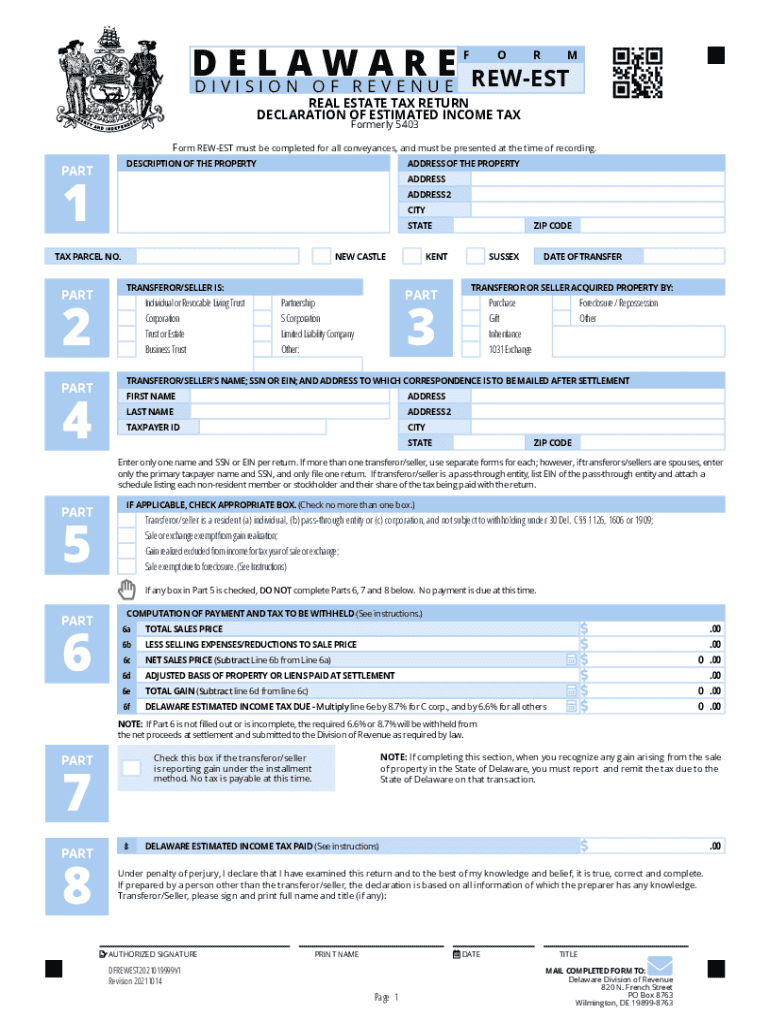

REW EST Form

Understanding Delaware Estimated Income Tax

The Delaware estimated income tax is a payment method for individuals and businesses who expect to owe a certain amount in state taxes. This system is designed to help taxpayers manage their tax liabilities throughout the year, rather than facing a large payment at tax time. The estimated income tax is typically required for those who have income that is not subject to withholding, such as self-employment income, rental income, or interest and dividends.

Steps to Complete the Delaware Estimated Income Tax

Completing the Delaware estimated income tax involves several key steps:

- Determine your expected income for the year, including all sources of income.

- Calculate your estimated tax liability using the current tax rates and any applicable deductions or credits.

- Divide your total estimated tax liability by the number of payment periods, typically four.

- Complete the required forms, such as the Delaware Estimated Tax Payment Voucher (Form 400ES).

- Submit your payment by the due dates established by the state.

Filing Deadlines and Important Dates

Timely filing of the Delaware estimated income tax is crucial to avoid penalties. The estimated tax payments are generally due on the following dates:

- April 30 for the first quarter

- June 30 for the second quarter

- September 30 for the third quarter

- January 31 of the following year for the fourth quarter

It is essential to mark these dates on your calendar to ensure compliance and avoid late fees.

Required Documents for Filing

When preparing to file your Delaware estimated income tax, gather the following documents:

- Last year’s tax return for reference

- Income statements, such as W-2s or 1099s

- Records of any deductions or credits you plan to claim

- Delaware Estimated Tax Payment Voucher (Form 400ES)

Having these documents ready will streamline the filing process and help ensure accuracy in your calculations.

Penalties for Non-Compliance

Failing to pay the Delaware estimated income tax can result in penalties and interest. If you do not make the required payments or underpay your estimated tax, you may face:

- Late payment penalties, which can accumulate over time

- Interest on unpaid tax amounts

- Potential audits or further scrutiny from the Delaware Division of Revenue

It is advisable to stay informed about your payment obligations to avoid these consequences.

Eligibility Criteria for Estimated Tax Payments

To determine if you need to make estimated tax payments, consider the following eligibility criteria:

- Your expected tax liability for the year must be at least $1,000 after subtracting any withholding and refundable credits.

- You must expect your withholding and credits to be less than 90% of your current year’s tax or 100% of the prior year’s tax.

- Self-employed individuals or those with significant non-wage income are typically required to pay estimated taxes.

Reviewing these criteria will help you understand your obligations regarding estimated income tax payments in Delaware.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rew est

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Delaware estimated income tax?

Delaware estimated income tax refers to the tax payments that individuals and businesses in Delaware must make throughout the year based on their expected income. This system helps taxpayers avoid a large tax bill at the end of the year by allowing them to pay their estimated taxes quarterly.

-

How can airSlate SignNow help with Delaware estimated income tax documents?

airSlate SignNow provides a seamless platform for businesses to send and eSign documents related to Delaware estimated income tax. With our easy-to-use interface, you can quickly prepare and sign tax forms, ensuring compliance and timely submissions.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for your Delaware estimated income tax documents offers numerous benefits, including enhanced security, reduced processing time, and improved organization. Our platform allows you to track document status and manage your tax paperwork efficiently.

-

Is airSlate SignNow cost-effective for managing Delaware estimated income tax?

Yes, airSlate SignNow is a cost-effective solution for managing your Delaware estimated income tax documents. Our pricing plans are designed to fit various business needs, ensuring you get the best value while simplifying your tax processes.

-

Can I integrate airSlate SignNow with other accounting software for Delaware estimated income tax?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage your Delaware estimated income tax documents. This integration allows for streamlined workflows and ensures that your tax information is always up-to-date.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for tax document management, including Delaware estimated income tax forms. These features help you maintain compliance and enhance your overall efficiency.

-

How does airSlate SignNow ensure the security of my Delaware estimated income tax documents?

We prioritize the security of your Delaware estimated income tax documents by employing advanced encryption and secure cloud storage. Our platform complies with industry standards to protect your sensitive information throughout the signing process.

Get more for REW EST

- Use of colored and flashing lights on vehicles connecticut form

- Freedom of information law request form new york dmv

- Illinoisschool affirmation form

- Get the free vehicle dealer certificate clear form

- Dsdfr9pdf illinois secretary of state form

- Department of motor vehicles received junk ctgov form

- Small pdf for android apk download apkpurecom form

- 10 off lockout service new york call 844 786 5625 fast form

Find out other REW EST

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document