All Organizations Must Complete This Part Form

What is the All Organizations Must Complete This Part

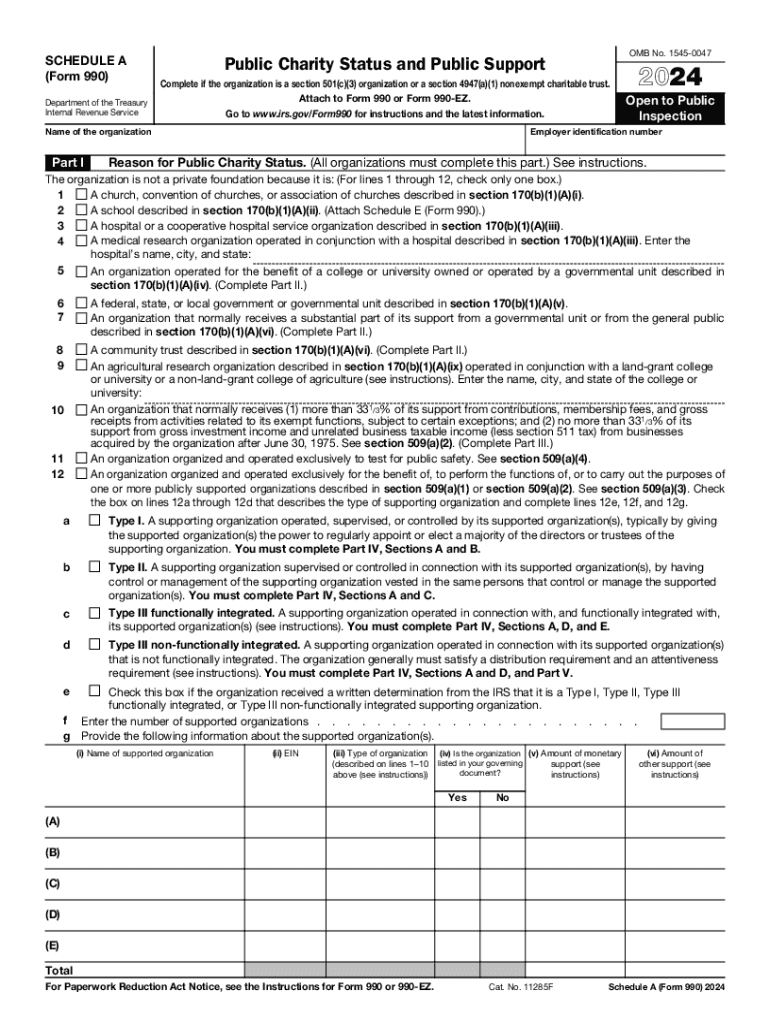

The section titled "All Organizations Must Complete This Part" is a crucial component of the IRS Schedule A for the 2024 tax year. This part is designed to gather essential information from all organizations that are required to file Form 990 or Form 990-EZ. It ensures that the IRS has a comprehensive understanding of the organization’s structure, mission, and financial activities. This section includes details such as the organization’s name, address, and Employer Identification Number (EIN), as well as the type of organization and its primary purpose.

How to use the All Organizations Must Complete This Part

To effectively use the "All Organizations Must Complete This Part," organizations should begin by accurately filling in each required field. This includes providing the legal name of the organization as registered with the IRS, the correct EIN, and the primary address. Additionally, organizations must select the appropriate classification that reflects their operational status, such as nonprofit or charitable organization. It is important to ensure that all information is current and precise to avoid any potential issues during the filing process.

Steps to complete the All Organizations Must Complete This Part

Completing the "All Organizations Must Complete This Part" involves several key steps:

- Gather necessary information, including the organization’s legal name, EIN, and address.

- Identify the organization’s classification type, ensuring it aligns with IRS definitions.

- Fill out the section carefully, ensuring all fields are completed accurately.

- Review the information for any errors or omissions before submission.

Following these steps will help ensure that the organization meets IRS requirements and facilitates a smoother filing process.

IRS Guidelines

The IRS provides specific guidelines for completing the "All Organizations Must Complete This Part." These guidelines outline the necessary information that must be included and emphasize the importance of accuracy. Organizations should refer to the IRS instructions for Form 990 or Form 990-EZ to understand the specific requirements and any updates for the 2024 tax year. Adhering to these guidelines helps prevent common errors that could lead to delays or penalties.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Schedule A are critical for compliance. For most organizations, the due date for filing Form 990 or Form 990-EZ is the fifteenth day of the fifth month after the end of the organization’s fiscal year. For those operating on a calendar year, this means the deadline is typically May fifteenth. It is essential to be aware of these dates to avoid late filing penalties and ensure timely processing of the return.

Required Documents

When completing the "All Organizations Must Complete This Part," organizations should have certain documents on hand to facilitate accurate reporting. Required documents may include:

- Previous year’s Form 990 or Form 990-EZ for reference.

- Financial statements that reflect the organization’s fiscal activities.

- Documentation supporting the organization’s classification and mission.

Having these documents readily available can streamline the completion process and enhance accuracy.

Handy tips for filling out All Organizations Must Complete This Part online

Quick steps to complete and e-sign All Organizations Must Complete This Part online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Gain access to a HIPAA and GDPR compliant solution for maximum simplicity. Use signNow to electronically sign and send All Organizations Must Complete This Part for e-signing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the all organizations must complete this part

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to irs schedule a 2024 tax appointment?

To irs schedule a 2024 tax appointment, you can visit the IRS website or use their official app. It's important to gather all necessary documents beforehand to ensure a smooth process. Additionally, consider using airSlate SignNow to securely eSign any required forms.

-

How can airSlate SignNow help with irs schedule a 2024 forms?

airSlate SignNow simplifies the process of completing and submitting irs schedule a 2024 forms. Our platform allows you to fill out, sign, and send documents electronically, saving you time and reducing errors. This ensures that your forms are submitted accurately and on time.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Whether you're a small business or a large enterprise, you can find a plan that fits your budget while providing the necessary features to manage your irs schedule a 2024 documents efficiently.

-

Are there any integrations available with airSlate SignNow for tax preparation?

Yes, airSlate SignNow integrates seamlessly with various tax preparation software and tools. This allows you to streamline your workflow when dealing with irs schedule a 2024 documents. By integrating with your existing systems, you can enhance productivity and ensure compliance.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features for effective document management, including eSigning, templates, and real-time tracking. These features are particularly useful when handling irs schedule a 2024 documents, ensuring that you can manage your paperwork efficiently and securely.

-

How does airSlate SignNow ensure the security of my documents?

Security is a top priority at airSlate SignNow. We use advanced encryption and secure cloud storage to protect your documents, including those related to irs schedule a 2024. You can trust that your sensitive information is safe while using our platform.

-

Can I access airSlate SignNow on mobile devices?

Absolutely! airSlate SignNow is accessible on mobile devices, allowing you to manage your irs schedule a 2024 documents on the go. Our mobile app provides the same features as the desktop version, ensuring you can eSign and send documents anytime, anywhere.

Get more for All Organizations Must Complete This Part

Find out other All Organizations Must Complete This Part

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free