other relevant income statements. The form requires taxpayers to list various types of income adjustments, such as state tax refunds, interest from state and local bonds, and contributions to certain retirement accounts. Each adjustment must be clearly documented and calculated to ensure accuracy in the final tax return.

Steps to Complete the Nebraska Schedule I Adjustments To Income

Completing the Nebraska Schedule I involves several key steps:

- Begin by downloading the Schedule I form from the Nebraska Department of Revenue website.

- Fill in your personal information at the top of the form, including your name, address, and Social Security number.

- List all applicable income adjustments in the designated sections of the form, ensuring that you provide accurate figures for each item.

- Calculate the total adjustments and transfer this amount to your Nebraska 1040N form.

- Review the completed form for accuracy before submission.

Key Elements of the Nebraska Schedule I Adjustments To Income

The Nebraska Schedule I includes several key elements that taxpayers should be aware of:

- Adjustment Types: The form allows for various adjustments, including those for state tax refunds and certain retirement contributions.

- Calculation Instructions: Clear guidelines are provided for calculating each adjustment to ensure compliance with state tax laws.

- Submission Details: Information on how to submit the form, whether electronically or by mail, is included.

Filing Deadlines / Important Dates

It is essential for taxpayers to be aware of the filing deadlines associated with the Nebraska Schedule I. Typically, the deadline for submitting the Nebraska 1040N, along with the Schedule I, aligns with the federal tax filing deadline, which is usually April 15. However, taxpayers should verify any changes to deadlines or extensions that may apply in a given tax year.

Required Documents

When completing the Nebraska Schedule I, taxpayers should gather the following documents:

- W-2 forms from employers

- 1099 forms for any additional income

- Documentation for any adjustments claimed, such as receipts for retirement contributions

- Previous year’s tax return for reference

Legal Use of the Nebraska Schedule I Adjustments To Income

The Nebraska Schedule I is legally required for taxpayers who need to report specific income adjustments. Failure to accurately complete and submit this form can result in penalties or delays in processing tax returns. It is important to adhere to all state regulations regarding the use of this form to avoid potential legal issues.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule i nebraska adjustments to income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nebraska Schedule 1 form?

The Nebraska Schedule 1 form is a tax document used to report additional income or adjustments to income for Nebraska state tax purposes. It is essential for individuals and businesses to accurately complete this form to ensure compliance with state tax regulations.

-

How can airSlate SignNow help with the Nebraska Schedule 1 form?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending the Nebraska Schedule 1 form. With our solution, you can streamline the process, ensuring that your documents are securely signed and submitted on time.

-

Is there a cost associated with using airSlate SignNow for the Nebraska Schedule 1 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solution allows you to manage your documents, including the Nebraska Schedule 1 form, without breaking the bank.

-

What features does airSlate SignNow offer for the Nebraska Schedule 1 form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which enhance the experience of managing the Nebraska Schedule 1 form. These features ensure that your documents are handled efficiently and securely.

-

Can I integrate airSlate SignNow with other software for the Nebraska Schedule 1 form?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage the Nebraska Schedule 1 form alongside your existing tools. This flexibility allows for a seamless workflow and improved productivity.

-

What are the benefits of using airSlate SignNow for the Nebraska Schedule 1 form?

Using airSlate SignNow for the Nebraska Schedule 1 form provides numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform simplifies the signing process, allowing you to focus on your core business activities.

-

How secure is airSlate SignNow when handling the Nebraska Schedule 1 form?

airSlate SignNow prioritizes security and compliance, ensuring that your Nebraska Schedule 1 form and other documents are protected. We utilize advanced encryption and security protocols to safeguard your sensitive information throughout the signing process.

Get more for Schedule I Nebraska Adjustments To Income

- Code pj or form

- Self help forms kentucky justice online

- Form aoc jv 29 download fillable pdf or fill online order

- Aoc jv 1 doc type pj juvenile id kycourtsgov form

- Licensing agency request form

- Business form finder all forms on file for kansas

- Reciprocal pesticide applicators license request form

- Wwwirsgovbusinessessmall businesses selfsingle member limited liability companiesinternal revenue form

Find out other Schedule I Nebraska Adjustments To Income

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online